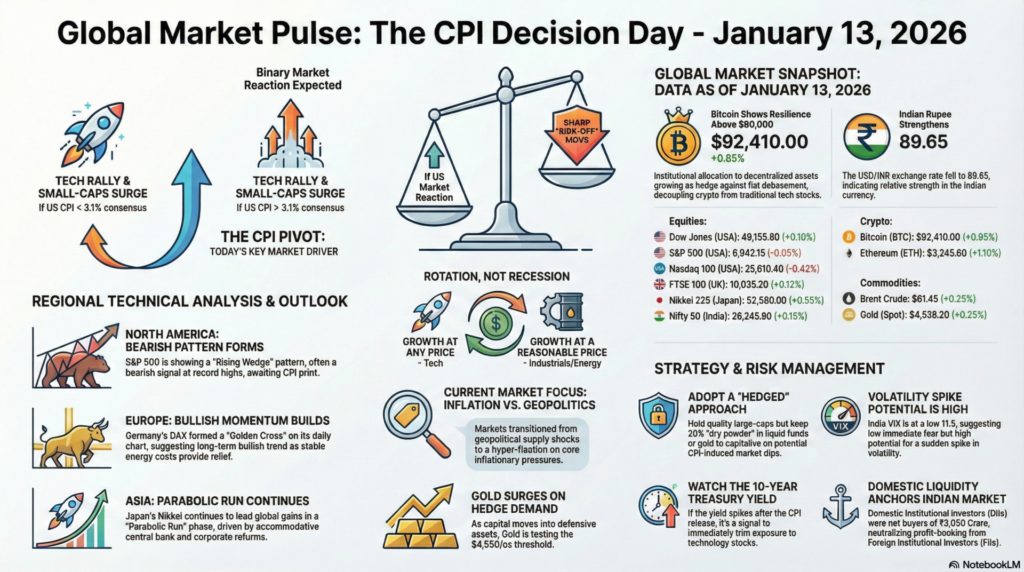

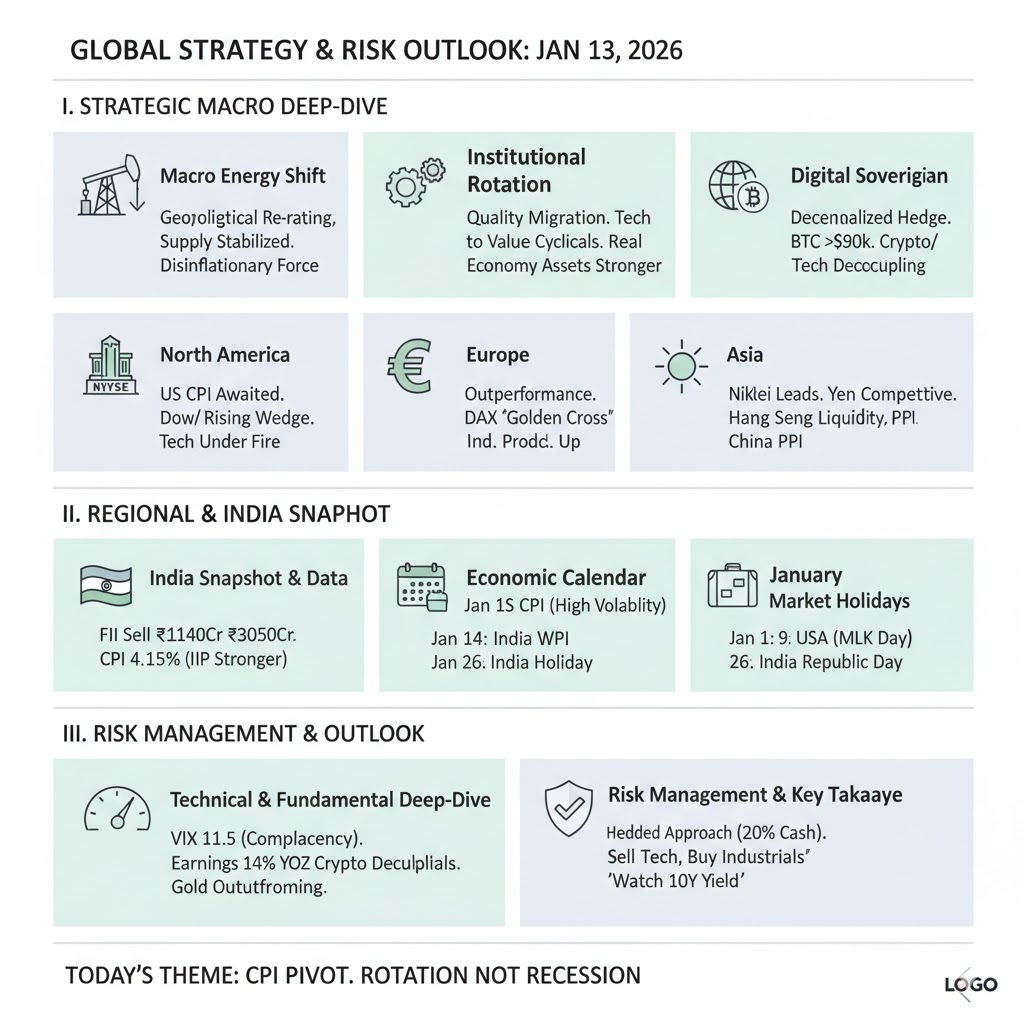

The global financial ecosystem is currently standing at a pivotal crossroads as of January 13, 2026. Today’s primary market driver is the highly anticipated U.S. Consumer Price Index (CPI) release, which is expected to dictate the Federal Reserve’s trajectory for the first quarter. Following a period of “Goldilocks” stabilization, investors are now bracing for potential volatility. Markets are transitioning from a focus on geopolitical supply shocks—specifically the stabilization of South American energy flows—to a hyper-fixation on core inflationary pressures and the sustainability of the “soft landing” narrative.

