Global Market Intelligence: Navigating Volatility Amidst Institutional Rebalancing and Economic Shifts

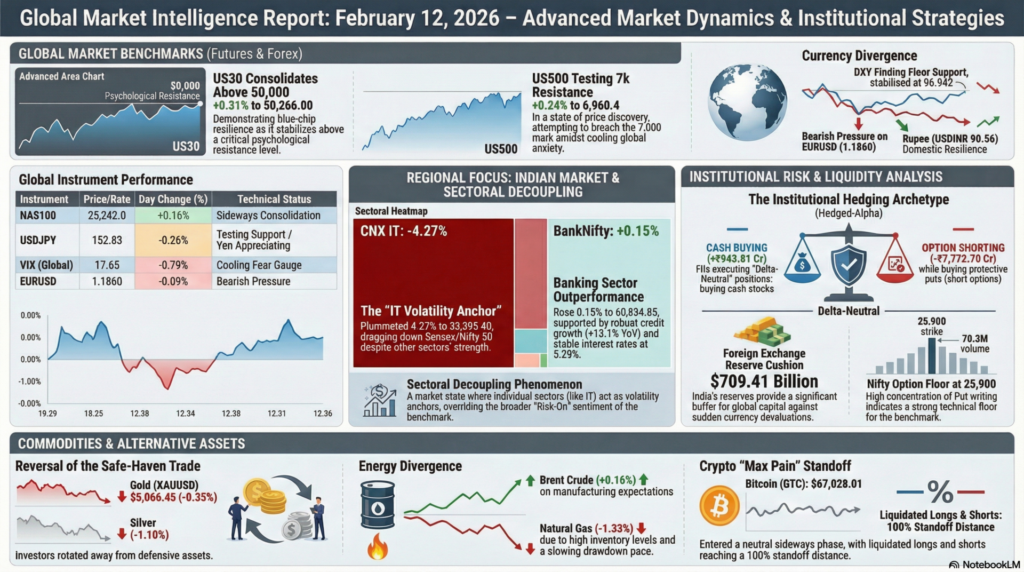

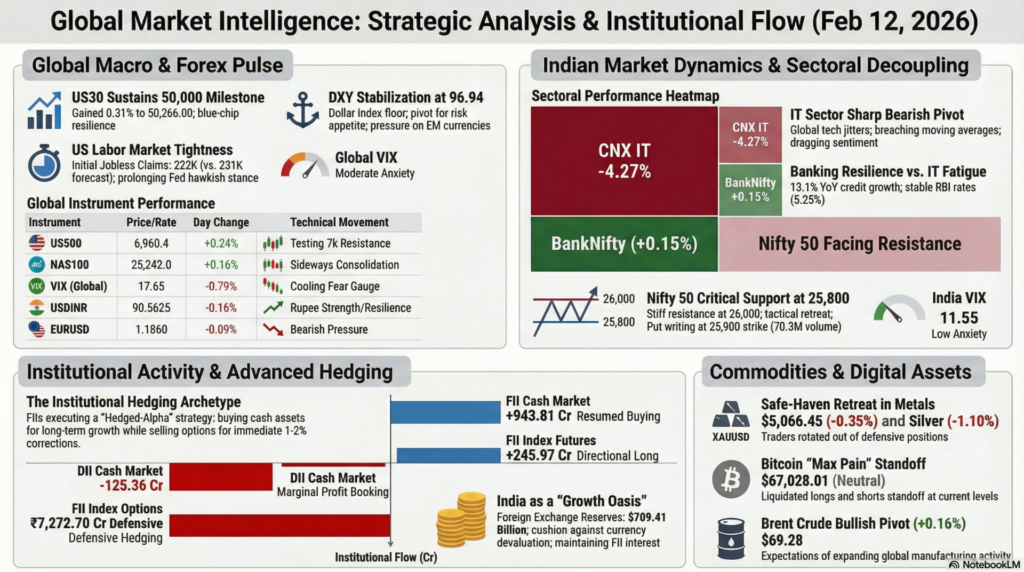

The global financial landscape on February 12, 2026, reflects a state of cautious navigation as major equity indices grapple with localized volatility and shifting institutional sentiment. In the Western markets, US futures exhibited a modest recovery with the US30 gaining 0.31% and the US500 climbing 0.24%, suggesting a steadying hand following recent sessions of price discovery. European indices presented a mixed picture, with the German DAX edging up 0.27% while the French CAC 40 dipped by 0.20%, indicating a continent-wide rotation between industrial resilience and luxury softness. This collective plateauing suggests that global investors are currently in a “wait-and-watch” mode, processing initial jobless claims data and preparing for upcoming central bank signals.

