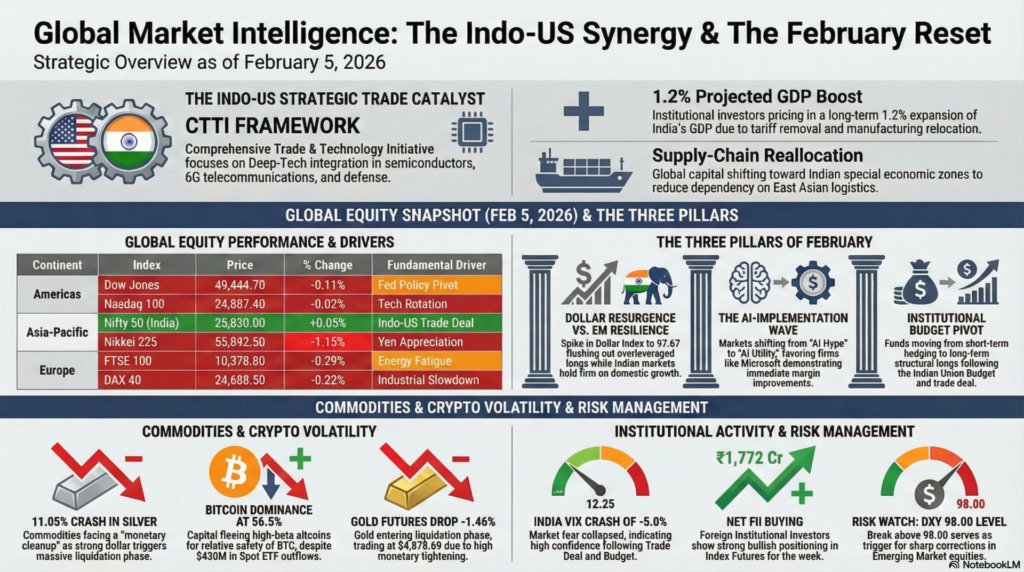

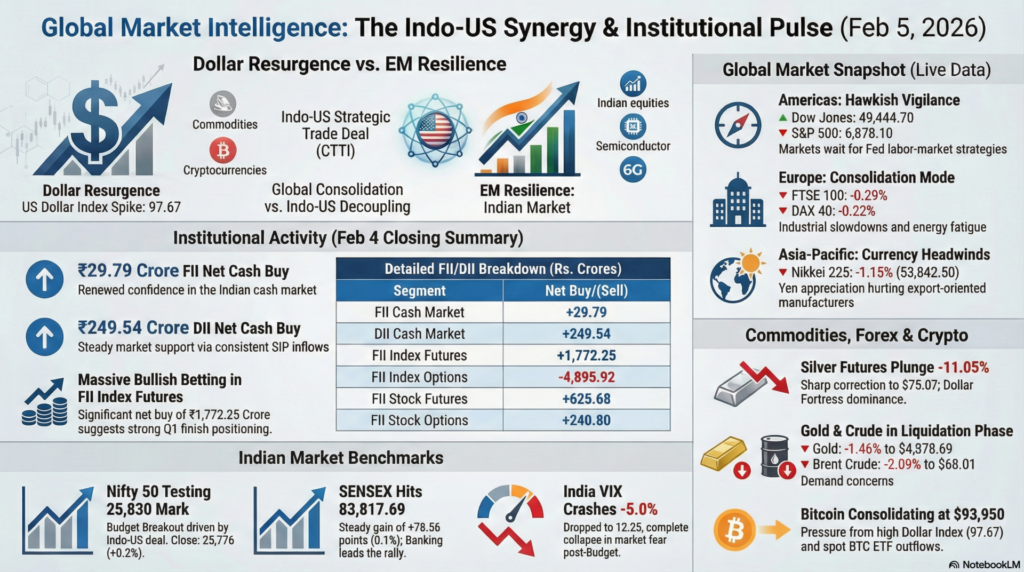

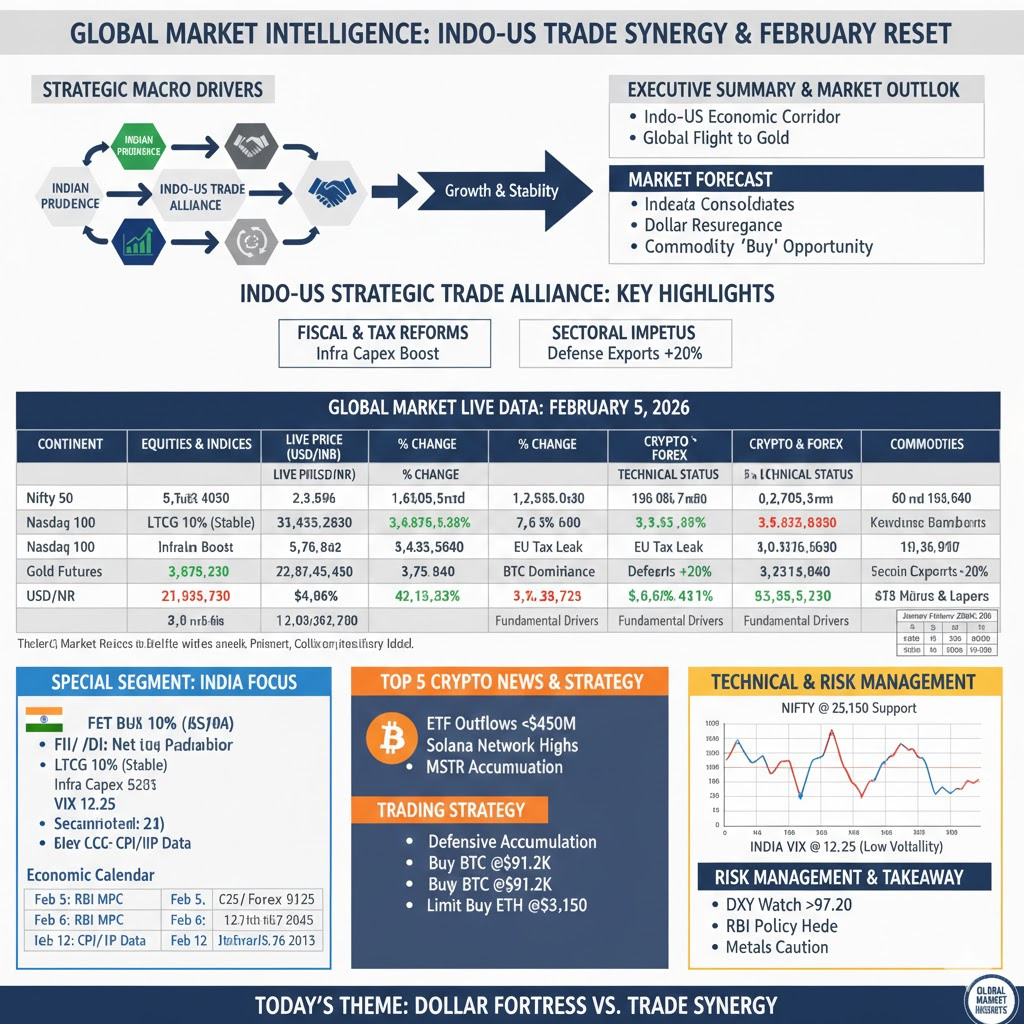

As of February 5, 2026, the global financial landscape is characterized by a historic structural shift. The signing of the Indo-US Strategic Trade Deal has injected a fresh wave of optimism into Emerging Markets, specifically India, while providing a stabilizing anchor for U.S. industrial and tech-export sectors. While U.S. technology indices are witnessing a tactical rotation due to yield adjustments under the new Fed leadership, the Indian markets are celebrating a “double win” of fiscal prudence and expanded global market access.

Market Reaction Forecast: We anticipate a “High-Conviction Bullish” trend for the Indian Nifty 50, which is currently testing the 25,830 mark in early trade. The Indo-US trade deal is expected to trigger a significant reallocation of global supply-chain capital toward the NSE/BSE. Conversely, Western indices like the Nasdaq are likely to undergo a period of “Price Discovery” as the VIX edges toward 19.43. Expect defensive sectors like Banking and Infrastructure to lead in India, while Big Tech in the U.S. consolidates until there is more clarity on the Fed’s labor-market defense strategy.