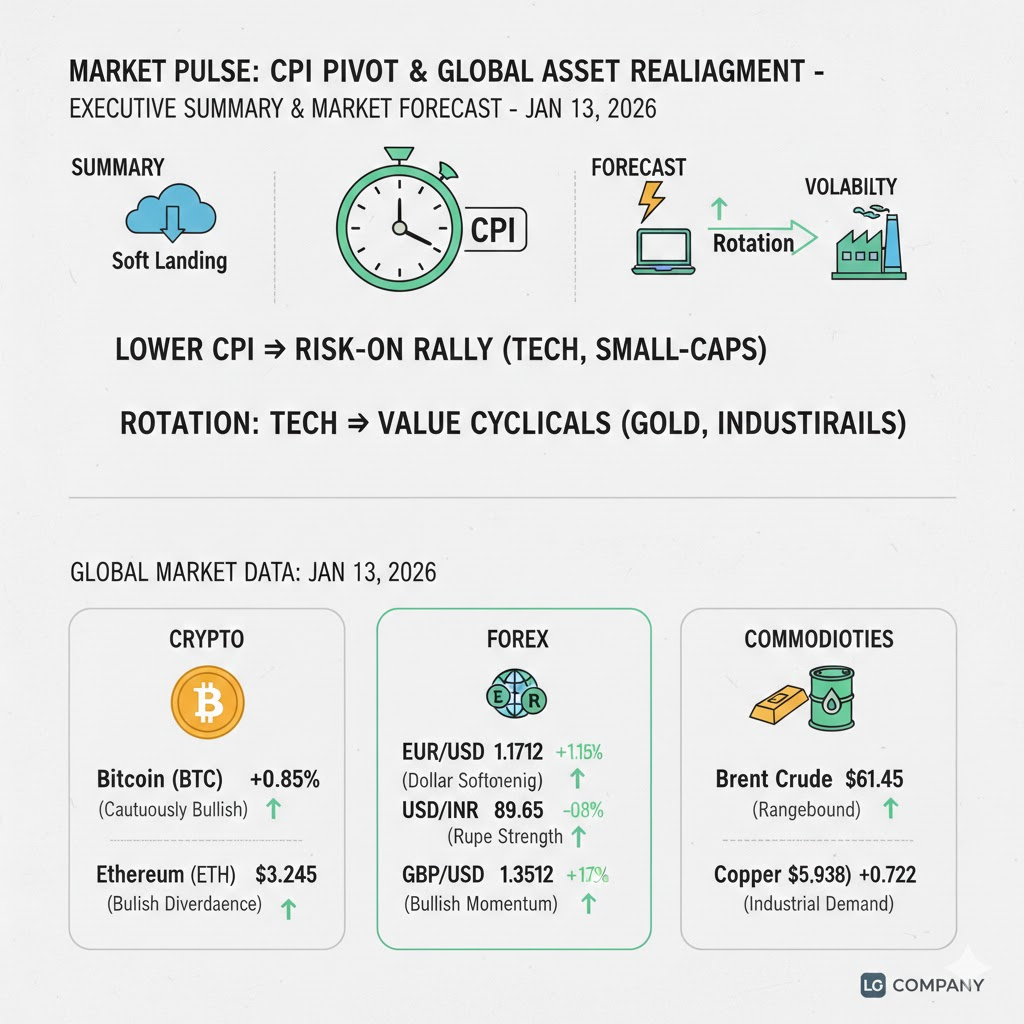

Market Reaction: We anticipate a “binary” reaction across global exchanges today. Should CPI data print lower than the 3.1% consensus, we expect a massive short-covering rally in interest-rate-sensitive sectors like Technology and Small-caps. Conversely, any upside surprise will likely trigger a sharp “risk-off” move, strengthening the US Dollar and putting immediate pressure on Emerging Markets. Currently, a “rotation trade” is visible, where institutional capital is shifting from overvalued AI momentum plays into defensive high-yield industrials and bullion, as Gold tests the $4,550/oz threshold.

