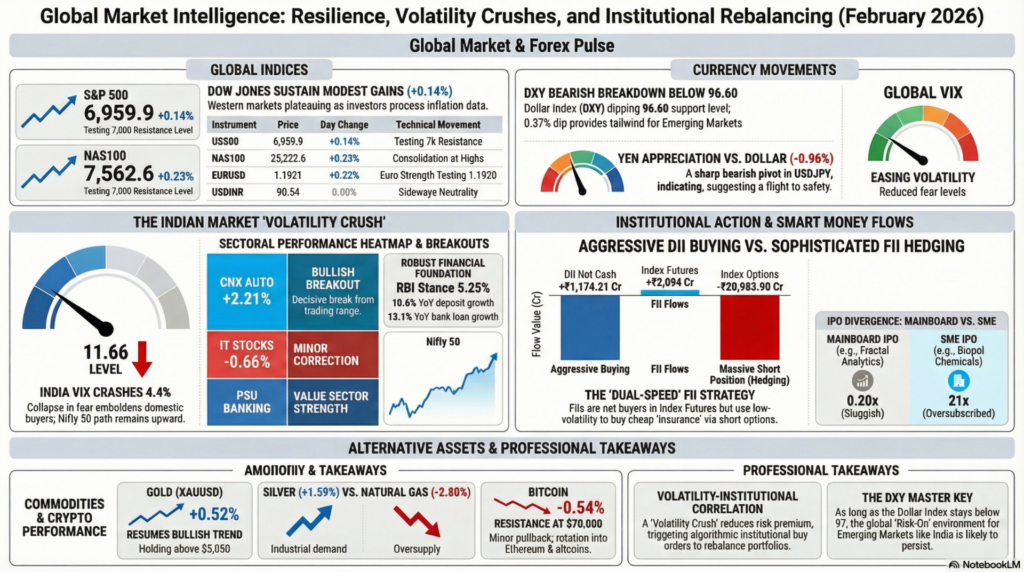

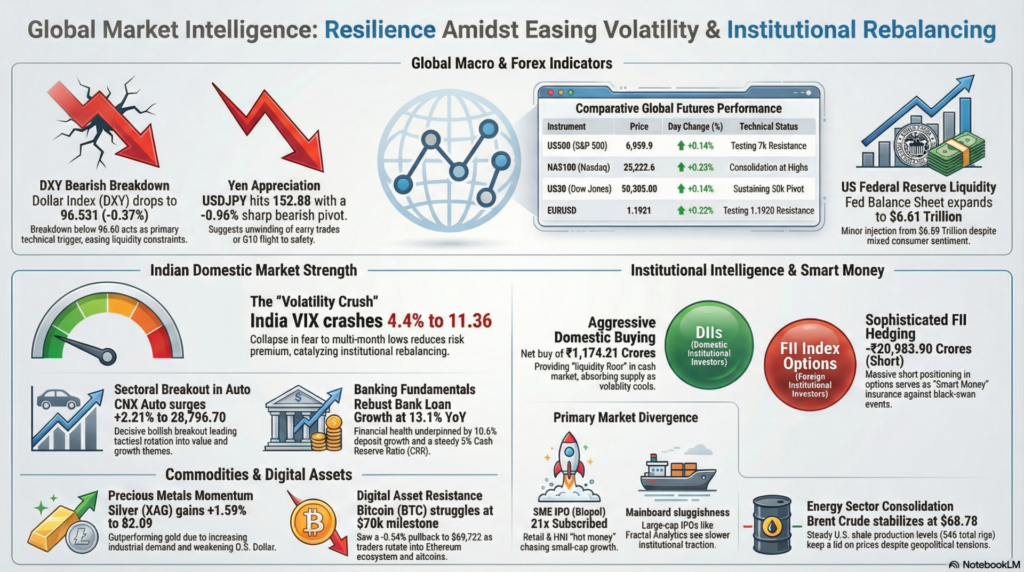

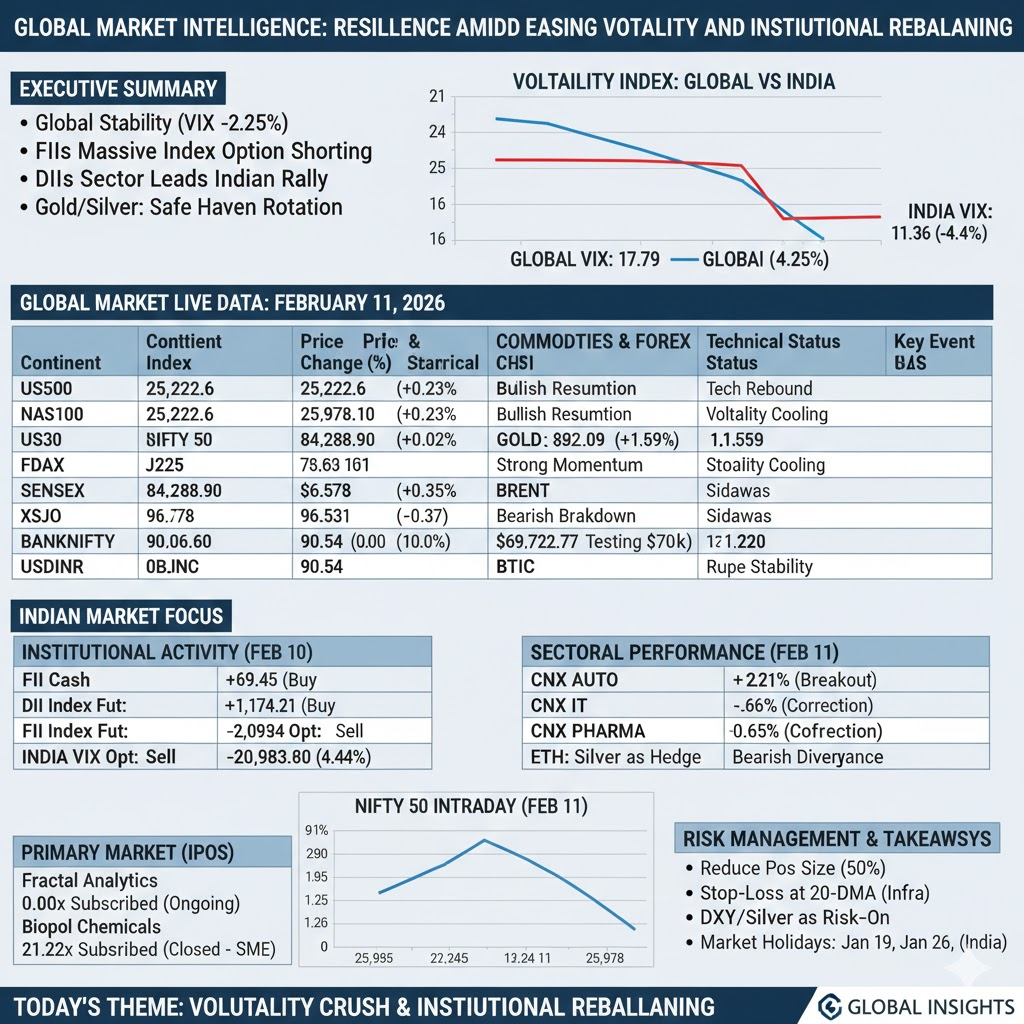

The global financial landscape on February 11, 2026, reflects a state of cautious optimism as major equity indices stabilize following a period of heightened uncertainty. In the United States, the S&P 500 and Dow Jones Industrial Average showed modest gains of 0.14%, indicating a steadying hand in the West. European markets mirrored this stability, with the DAX and CAC 40 posting marginal positive movements, while the Euro Stoxx 50 saw a negligible dip. This collective plateauing suggests that global investors are currently in a “wait-and-watch” mode, processing recent inflation data and central bank signals. The significant easing of the Global VIX by 2.25% recently has provided much-needed breathing room for risk assets, allowing for a tactical rotation into value sectors.

