Effortless Analysis: Using the Auto Fibonacci Retracement Tool on TradingView

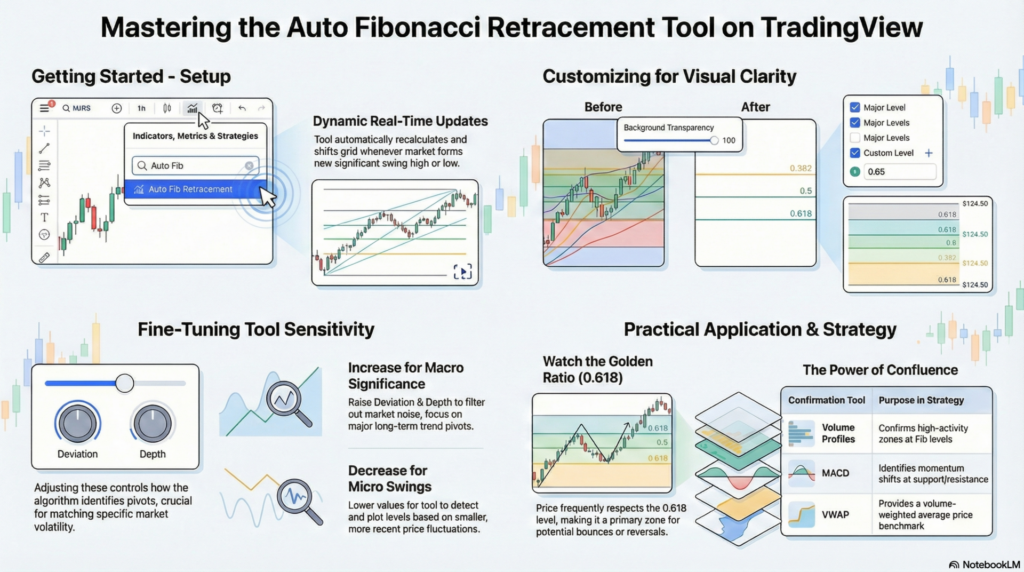

For many traders, Fibonacci retracements are a staple tool for identifying potential support and resistance levels. However, manually drawing them can sometimes be subjective or time-consuming, especially for beginners. In a recent tutorial, TradingView introduced the Auto Fibonacci Retracement tool, a feature designed to automatically detect swing highs and lows to plot these key levels for you.

Here is a guide on how to set it up, customize it, and use it to enhance your trading strategy.

Fibonacci retracements are horizontal lines that indicate where price might “pull back” or find support after a significant move. Traditionally, a trader manually selects a high and a low point. The Auto Fib Retracement tool removes this manual step by algorithmically identifying the most recent significant high and low and plotting the levels instantly. As price action evolves and new highs or lows are formed, the tool automatically updates.

The default settings might look a bit cluttered with background colors and numerous levels. The tutorial suggests a few tweaks to make the chart cleaner:

The video demonstrates the tool on a Bitcoin chart, showing how price frequently respects levels like the 0.618 (the Golden Ratio).

The key takeaway from the tutorial is that Fibonacci levels should not be used in isolation. Just because price hits the 0.618 level doesn’t guarantee a bounce. These levels work best when combined with other forms of analysis, such as Volume Profiles, MACD, or VWAP, to confirm a potential trade entry.

By automating the technical drawing process, this tool allows traders to focus less on “how to draw” the lines and more on “how to trade” the levels.

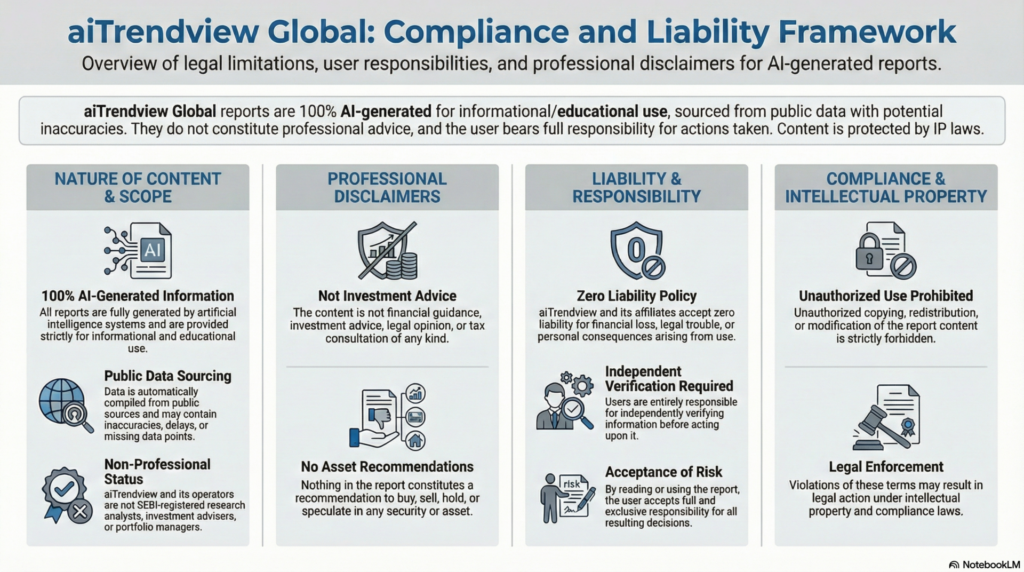

aiTrendview Global Disclaimer

This report is fully AI-generated and is provided strictly for informational and educational use only. It is not investment advice, financial guidance, legal opinion, tax consultation, or professional recommendation of any kind. aiTrendview and its operators are not SEBI-registered research analysts, investment advisers, or portfolio managers. All data is automatically compiled from public sources that may contain inaccuracies, delays, or missing information. If you act on this content without verifying it independently, that is entirely your responsibility.

Nothing in this report is a recommendation to buy, sell, hold, or speculate in any asset or security. aiTrendview, its creators, developers, affiliates, and associated AI systems accept zero liability for financial loss, legal trouble, or personal consequences arising from the use of this material. By reading or using this report, you accept full responsibility for your decisions. Unauthorized copying, redistribution, or modification of this content is prohibited and may result in legal action under intellectual property and compliance laws.

© Copyright 2025. All Rights Reserved By aiTrendview.com a AQJ TRADERS Product

1) or fractional share

Investing in the stock markets carries risk: the value of investments can go up as well as down and you may receive back less than your original investment. Individual investors should make their own decisions or seek independent advice.