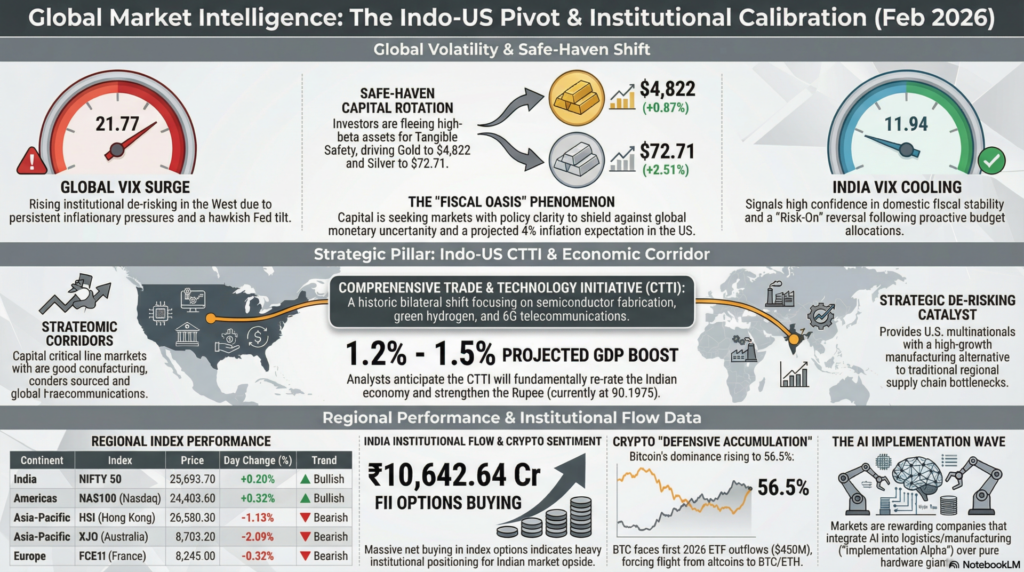

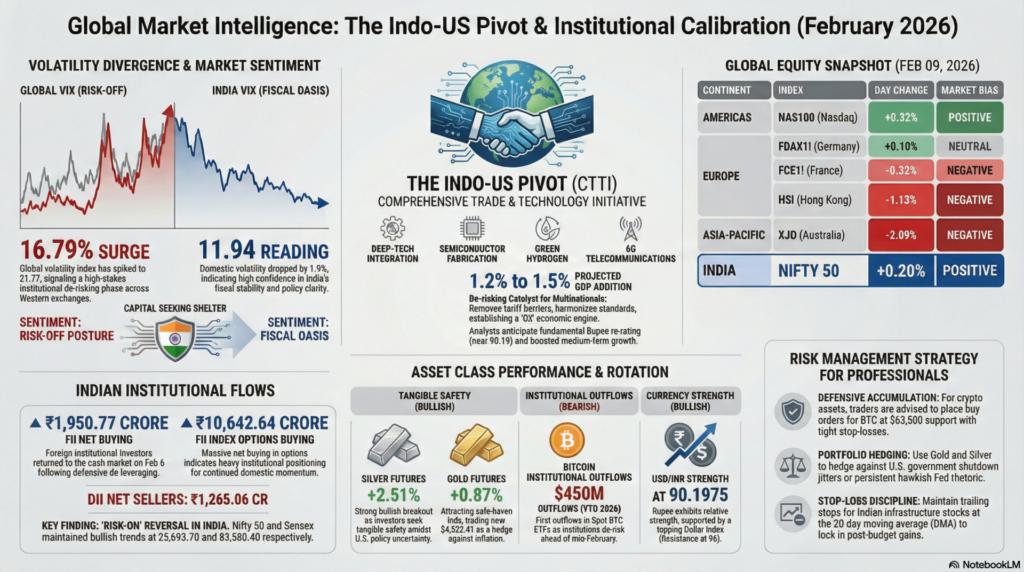

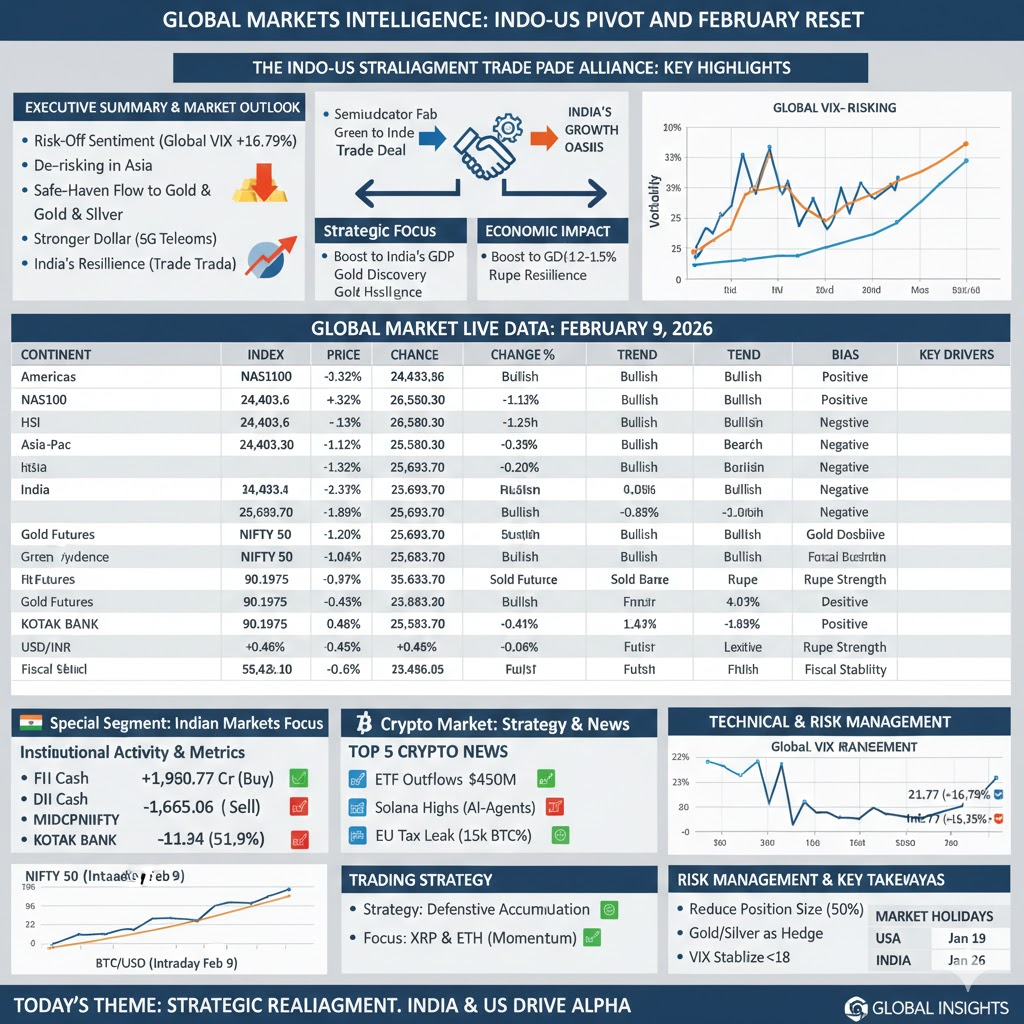

As of February 9, 2026, global financial markets are navigating a high-stakes “Institutional Calibration” phase. Market sentiment is defined by a “Risk-Off” posture in the West, where a 16.79% surge in the global VIX to 21.77 indicates rising institutional de-risking amidst persistent inflationary pressures. In contrast, the Indian market exhibits resilience, supported by the India VIX cooling to 11.94 and a parabolic move in domestic indices following the proactive Union Budget and strategic international trade breakthroughs.

Market reaction for the week is expected to be “Selective Bullish” for the Indo-US economic corridor while remaining defensive in broader Asian and European exchanges. Investors are rotating capital out of high-beta tech laggards and into tangible growth and safe-haven hedges, with Gold (+0.87%) and Silver (+2.51%) attracting strong safe-haven bids. The divergence between the global VIX expansion and the Indian VIX contraction suggests that capital is seeking “Fiscal Oases” where policy clarity provides a shield against global monetary uncertainty.