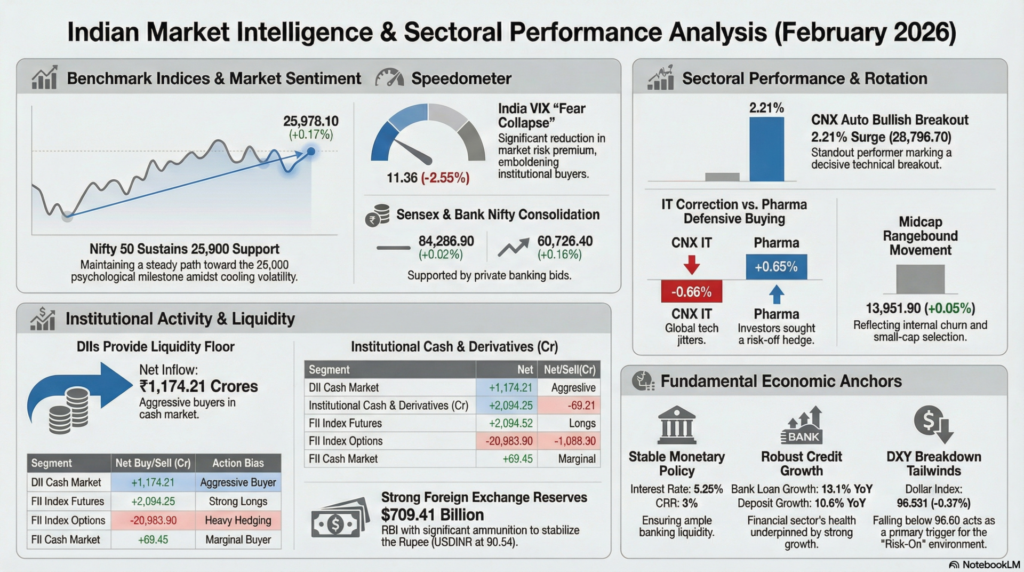

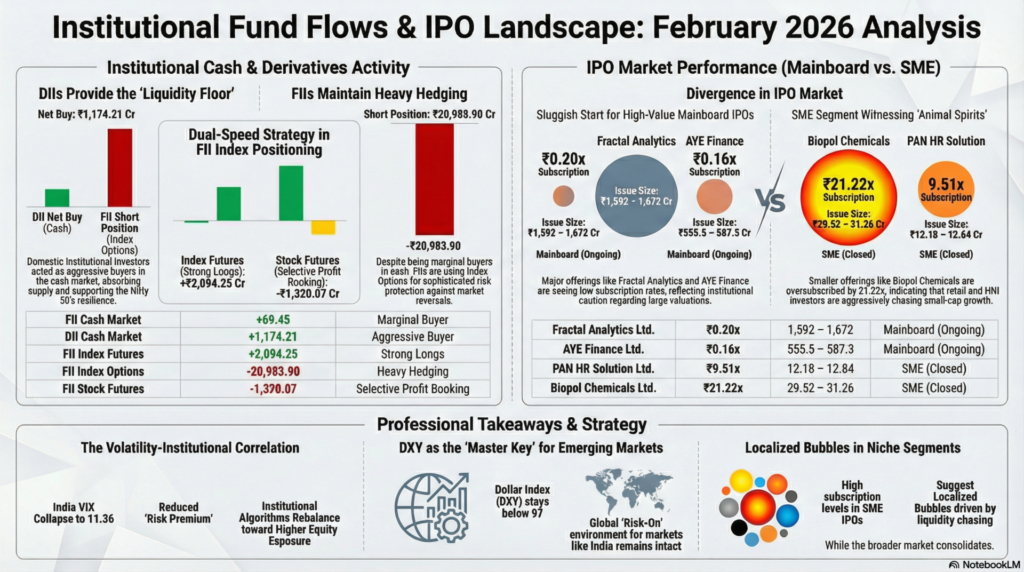

In the Indian domestic market, the narrative is one of clear structural strength and cooling fear. The Nifty 50 and Sensex both recorded gains of 0.3%, fueled by a significant reduction in the India VIX, which crashed by 4.4% to reach the 11.66 level. This collapse in volatility has emboldened domestic institutional investors, who participated with a net buy of ₹1,174.21 Crores in the cash market. While Foreign Institutional Investors (FIIs) remained marginal buyers in cash, their massive short positioning in Index Options, totaling -₹20,983.90 Crores, indicates a sophisticated hedging strategy against potential tail risks. Overall, the market is transitioning from a high-volatility regime to one of steady accumulation, supported by robust sectoral performances in Auto and PSU Banking.

| Instrument | Price / Rate | Day Change (%) | Technical Movement | Key Event |

| US500 | 6,959.9 | +0.14% | Testing 7k Resistance | Stabilization Post-Fed |

| US30 | 50,305.00 | +0.14% | Sustaining 50k Pivot | Blue-chip Resilience |

| NAS100 | 25,222.6 | +0.23% | Consolidation at Highs | Tech Sector Rebound |

| DXY | 96.531 | -0.37% | Bearish Breakdown | Dollar Weakness |

| VIX (Global) | 17.79 | +2.48% | Floor Support Bounce | Tactical Hedging |

| EURUSD | 1.1921 | +0.22% | Testing 1.1920 | Euro Strength |

| USDJPY | 152.88 | -0.96% | Sharp Bearish Pivot | Yen Appreciation |

| USDINR | 90.54 | 0.00% | Neutral Sideways | Rupee Stability |

Technical Analysis: Global futures are currently exhibiting a “sideways-to-positive” bias. The US500 is attempting to establish a firm base above the 6,950 level, while the NAS100 is consolidating after recent volatility. The breakdown of the Dollar Index (DXY) below 96.60 is a primary technical trigger, providing a tailwind for Emerging Market currencies and global equities.

