Professional Technical Analysis Dashboard – Complete Guide

To access Tradingview Indicator for FREE Click Here

🎯 Overview

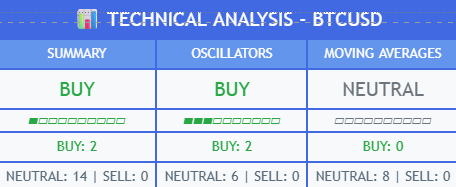

This is a comprehensive, institutional-grade technical analysis dashboard that combines multiple proven indicators into a single, visually stunning interface. It provides real-time market sentiment analysis through three critical categories: Summary, Oscillators, and Moving Averages, all displayed in a professional royal blue and white theme with intuitive progress indicators.

🔬 Technical Foundation & Methodology

📈 Summary Section – The Master Signal

The Summary section is the crown jewel of this dashboard, combining all 16 individual indicators into one powerful, unified signal.

What It Does:

• Aggregates 16 Technical Indicators: Combines 8 oscillators + 8 moving averages

• Weighted Scoring System: Each indicator contributes equally to the final score

• Real-Time Analysis: Updates with every bar close for current market conditions

• Universal Compatibility: Works on any symbol (stocks, forex, crypto, commodities)

How It Works:

Summary Score = Oscillator Signals + Moving Average Signals

Range: -16 to +16

├── Strong Buy: +6 to +16 (Green)

├── Buy: +2 to +5 (Light Green)

├── Neutral: -1 to +1 (Gray)

├── Sell: -5 to -2 (Light Red)

└── Strong Sell: -16 to -6 (Red)

Trading Advantages:

✅ Quick Decision Making: One glance tells you market sentiment

✅ Reduces Analysis Paralysis: No need to check 16 indicators individually

✅ Higher Accuracy: Multiple confirmations reduce false signals

✅ Risk Management: Clear zones help position sizing decisions

✅ Time Efficient: Perfect for busy traders managing multiple positions

When To Use Summary:

• Entry Decisions: Strong Buy/Sell signals for new positions

• Portfolio Overview: Quick assessment of multiple holdings

• Risk Assessment: Understanding overall market bias

• Position Sizing: Stronger signals warrant larger positions

⚡ Oscillators Section – Market Momentum Analysis

The Oscillators section focuses on momentum and overbought/oversold conditions, using 8 powerful momentum indicators.

Included Indicators & Their Purposes:

1. RSI (Relative Strength Index) – 14 Period

• Purpose: Identifies overbought (>70) and oversold (<30) conditions

• Trading Signal: RSI > 70 = Sell | RSI < 30 = Buy

• Best For: Mean reversion strategies, divergence analysis

2. Stochastic Oscillator – 14 Period

• Purpose: Compares closing price to price range over time

• Trading Signal: >80% = Overbought | <20% = Oversold

• Best For: Short-term swing trading, momentum confirmation

3. CCI (Commodity Channel Index) – 20 Period

• Purpose: Measures deviation from statistical mean

• Trading Signal: >100 = Sell | <-100 = Buy

• Best For: Cycle analysis, breakout confirmation

4. Williams %R – 14 Period

• Purpose: Momentum oscillator measuring closing vs. high-low range

• Trading Signal: >-20 = Overbought | <-80 = Oversold

• Best For: Timing entries in trending markets.

5. MACD (Moving Average Convergence Divergence)

• Purpose: Trend-following momentum indicator

• Trading Signal: MACD Line > Signal Line = Buy | Below = Sell

• Best For: Trend identification, momentum shifts.

6. Momentum – 10 Period

• Purpose: Rate of price change over specified period

• Trading Signal: Positive = Bullish | Negative = Bearish

• Best For: Early trend detection, momentum confirmation

7. ROC (Rate of Change) – 9 Period

• Purpose: Percentage change in price over time

• Trading Signal: >2% = Buy | <-2% = Sell

• Best For: Identifying acceleration in price movements

8. Bollinger Bands – 20 Period, 2 StdDev

• Purpose: Volatility-based support/resistance levels

• Trading Signal: Above Upper Band = Sell | Below Lower Band = Buy

• Best For: Volatility trading, mean reversion strategies

Oscillator Trading Advantages:

✅ Timing Precision: Excellent for entry/exit timing

✅ Overbought/Oversold Detection: Identifies potential reversals

✅ Divergence Analysis: Spots weakening trends early

✅ Short-Term Focus: Perfect for day trading and swing trading

✅ Momentum Confirmation: Validates trend strength

When Oscillators Are Most Effective:

• Range-Bound Markets: Excellent for buying dips, selling peaks

• Reversal Trading: High probability setups at extreme levels

• Momentum Trading: Confirming breakouts and trend acceleration

• Risk Management: Avoiding entries at poor risk/reward levels

________________________________________

📊 Moving Averages Section – Trend Analysis

The Moving Averages section provides trend identification and direction, using 8 different moving averages across multiple timeframes.