The newly finalized Indo-US Comprehensive Trade & Technology Initiative (CTTI) marks a historic shift in bilateral economic relations. This alliance focuses on deep-tech integration, specifically joint semiconductor fabrication, green hydrogen infrastructure, and streamlined 6G telecommunications. By removing critical tariff barriers and harmonizing regulatory standards, the deal establishes a robust “G2” economic engine that offers a resilient alternative to traditional regional supply chain bottlenecks.

For institutional desks, this deal serves as a massive de-risking catalyst. U.S.-based multinationals are securing a high-growth manufacturing alternative, while Indian firms are gaining unprecedented access to American capital and cutting-edge IP. Analysts anticipate this strategic alignment will add an estimated 1.2% to 1.5% to India’s GDP over the medium term, fundamentally re-rating the Rupee—currently showing relative strength near 90.1975—against its emerging market peers.

| Continent | Index / Exchange | Price | Day Change (%) | Trend | Market Bias |

| Americas | NAS100 (Nasdaq) | 24,403.6 | +0.32% | Bullish | Positive |

| US500 (S&P 500) | 6,774.5 | +0.11% | Sideways | Neutral | |

| US30 (Dow Jones) | 48,802.0 | +0.08% | Sideways | Neutral | |

| Europe | FDAX1! (Germany) | 24,553.0 | +0.10% | Sideways | Neutral |

| FCE1! (France) | 8,245.0 | -0.32% | Bearish | Negative | |

| FESX1! (Eurozone) | 5,925.0 | -0.08% | Bearish | Negative | |

| Asia-Pacific | J225 (Nikkei) | 54,106.5 | +0.66% | Bullish | Positive |

| HSI (Hong Kong) | 26,580.30 | -1.13% | Bearish | Negative | |

| XJO (Australia) | 8,703.2 | -2.09% | Bearish | Negative | |

| KOSPI (S. Korea) | 5,064.96 | -1.91% | Bearish | Negative | |

| India | NIFTY 50 | 25,693.70 | +0.20% | Bullish | Positive |

| Asset Class | Instrument | Price | Change (%) | Trend | Technical View |

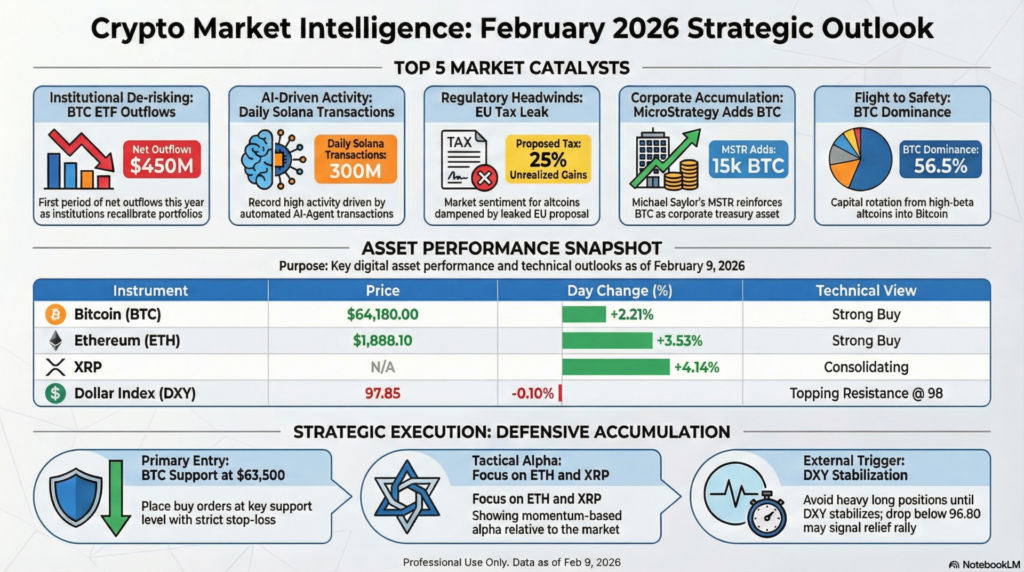

| Crypto | Bitcoin (BTC) | $64,180.00 | +2.21% | Bullish | Aggressive Bid |

| Ethereum (ETH) | $1,888.10 | +3.53% | Bullish | Momentum | |

| Forex | Dollar Index | 97.85 | -0.10% | Topping | Resistance at 98 |

| USD/INR | 90.1975 | -0.11% | Rupee Strength | Support at 90 | |

| Commodities | Gold Futures | $4,822.41 | +0.87% | Bullish | Safe Haven |

| Silver Futures | $72.71 | +2.51% | Strong Bullish | Breakout |

Technical Analysis: Global markets are testing primary support levels. While the NAS100 is holding its 10-day EMA, the HSI and XJO have breached their 50-day moving averages, signaling a shift toward a bearish market structure in those regions. The VIX breakout past 21 suggests a volatility expansion phase where traders should anticipate sharp, non-linear price movements in the short term.