Fundamental Analysis: The overarching fundamental theme is the recalibration of interest rate expectations. With the DXY weakening, there is a perceived easing of global liquidity constraints. The Yen’s sharp appreciation against the Dollar (-0.96%) suggests a potential unwinding of carry trades or a flight to safety within the G10 currency basket.

Economic Announcements: US Federal Reserve data shows the balance sheet standing at $6.61 Trillion, up from $6.59 Trillion, indicating a slight expansion in liquidity. Meanwhile, Michigan Consumer Sentiment (Actual: 55 vs Prev: 56.4) and 5-Year Inflation Expectations at 3.3% remain critical anchors for Western policy decisions.

| Index / Sector | Last Price | Day Change (%) | Technical Movement | Event / Driver |

| NIFTY 50 | 25,978.10 | +0.17% | Holding 25,900 Support | Volatility Cooling |

| SENSEX | 84,288.90 | +0.02% | Sideways Consolidation | Large-cap Stability |

| BANKNIFTY | 60,726.40 | +0.16% | Trading Near 60.7k | Private Bank Bids |

| INDIA VIX | 11.36 | -2.55% | Multi-month Lows | Fear Collapse |

| CNX AUTO | 28,796.70 | +2.21% | Bullish Breakout | Sectoral Rotation |

| CNX IT | 35,487.70 | -0.66% | Short-term Correction | Global Tech Jitters |

| CNX PHARMA | 22,355.20 | +0.65% | Defensive Buying | Risk-off Hedge |

| MIDCPNIFTY | 13,951.90 | +0.05% | Rangebound | Small-cap Churn |

Technical Analysis: The Nifty 50 is demonstrating remarkable resilience, maintaining its position within a striking distance of the 26,000 psychological milestone. A major technical highlight is the CNX Auto sector’s 2.21% surge, marking a decisive breakout from its recent trading range. The continued decline in India VIX to 11.36 suggests that the path of least resistance remains upward.