Included Moving Averages:

Simple Moving Averages (SMA):

• SMA 10: Very short-term trend (2 weeks of daily data)

• SMA 20: Short-term trend (1 month of daily data)

• SMA 50: Medium-term trend (2.5 months of daily data)

• SMA 100: Long-term trend (5 months of daily data)

• SMA 200: Major trend (10 months of daily data)

Exponential Moving Averages (EMA):

• EMA 10: Responsive short-term trend

• EMA 20: Responsive medium-term trend

• EMA 50: Responsive long-term trend

Signal Logic:

Price vs Moving Average Analysis:

├── Strong Buy: Price > MA by 2%+ (Strong uptrend)

├── Buy: Price > MA by 0-2% (Mild uptrend)

├── Neutral: Price ≈ MA (Sideways/transition)

├── Sell: Price < MA by 0-2% (Mild downtrend)

└── Strong Sell: Price < MA by 2%+ (Strong downtrend)

Moving Average Trading Advantages:

✅ Trend Identification: Clear bullish/bearish bias

✅ Support/Resistance: MAs act as dynamic support/resistance

✅ Multi-Timeframe Analysis: Short to long-term perspectives

✅ Position Management: Trend following for position sizing

✅ Market Context: Understanding broader market direction

Strategic Applications:

• Trend Following: Buy above MAs, sell below MAs

• Support/Resistance Trading: MAs as dynamic levels

• Position Management: Trailing stops using moving averages

• Market Bias: Understanding institutional positioning

🎯 Step-by-Step Trading Guide for New Traders

Phase 1: Dashboard Setup (5 Minutes)

Step 1: Installation

1. Copy the Pine Script code

2. Open TradingView Pine Editor

3. Paste code and click “Add to Chart”

4. The dashboard appears at bottom center

Step 2: Initial Configuration

1. Size Selection: Choose “Normal” for balanced view

2. Enable All Sections: Keep Summary, Oscillators, and MAs enabled

3. Progress Bars: Keep enabled for visual clarity

4. Timeframe: Start with “60” (1-hour analysis)

Step 3: Visual Verification

• Confirm dashboard shows at bottom center

• Verify all three sections are visible

• Check that progress bars are displaying

• Ensure colors are clear (green=bullish, red=bearish)

Phase 2: Understanding the Signals (10 Minutes Practice)

Step 1: Summary Section Reading

Practice Exercise: Look at 5 different stocks and note:

• What color is the signal? (Green=Buy, Red=Sell, Gray=Neutral)

• What’s the text saying? (Strong Buy, Buy, Neutral, Sell, Strong Sell)

• How filled is the progress bar? (More filled = stronger signal)

Example Reading:

SUMMARY: BUY (Green text)

Progress: ▰▰▰▰▰▰▱▱▱▱ (60% filled, positive)

BUY: 8 | NEUTRAL: 4 | SELL: 4

Interpretation: Moderately bullish, 8 indicators bullish vs 4 bearish

Step 2: Oscillator Analysis

Key Questions to Ask:

• Is the oscillator signal the same as summary?

• Are we in overbought territory (red signal)?

• Are we in oversold territory (green signal)?

• Is momentum building (progress bar filling)?

Trading Application:

• Green Oscillator + Green Summary = High probability buy

• Red Oscillator + Red Summary = High probability sell

• Conflicting signals = Wait for clarity

Step 3: Moving Average Confirmation

Trend Analysis Checklist:

• What’s the MA signal? (Bullish/Bearish)

• Does it match the summary?

• How strong is the trend? (Progress bar intensity)

• Are we trading with or against the trend?