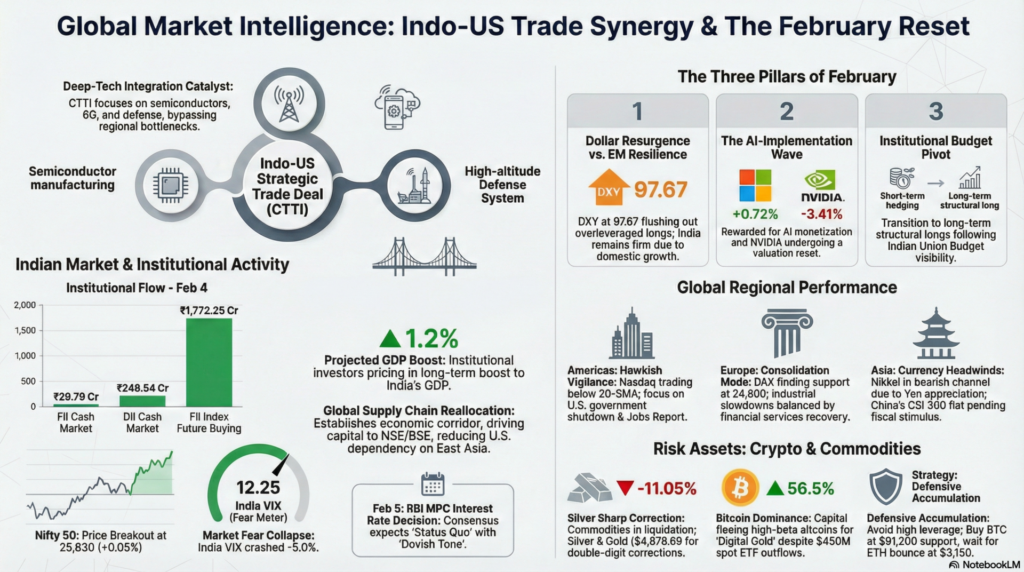

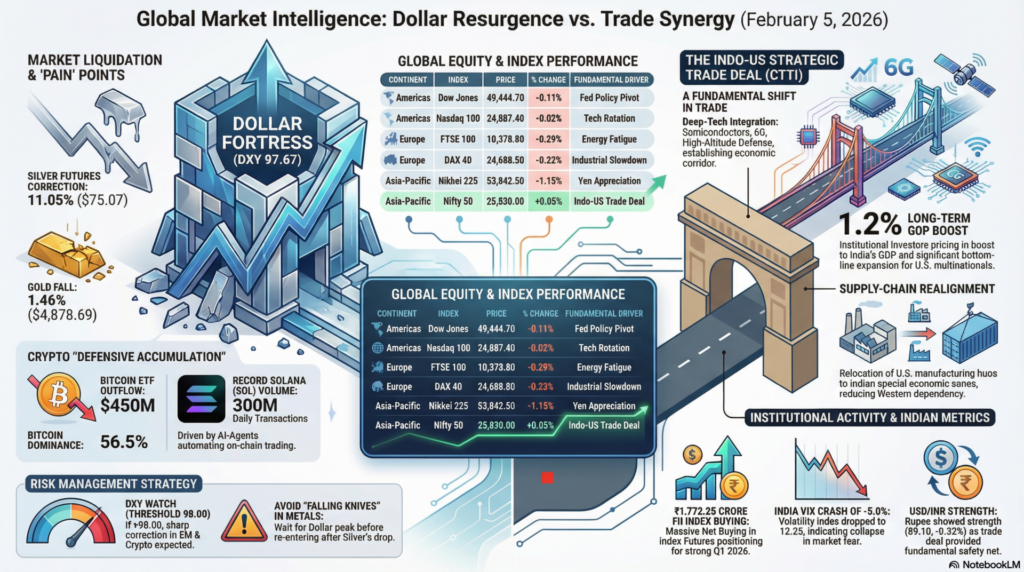

The newly inked Indo-US Comprehensive Trade & Technology Initiative (CTTI) marks a fundamental departure from traditional trade agreements. This deal focuses on “Deep-Tech Integration,” specifically in semiconductor manufacturing, 6G telecommunications, and high-altitude defense systems. By removing tariff barriers for Indian tech exports and facilitating the relocation of U.S. manufacturing hubs to Indian special economic zones, the deal establishes a robust economic corridor that effectively bypasses regional geopolitical bottlenecks.

From a market perspective, this is a massive tailwind for the Indian Rupee (INR) and Indian export-oriented sectors. For the U.S., the deal provides a critical secondary manufacturing base that reduces dependency on East Asian logistics. Institutional investors are already pricing in a long-term 1.2% boost to India’s GDP and a significant expansion in the bottom line for U.S.-based multinationals with large Indian footprints. This synergy is the primary driver behind the recent surge in FII Index Futures and the record-breaking DII inflows seen this week.