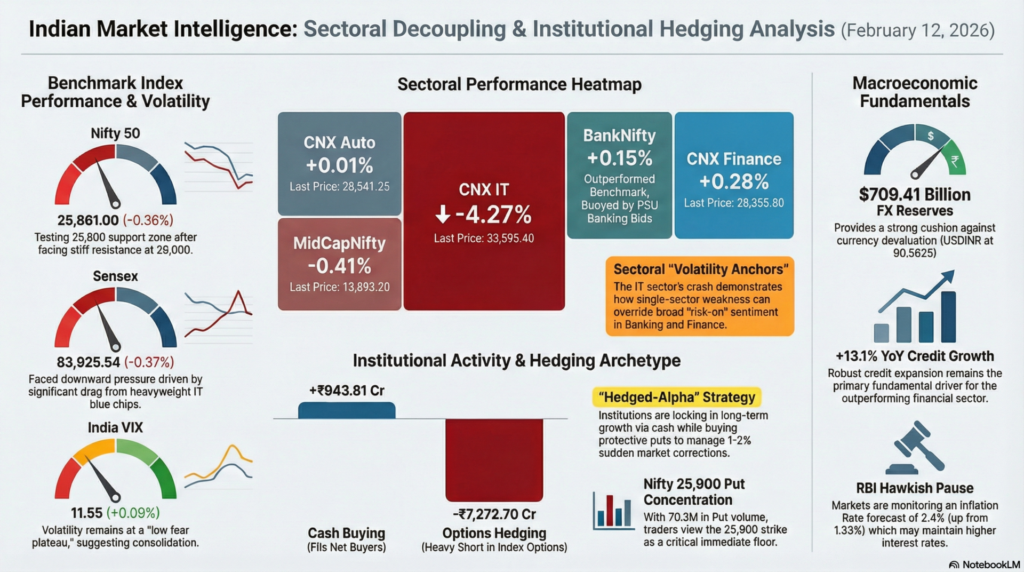

In the Indian domestic market, the narrative remains one of localized structural strength despite a marginal cooling of institutional fervor. The Nifty 50 and Sensex both recorded slight gains, holding near psychological resistance levels as the India VIX marginally rose to 11.55. While Foreign Institutional Investors (FIIs) returned to the cash market as net buyers with an inflow of ₹943.81 Crores, their heavy short positioning in Index Options, totaling -₹7,272.70 Crores, indicates a sophisticated hedging strategy against immediate tail risks. Sectoral performance was notably bifurcated; while Auto and Banking showed resilience, the IT sector faced a sharp correction of 4.27%, largely driven by global tech jitters and profit-booking in heavyweight blue chips.

| Instrument | Price / Rate | Day Change (%) | Technical Movement | Key Event / Driver |

| US500 | 6,960.4 | +0.24% | Testing 7k Resistance | Stabilization Efforts |

| US30 | 50,266.00 | +0.31% | Consolidating above 50k | Blue-chip Resilience |

| NAS100 | 25,242.0 | +0.16% | Sideways Consolidation | Tech Growth Pivot |

| DXY | 96.942 | +0.04% | Finding Floor Support | Dollar Index Recovery |

| VIX (Global) | 17.65 | -0.79% | Cooling Fear Gauge | Easing Global Anxiety |

| EURUSD | 1.1860 | -0.09% | Bearish Pressure | Euro Softness |

| USDJPY | 152.83 | -0.26% | Testing Support | Yen Appreciation |

| USDINR | 90.5625 | -0.16% | Rupee Strength | Domestic Resilience |

Technical Analysis: Global futures are exhibiting a “bullish-neutral” bias, with the US30 leading the charge back above the 50,000 mark. The Dollar Index (DXY) is showing signs of stabilization near 96.94, which is currently acting as a pivot point for global risk appetite.

Fundamental Analysis: The fundamental backdrop is dominated by the recalibration of labor market expectations. With the DXY finding support, the immediate pressure on Emerging Market currencies has intensified, although the Rupee maintains strength due to robust local reserves.

Economic Announcements: US Initial Jobless Claims came in at 222K (Actual) against a forecast of 231K, suggesting a tighter-than-expected labor market which could prolong the Fed’s hawkish stance. Meanwhile, the Indian Inflation Rate (YoY) is being closely watched with a prior of 1.33%.

| Index / Sector | Last Price | Day Change (%) | Technical Movement | Event / Driver |

| NIFTY 50 | 25,861.00 | -0.36% | Testing 25,800 Support | Large-cap Pressure |

| SENSEX | 83,925.54 | -0.37% | Sideways Bias | IT Sector Drag |

| BANKNIFTY | 60,834.85 | +0.15% | Outperforming Benchmark | PSU Banking Bids |

| INDIA VIX | 11.55 | +0.09% | Consolidation at Base | Low Fear Plateau |

| CNX IT | 33,595.40 | -4.27% | Sharp Bearish Pivot | Global Tech Jitters |

| CNX AUTO | 28,541.25 | +0.01% | Rangebound | Sectoral Churn |

| CNX FINANCE | 28,355.80 | +0.28% | Bullish Divergence | Credit Growth Hopes |

| MIDCPNIFTY | 13,893.20 | -0.41% | Profit Booking | Broad Market Fatigue |

Technical Analysis: The Nifty 50 is facing stiff resistance at the 26,000 mark, leading to a tactical retreat toward the 25,800 support zone. The most significant technical event is the 4.27% crash in the CNX IT index, which has breached key moving averages and dragged the broader market sentiment down.