Phase 3: Practical Trading Application (Real Trading)

Strategy 1: Conservative Confirmation Trading

Entry Rules (Low Risk):

1. All three sections must agree (Summary, Oscillators, MAs)

2. Signal strength >60% (progress bars more than half filled)

3. Wait for “Strong Buy” or “Strong Sell” signals only

4. Enter in direction of strongest signal

Example:

Summary: STRONG BUY (▰▰▰▰▰▰▰▰▱▱)

Oscillators: BUY (▰▰▰▰▰▱▱▱▱▱)

Moving Averages: STRONG BUY (▰▰▰▰▰▰▰▰▰▱)

Action: LONG position with high confidence

Strategy 2: Scalping with Oscillators

Entry Rules (Active Trading):

1. Focus primarily on Oscillator section

2. Look for oversold (strong green) for buys

3. Look for overbought (strong red) for sells

4. Use 5-15 minute timeframes

5. Quick exits when signal changes

Strategy 3: Trend Following with MAs

Entry Rules (Position Trading):

1. Moving Average section must be bullish for longs

2. Summary should confirm the trend

3. Use pullbacks in oscillators for entries

4. Hold positions while MAs remain favorable

________________________________________

Phase 4: Risk Management Integration

Position Sizing Based on Signal Strength

Signal Strength Guide:

├── 90-100% filled bars: 3-5% of capital (very high confidence)

├── 70-89% filled bars: 2-3% of capital (high confidence)

├── 50-69% filled bars: 1-2% of capital (moderate confidence)

└── <50% filled bars: No position or paper trade only

Stop Loss Placement

• Oscillator Trades: 2-3% stops (short-term)

• Trend Following: 5-8% stops (give room for noise)

• Strong Signal Trades: Tighter stops (1-2%)

Take Profit Strategy

• First Target: When signal changes from Strong to Normal

• Second Target: When signal goes neutral

• Full Exit: When signal reverses completely

________________________________________

🏆 Advanced Trading Applications

Multi-Timeframe Analysis

Professional Technique:

1. Daily Chart: Check overall trend (MAs section)

2. 1-Hour Chart: Find entry timing (Oscillators)

3. 15-Minute Chart: Precise entry execution

Divergence Trading

Advanced Setup:

• Price makes new highs but Oscillators show weakness

• Price makes new lows but Oscillators show strength

• High probability reversal signals

Market Correlation Analysis

Portfolio Management:

• Check dashboard on multiple correlated assets

• Look for broad market agreement or divergence

• Adjust position sizes based on correlation

🚨 Common Mistakes to Avoid

Beginner Errors:

❌ Trading against all three signals (very low probability)

❌ Ignoring progress bar intensity (signal strength matters)

❌ Using wrong timeframe (scalping on daily signals)

❌ Over-leveraging on weak signals (<50% progress bars)

❌ Not waiting for confirmation (jumping on first green/red)

Proper Approach:

✅ Wait for alignment between sections

✅ Use signal strength for position sizing

✅ Match timeframe to trading style

✅ Start small while learning the system

✅ Keep trading journal of signal accuracy

________________________________________

📊 Performance Optimization Tips

Best Timeframes for Different Strategies:

• Scalping: 5-15 minute analysis

• Day Trading: 15-60 minute analysis

• Swing Trading: 1-4 hour analysis

• Position Trading: Daily analysis

Market Condition Adaptation:

• Trending Markets: Focus on MA section, use oscillator pullbacks

• Range-Bound Markets: Focus on oscillator extremes

• High Volatility: Reduce position sizes, wait for stronger signals

• Low Volatility: Can take moderate signals with proper stops

🎯 Success Metrics & Tracking

Key Performance Indicators:

• Signal Accuracy: Track win rate by signal strength

• Risk-Adjusted Returns: Profit per unit of risk taken

• Signal Consistency: How well signals align across sections

• Market Condition Performance: Which signals work best when

Recommended Practice Routine:

1. Daily Review: Check dashboard on 5-10 watchlist stocks

2. Signal Logging: Note signal strength and outcomes

3. Weekly Analysis: Review which signals performed best

4. Monthly Optimization: Adjust strategy based on performance data

This Professional Technical Analysis Dashboard represents a complete trading solution that combines institutional-grade analysis with retail trader accessibility. By following this comprehensive guide, traders of all experience levels can harness the power of 16 technical indicators through one beautiful, intuitive interface. 🚀📈

Remember: Consistent profitability comes from disciplined application of proven systems, proper risk management, and continuous learning from market feedback.

1) or fractional share

Investing in the stock markets carries risk: the value of investments can go up as well as down and you may receive back less than your original investment. Individual investors should make their own decisions or seek independent advice.