| Continent | Index / Exchange | Live/Futures Price | % Change | Technical Status | Fundamental Driver |

| Americas | Dow Jones (USA) | 49,444.70 | -0.11% | Testing 50-DMA | Fed Policy Pivot |

| S&P 500 (USA) | 6,878.10 | -0.07% | Support Held | Earnings Revisions | |

| Nasdaq 100 (USA) | 24,887.40 | -0.02% | Below 20-SMA | Tech Rotation | |

| Europe | FTSE 100 (UK) | 10,378.80 | -0.29% | Key Resistance | Energy Fatigue |

| DAX 40 (Germany) | 24,688.50 | -0.22% | Sideways | Industrial Slowdown | |

| CAC 40 (France) | 8,281.90 | -0.18% | Consolidation | Luxury Softness | |

| Asia-Pacific | Nikkei 225 (Japan) | 53,842.50 | -1.15% | Bearish Trend | Yen Appreciation |

| Hang Seng (HK) | 26,518.00 | -0.23% | Testing Floor | China PMI Jitters | |

| Nifty 50 (India) | 25,830.00 | +0.05% | Budget Breakout | Indo-US Trade Deal |

| Asset Class | Instrument | Live Price | % Change | Technical View |

| Crypto | Bitcoin (BTC) | $93,950.00 | -0.45% | Consolidating |

| Ethereum (ETH) | $3,192.40 | -0.80% | Support at $3.1k | |

| Forex | Dollar Index | 97.67 | +0.19% | Bullish Breakout |

| USD/INR | 89.10 | -0.32% | Rupee Strength | |

| Commodities | Gold Futures | $4,878.69 | -1.46% | Liquidation Phase |

| Brent Crude | $68.01 | -2.09% | Demand Concerns | |

| Silver Futures | $75.07 | -11.05% | Sharp Correction |

Institutional Activity (Feb 4 – Closing Summary):

Economic Calendar (India Focus):