Fundamental Analysis: Domestic sentiment is currently split between robust credit growth in the financial sector (+13.1% YoY) and valuation concerns in the IT services segment. The banking sector remains fundamentally supported by healthy deposit growth and stable RBI interest rates at 5.25%.

Economic Announcements: The Indian economic calendar remains focused on the Inflation Rate (YoY) forecast of 2.4%, a significant jump from the prior 1.33%, which may influence the RBI’s “Hawkish Pause” stance in the coming months.

| Segment | Net Buy/Sell (Cr) | Action Bias |

| FII Cash Market | +943.81 | Resumed Buying |

| DII Cash Market | -125.36 | Marginal Profit Booking |

| FII Index Futures | +245.97 | Directional Long |

| FII Index Options | -7,272.70 | Defensive Hedging |

| FII Stock Futures | -760.97 | Selective Selling |

| Index | ATM Strike | ATM IV (%) | Put Volume | Call Volume |

| NIFTY | 25,900 | 10.0 | 70,335,265 | 62,723,960 |

| BANKNIFTY | 60,800 | 9.1 | 1,436,130 | 1,601,940 |

Technical Analysis: The Nifty option chain indicates a high concentration of Put writing at the 25,900 strike (70.3M volume), suggesting that traders view this level as a critical immediate floor. However, the FII net short position in options (-₹7,272 Cr) indicates they are buying protective puts to hedge their long cash positions.

Fundamental Analysis: Institutional rebalancing is evident as FIIs return to cash buying while DIIs take a slight breather. This suggest that global capital is finding value in the Indian “Growth Oasis” despite the global headwinds, provided they can manage the short-term volatility through derivatives.

Economic Announcements: Foreign Exchange Reserves stand at $709.41 Billion, providing a strong cushion for institutional investors who fear sudden currency devaluations. This fundamental strength continues to attract FIIs back to the cash market despite global dollar strength.

| Instrument | Price | Day Change (%) | Technical Status |

| Bitcoin (BTC) | $67,028.01 | 0.00% | Neutral Sideways |

| Ethereum (ETH) | $1,966.3 | +1.32% | Bullish Recovery |

| GOLD (XAUUSD) | $5,066.45 | -0.35% | Corrective Phase |

| SILVER | $83.33 | -1.10% | Bearish Momentum |

| BRENT CRUDE | $69.285 | +0.16% | Bullish Pivot |

| NATGAS | $3.925 | -1.33% | Bearish Breakdown |

Technical Analysis: Commodities are seeing a reversal of the safe-haven trade, with Gold and Silver retreating from their recent peaks. In the crypto market, Bitcoin is undergoing a period of “Max Pain” with a neutral price of $66,951, as liquidated longs and shorts reach a standoff at 100% distance from their pain points.

Fundamental Analysis: The uptick in Brent Crude (+0.16%) is largely driven by a slight expansion in global manufacturing activity expectations, while Natural Gas continues to suffer from oversupply and high inventory levels (-256B cf change).

Economic Announcements: The EIA Natural Gas Stocks Change of -256B cf compared to the prior -360B cf indicates a slowing pace of inventory drawdown, further pressuring NatGas prices.

For educational and training purposes, today’s session highlights the Sectoral Decoupling Phenomenon. While the broader benchmark (Nifty) remained relatively stable, the IT sector’s 4.27% crash demonstrates how individual sectors can act as “volatility anchors” during periods of global uncertainty. For a trainee trader, this underscores the importance of not just watching the benchmark, but analyzing sectoral weightage and its impact on the index. The IT drag on the Sensex (-308 points) shows that even when the banking sector is positive, a single sector’s fundamental weakness can override the broader “Risk-On” sentiment.

Secondly, the Institutional Hedging Archetype observed today provides a masterclass in risk management. FIIs are net buyers in the cash market (+₹943 Cr) yet net sellers in options (-₹7,272 Cr). This teaches us that institutional investors rarely take a naked “Bull” or “Bear” stance; instead, they build complex “Delta-Neutral” or “Hedged-Alpha” positions. By buying cash and selling options, they are effectively locking in long-term growth while protecting their capital against a 1-2% sudden market correction—a strategy every professional trader must master to survive a high-terminal rate environment.

Legal Disclaimer & Liability Waiver

This AI-generated report is strictly educational and does not constitute financial, legal, or professional advice. aiTrendview and its affiliates are not SEBI-registered advisors and assume zero liability for any losses or consequences resulting from its use. All data is autonomously harvested from public sources and may be flawed, delayed, or incomplete; therefore, you assume exclusive responsibility for independently verifying information before taking any action. Under no circumstances should this content be construed as a recommendation to trade or speculate in any security. By accessing this material, you acknowledge that any reliance on this data is at your sole risk, and you agree to be bound by strict intellectual property protections prohibiting the unauthorized redistribution or modification of this work.

1) or fractional share

Investing in the stock markets carries risk: the value of investments can go up as well as down and you may receive back less than your original investment. Individual investors should make their own decisions or seek independent advice.