For income-focused investors, the dividend yield is a critical metric. It measures how much a company pays out in dividends each year relative to its stock price. A recent tutorial from TradingView explains exactly how to find, analyze, and interpret this data using their built-in tools.

Here is a summary of the key points to help you research dividend stocks effectively.

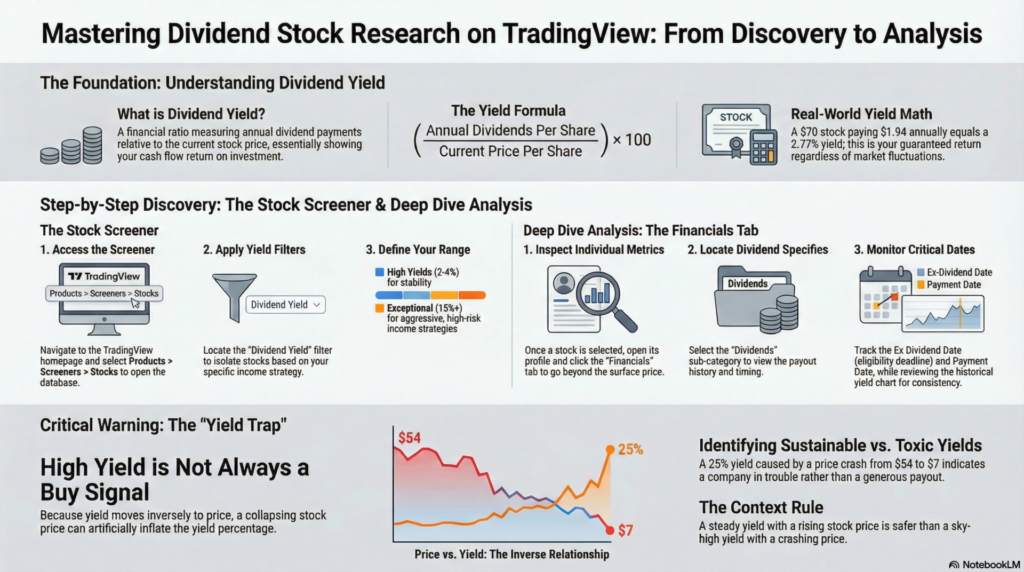

The dividend yield is a financial ratio that shows how much cash flow you are getting for your money.

The video demonstrates using the Stock Screener to filter for dividend opportunities:

Once you select a stock (e.g., Coca-Cola), you can dive deeper into its specific metrics:

The tutorial offers a crucial piece of advice: A high yield is not always a buy signal.

Key Takeaway: Always check the context. A steady yield from a company with a rising stock price (like Coca-Cola) is often safer than a sky-high yield from a company with a crashing stock price.

Legal Disclaimer & Liability Waiver

This AI-generated report is strictly educational and does not constitute financial, legal, or professional advice. aiTrendview and its affiliates are not SEBI-registered advisors and assume zero liability for any losses or consequences resulting from its use. All data is autonomously harvested from public sources and may be flawed, delayed, or incomplete; therefore, you assume exclusive responsibility for independently verifying information before taking any action. Under no circumstances should this content be construed as a recommendation to trade or speculate in any security. By accessing this material, you acknowledge that any reliance on this data is at your sole risk, and you agree to be bound by strict intellectual property protections prohibiting the unauthorized redistribution or modification of this work.

© Copyright 2025. All Rights Reserved By aiTrendview.com a AQJ TRADERS Product

1) or fractional share

Investing in the stock markets carries risk: the value of investments can go up as well as down and you may receive back less than your original investment. Individual investors should make their own decisions or seek independent advice.