Fundamental Analysis: Domestic sentiment is being propped up by stable interest rate expectations, with the RBI maintaining its stance at 5.25%. Robust deposit growth (10.6% YoY) and bank loan growth (13.1% YoY) underpin the fundamental health of the financial sector, despite the minor correction in IT stocks.

Economic Announcements: The Cash Reserve Ratio (CRR) remains steady at 3%, providing ample liquidity for the banking system. Traders are now awaiting the finalization of Bank Loan and Deposit growth figures to gauge the pace of economic expansion for the first quarter of 2026.

| Segment | Net Buy/Sell (Cr) | Action Bias |

| FII Cash Market | +69.45 | Marginal Buyer |

| DII Cash Market | +1,174.21 | Aggressive Buyer |

| FII Index Futures | +2,094.25 | Strong Longs |

| FII Index Options | -20,983.90 | Heavy Hedging |

| FII Stock Futures | -1,320.07 | Selective Profit Booking |

| IPO Company | Subscription (Times) | Issue Size (Rs. Cr) | Status |

| Fractal Analytics Ltd. | 0.20x | 1,592 – 1,672 | Ongoing |

| AYE Finance Ltd. | 0.16x | 555.5 – 587.3 | Ongoing |

| PAN HR Solution Ltd. | 9.51x | 12.18 – 12.84 | Closed |

| Biopol Chemicals Ltd. | 21.22x | 29.52 – 31.26 | Closed |

Technical Analysis: FIIs are showing a “dual-speed” strategy; while they are net buyers in Index Futures (+2,094.25 Cr), their massive short position in Index Options suggests they are protecting against a potential sudden reversal. DIIs, conversely, are providing the “liquidity floor” in the cash segment, absorbing any minor supply.

Fundamental Analysis: The primary market (IPOs) shows a stark contrast between large-cap and SME offerings. Mainboard IPOs like Fractal Analytics are seeing a sluggish start, whereas SME IPOs like Biopol Chemicals are being oversubscribed by 21 times, indicating that retail and HNI “hot money” is currently chasing small-cap growth stories.

Economic Announcements: Foreign Exchange Reserves stand at a healthy $709.41 Billion, providing the RBI with significant ammunition to defend the Rupee against any global shocks. This reserve strength is a key reason for the Rupee’s recent 0.00% change despite global forex volatility.

