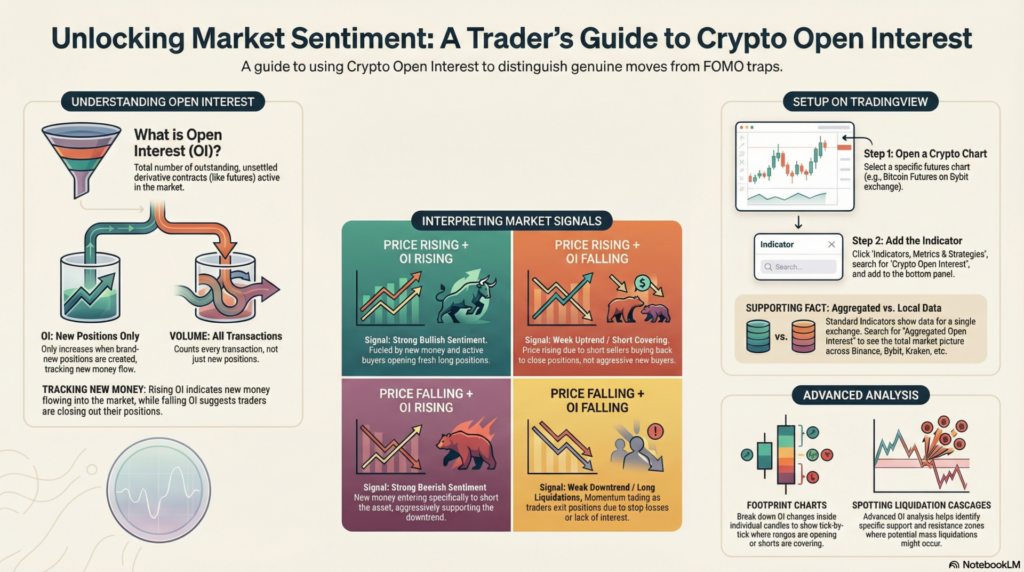

In the volatile world of cryptocurrency trading, price action alone doesn’t always tell the full story. Understanding the commitment behind a move—whether it’s driven by new money or people rushing for the exit—is crucial. A recent tutorial on the TradingView channel dives into Crypto Open Interest, a powerful indicator that reveals the “real-time pulse” of market leverage.

Here is a breakdown of what Open Interest is, how to find it, and how to interpret it to make better trading decisions.

Open Interest represents the total number of outstanding, unsettled derivative contracts (like futures) in the market at any given moment. Unlike volume, which counts every transaction, Open Interest only grows when new positions are created.

Note: The standard TradingView indicator shows data for the specific exchange you are viewing (e.g., Bybit). To see the total market picture, you can search for “Aggregated Open Interest” indicators in the community library, which sum up data from major exchanges like Binance, Bybit, and Kraken.

The key to using this tool is analyzing the relationship between Price and Open Interest. The video outlines four main scenarios:

For those looking to go deeper, the tutorial mentions Footprint Charts. These advanced charts break down Open Interest changes inside each candle, showing you exactly where longs are opening or shorts are covering tick-by-tick. This level of detail helps identify support/resistance zones and potential liquidation cascades.

By mastering Open Interest, you gain a view into who is participating in the market, helping you distinguish between a genuine breakout and a “FOMO” trap.

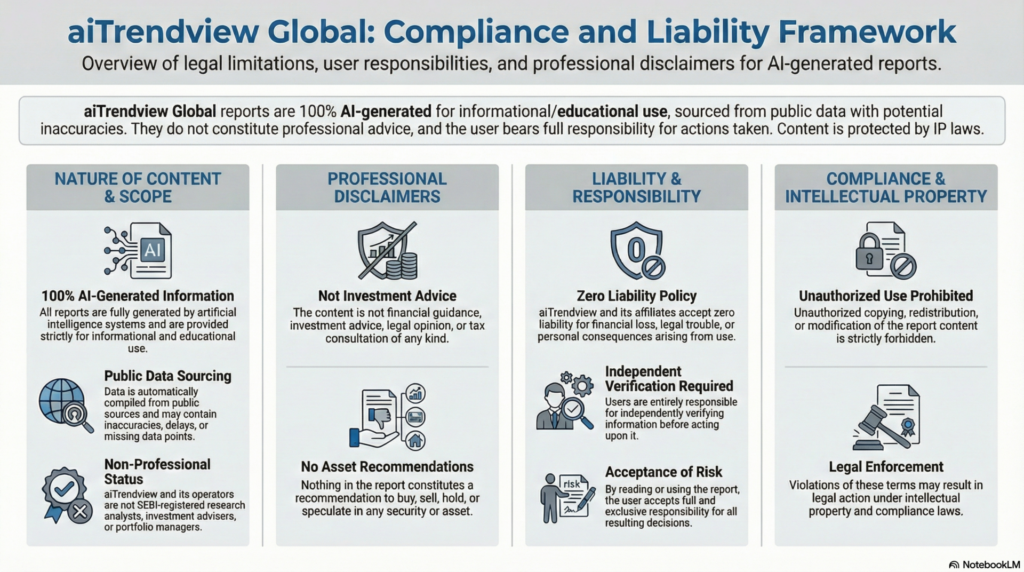

aiTrendview Global Disclaimer

This report is fully AI-generated and is provided strictly for informational and educational use only. It is not investment advice, financial guidance, legal opinion, tax consultation, or professional recommendation of any kind. aiTrendview and its operators are not SEBI-registered research analysts, investment advisers, or portfolio managers. All data is automatically compiled from public sources that may contain inaccuracies, delays, or missing information. If you act on this content without verifying it independently, that is entirely your responsibility.

Nothing in this report is a recommendation to buy, sell, hold, or speculate in any asset or security. aiTrendview, its creators, developers, affiliates, and associated AI systems accept zero liability for financial loss, legal trouble, or personal consequences arising from the use of this material. By reading or using this report, you accept full responsibility for your decisions. Unauthorized copying, redistribution, or modification of this content is prohibited and may result in legal action under intellectual property and compliance laws.

© Copyright 2025. All Rights Reserved By aiTrendview.com a AQJ TRADERS Product

1) or fractional share

Investing in the stock markets carries risk: the value of investments can go up as well as down and you may receive back less than your original investment. Individual investors should make their own decisions or seek independent advice.