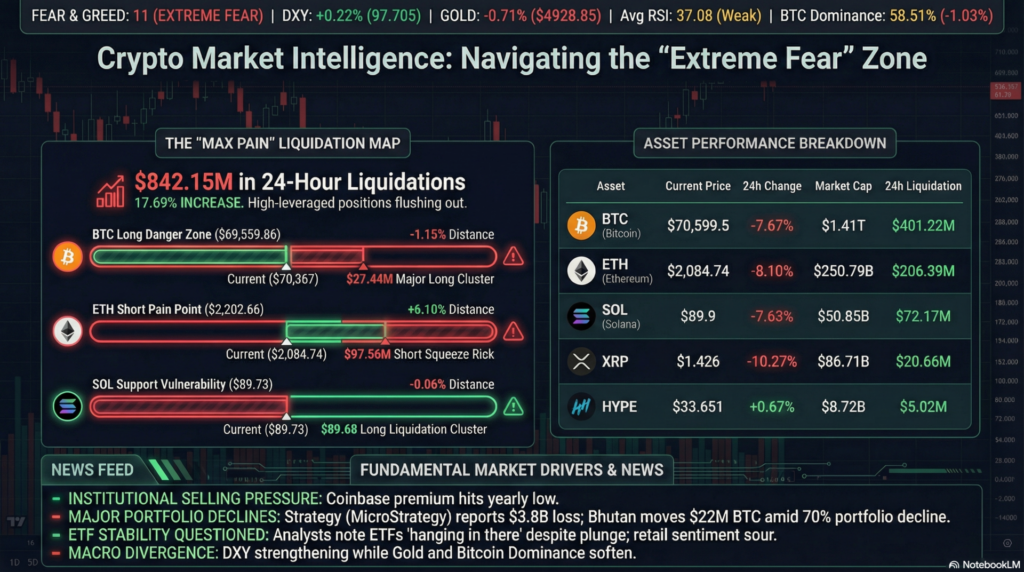

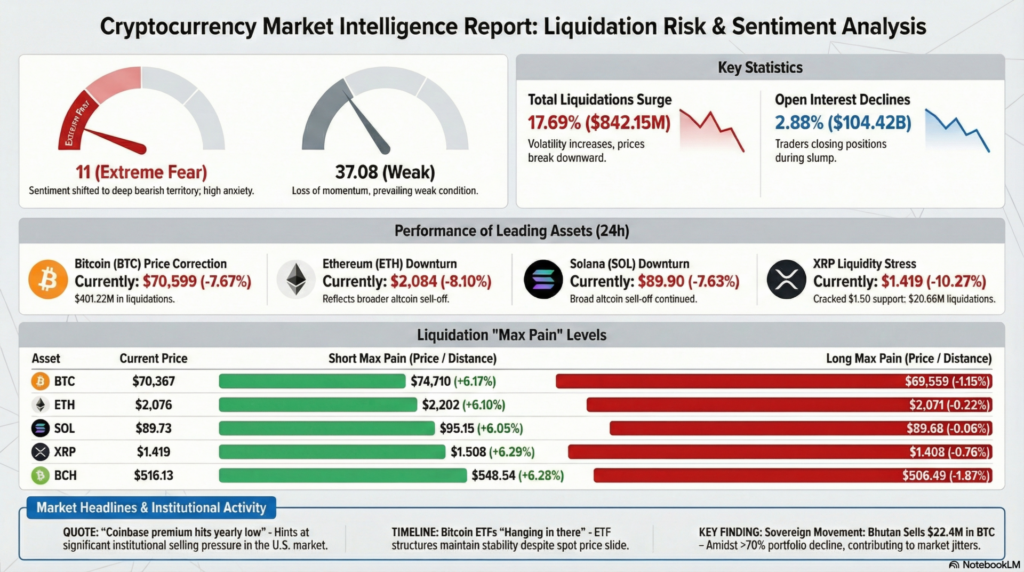

How to Trade Crypto Today:

The strategy today is “Defensive Accumulation.” Avoid high-leverage longs. For Bitcoin, place buy orders at the $91,200 support level with a tight stop-loss. For Ethereum, wait for a confirmed bounce at the $3,150 mark. Tip: In a high-DXY environment (97.67), crypto typically faces pressure; wait for Dollar stabilization before entering heavy positions.

The primary narrative of February 5 is “Dollar Resurgence vs. EM Resilience.” The spike in the Dollar Index to 97.67 is exerting massive pressure on commodities like Gold and Silver, which are seeing double-digit corrections. This is a classic “monetary cleanup” where overleveraged speculative longs are being flushed out. However, unlike previous cycles, Emerging Markets like India are holding firm, supported by a fundamental domestic growth story and favorable trade treaties.

The second pillar is the “AI-Implementation Wave.” We are seeing a divergence in Big Tech; firms like Microsoft (+0.72%) are being rewarded for enterprise AI monetization, while high-beta tech like NVIDIA (-3.41%) is undergoing a valuation reset. The market is shifting from “AI Hype” to “AI Utility,” and portfolios are being recalibrated to favor companies that can show immediate margin improvements from automated workflows.

Finally, the “Institutional Budget Pivot” is now in its execution phase. With the Indian Union Budget and the Indo-US trade deal both providing long-term visibility, institutional desks are shifting from “short-term hedging” to “long-term structural longs.” This is evidenced by the massive FII Index Future buying (₹1,772 Cr) seen in the latest data, indicating that the smart money is betting on a strong finish to the first quarter.

| Date | Country | Occasion | Market Status |

| Jan 1 | USA / India | New Year’s Day | CLOSED |

| Jan 19 | USA | MLK Jr. Day | CLOSED |

| Jan 26 | India | Republic Day | CLOSED |

| Feb 1 | India | Union Budget Day | OPEN (Special Session) |

How to View the Global Markets Today:

The market is in an “Institutional Calibration” phase. The volatility in Gold and Silver is a warning sign of high monetary tightening. Do not catch falling knives in the metals space; wait for the Dollar to peak.

Risk Management Analysis:

Important Takeaway:

The theme of February 5 is “Dollar Fortress vs. Trade Synergy.” While the Greenback is exerting its dominance over commodities, the Indo-US trade deal has created a fundamental safety net for Indian equities. Stay focused on “Trade-Beneficiary” sectors and maintain a defensive posture in the global crypto and metals market.

Legal Disclaimer & Liability Waiver

This AI-generated report is strictly educational and does not constitute financial, legal, or professional advice. aiTrendview and its affiliates are not SEBI-registered advisors and assume zero liability for any losses or consequences resulting from its use. All data is autonomously harvested from public sources and may be flawed, delayed, or incomplete; therefore, you assume exclusive responsibility for independently verifying information before taking any action. Under no circumstances should this content be construed as a recommendation to trade or speculate in any security. By accessing this material, you acknowledge that any reliance on this data is at your sole risk, and you agree to be bound by strict intellectual property protections prohibiting the unauthorized redistribution or modification of this work.

© Copyright 2025. All Rights Reserved By aiTrendview.com a AQJ TRADERS Product

1) or fractional share

Investing in the stock markets carries risk: the value of investments can go up as well as down and you may receive back less than your original investment. Individual investors should make their own decisions or seek independent advice.