Fundamental Analysis: The market is currently grappling with a hawkish tilt in central bank rhetoric. The Fed Balance Sheet remains elevated at 6.61T, while Michigan Inflation Expectations at 4% are capping growth prospects in the West. Conversely, capital is rewarding “Fiscal Prudence,” as seen in the resilience of the Indian Nifty 50, which is benefitting from infrastructure-focused budget allocations and stable terminal rates.

Economic Data & Announcements: The primary focus today remains on the aftermath of the Michigan Consumer Sentiment data (55 actual vs 56.4 previous). In India, the market is pricing in the “Status Quo” stance from the RBI Interest Rate Decision (5.25%), with the focus now shifting to upcoming CPI and IIP data releases scheduled for mid-February.

The Indian indices concluded the previous session with a “Risk-On” reversal as Foreign Institutional Investors (FIIs) returned to the cash market following a week of defensive de-leveraging.

How to Trade Crypto Today:

The strategy today is “Defensive Accumulation.” Place buy orders for BTC at the $63,500 support level with a tight stop-loss. Focus on XRP (+4.14%) and ETH (+3.53%) for momentum-based alpha, but wait for Dollar stabilization before entering heavy long positions.

The current market regime is characterized by “Institutional Calibration.” We are seeing a divergence where high-beta technology and emerging market laggards are being sold to fund positions in tangible growth (India) and tangible safety (Gold and Silver). This rotation is a direct response to the uncertainty of the U.S. Fed transition and persistent inflationary pressures.

Furthermore, the “AI-Implementation Wave” is beginning to differentiate winners from laggards. While hardware giants are consolidating, companies integrating AI into logistics and manufacturing are seeing expanding P/E ratios. This “Implementation Alpha” is why sectors like NIFTY IT (-1.94%) are seeing short-term pain as they transition toward high-utility AI models.

Lastly, the “Global Fiscal Pivot” is now in full swing. Investors are no longer rewarding growth for growth’s sake. They are demanding “Fiscal Prudence,” rewarding regions like India that show clear paths to debt reduction while maintaining high infrastructure ROI. This confidence is reflected in the Rupee’s relative strength and the crash in the India VIX compared to the global VIX surge.

| Market | Holiday | Occasion | Status |

| USA | Jan 19 | MLK Jr. Day | CLOSED |

| India | Jan 26 | Republic Day | CLOSED |

How to View Global Markets Today:

The market is in an “Institutional Re-Balancing” phase. The volatility in developed indices contrasts with the fiscal stability in India. Do not chase the Nasdaq rally; instead, look for value in Indian infrastructure and defense.

Risk Management & Important Takeaway:

Traders’ Takeaway: Stay long on “Trade-Beneficiary” sectors in India. The Indo-US trade narrative is the primary driver of alpha for the month of February. Reduce position sizes by 50% globally until the VIX stabilizes below 18.

Legal Disclaimer & Liability Waiver

This AI-generated report is strictly educational and does not constitute financial, legal, or professional advice. aiTrendview and its affiliates are not SEBI-registered advisors and assume zero liability for any losses or consequences resulting from its use. All data is autonomously harvested from public sources and may be flawed, delayed, or incomplete; therefore, you assume exclusive responsibility for independently verifying information before taking any action. Under no circumstances should this content be construed as a recommendation to trade or speculate in any security. By accessing this material, you acknowledge that any reliance on this data is at your sole risk, and you agree to be bound by strict intellectual property protections prohibiting the unauthorized redistribution or modification of this work.

© Copyright 2025. All Rights Reserved By aiTrendview.com a AQJ TRADERS Product

1) or fractional share

Investing in the stock markets carries risk: the value of investments can go up as well as down and you may receive back less than your original investment. Individual investors should make their own decisions or seek independent advice.