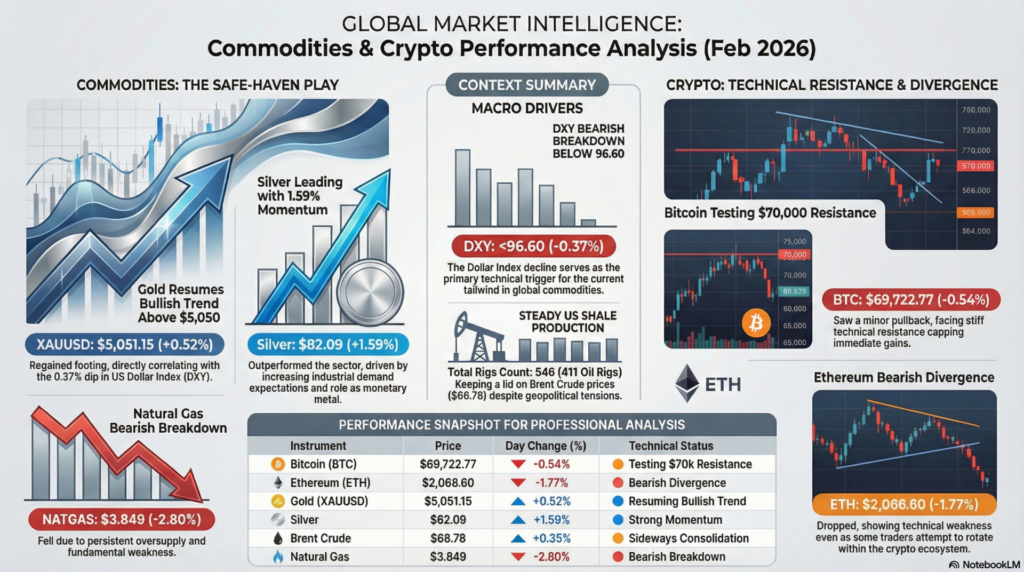

| Instrument | Price | Day Change (%) | Technical Status |

| Bitcoin (BTC) | 69,722.77 | -0.54% | Testing $70k Resistance |

| Ethereum (ETH) | 2,066.6 | -1.77% | Bearish Divergence |

| GOLD (XAUUSD) | 5,051.15 | +0.52% | Resuming Bullish Trend |

| SILVER | 82.09 | +1.59% | Strong Momentum |

| BRENT CRUDE | 68.78 | +0.35% | Sideways Consolidation |

| NATGAS | 3.849 | -2.80% | Bearish Breakdown |

Technical Analysis: Commodities are currently the preferred “safe-haven” play as equities consolidate. Gold has regained its footing above $5,050, while Silver is outperforming with a 1.59% gain. In the crypto space, Bitcoin is facing stiff technical resistance at the $70,000 mark, leading to a minor -0.54% pullback as traders rotate into the Ethereum ecosystem.

Fundamental Analysis: The rise in precious metals is directly correlated with the 0.37% dip in the Dollar Index (DXY). Silver’s outperformance suggests increasing industrial demand expectations alongside its role as a monetary metal. Natural Gas remains fundamentally weak due to oversupply, reflected in its sharp 2.80% decline.

Economic Announcements: The Baker Hughes Total Rigs Count stands at 546 (Oil Rigs at 411), indicating steady production levels in the US shale basins, which is keeping a lid on Crude Oil prices despite geopolitical tensions.

For educational and training purposes, it is vital to understand the Volatility-Institutional Correlation. A “Volatility Crush,” as seen in the 4.4% drop in India VIX, generally acts as a catalyst for institutional buying because it reduces the “Risk Premium” required for equity positions. When the VIX drops, institutional algorithms often trigger automatic buy orders to rebalance portfolios toward higher equity exposure. However, the massive FII Index Option shorting (-₹20,983 Cr) teaches us that “Smart Money” never leaves themselves exposed; they use the low-volatility environment to buy cheap “insurance” (Puts) against a black-swan event.

Secondly, the divergence between Mainboard and SME IPOs provides a key lesson in “Liquidity Chasing.” While institutional investors are cautious about large valuations (e.g., Fractal Analytics at 0.20x), retail and HNI investors are showing high “Animal Spirits” in the SME segment (Biopol at 21x). This suggests that while the broader market is in a consolidation phase, niche segments are experiencing localized bubbles. For a trader, the key lesson is that the Dollar Index (DXY) remains the master key; as long as the DXY stays below 97, the global “Risk-On” environment for Emerging Markets like India is likely to persist.

Legal Disclaimer & Liability Waiver

This AI-generated report is strictly educational and does not constitute financial, legal, or professional advice. aiTrendview and its affiliates are not SEBI-registered advisors and assume zero liability for any losses or consequences resulting from its use. All data is autonomously harvested from public sources and may be flawed, delayed, or incomplete; therefore, you assume exclusive responsibility for independently verifying information before taking any action. Under no circumstances should this content be construed as a recommendation to trade or speculate in any security. By accessing this material, you acknowledge that any reliance on this data is at your sole risk, and you agree to be bound by strict intellectual property protections prohibiting the unauthorized redistribution or modification of this work.

1) or fractional share

Investing in the stock markets carries risk: the value of investments can go up as well as down and you may receive back less than your original investment. Individual investors should make their own decisions or seek independent advice.