| Continent | Index / Exchange | Last Price | % Change | Technical Status | Fundamental Driver |

| Americas | Dow Jones (USA) | 49,155.80 | +0.10% | Support at 49,000 | Infrastructure/Energy |

| S&P 500 (USA) | 6,942.15 | -0.05% | Near RSI 70 | CPI Anticipation | |

| Nasdaq 100 (USA) | 25,610.40 | -0.42% | Mean Reversion | Tech Profit Booking | |

| Europe | FTSE 100 (UK) | 10,035.20 | +0.12% | Bullish Breakout | Mining Rebound |

| DAX 40 (Germany) | 19,288.50 | +0.22% | Testing 20-DMA | Industrial Export Growth | |

| CAC 40 (France) | 8,272.10 | +0.15% | Neutral | Luxury Goods Bounce | |

| Asia-Pacific | Nikkei 225 (Japan) | 52,580.00 | +0.55% | Trend Continuity | Export Resilience |

| Hang Seng (HK) | 26,512.40 | +0.35% | Short Covering | China Liquidity Hopes | |

| Nifty 50 (India) | 26,245.80 | +0.15% | Consolidation | DII Support |

| Asset Class | Instrument | Live Price | % Change | Sentiment |

| Crypto | Bitcoin (BTC) | $92,410.00 | +0.85% | Cautiously Bullish |

| Ethereum (ETH) | $3,245.60 | +1.10% | Bullish Divergence | |

| Forex | EUR/USD | 1.1712 | +0.15% | Dollar Softening |

| USD/INR | 89.65 | -0.08% | Rupee Strength | |

| GBP/USD | 1.3512 | +0.18% | Bullish Momentum | |

| Commodities | Brent Crude | $61.45 | +0.25% | Rangebound |

| Gold (Spot) | $4,538.20 | +0.72% | Hedge Demand | |

| Copper | $5.92 | +0.45% | Industrial Demand |

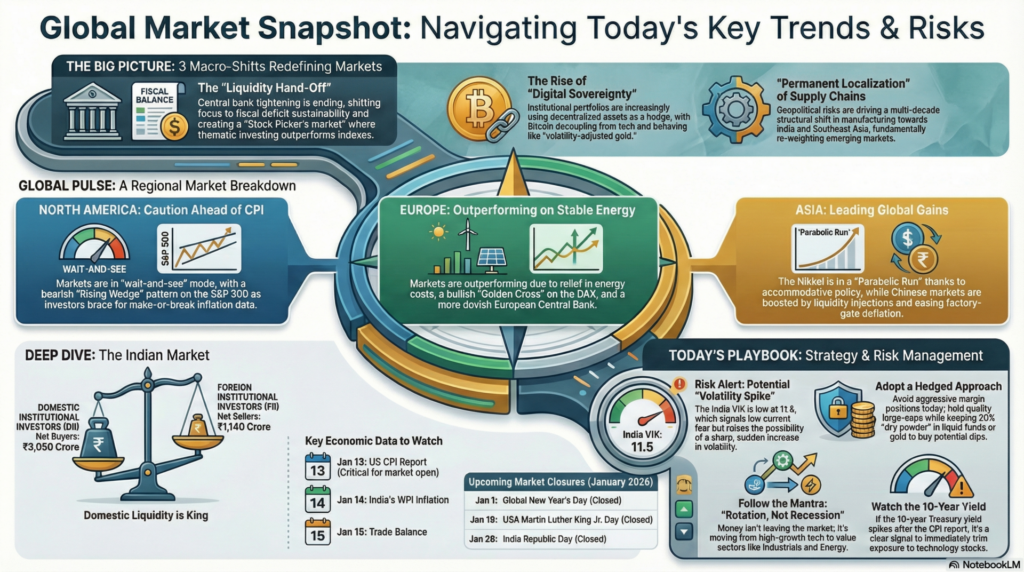

The current market environment is defined by a “liquidity hand-off.” As central banks transition away from emergency tightening, the focus is shifting toward fiscal deficit sustainability. In the U.S., the debate over tariff structures is causing a divergence between domestic manufacturers and global importers. This has created a fertile ground for “Stock Picker” markets, where generic index tracking is underperforming compared to thematic investing in energy infrastructure and AI-hardware integration.

Furthermore, the “Digital Sovereign” movement is accelerating. We are seeing institutional portfolios allocate significantly more to decentralized assets as a hedge against fiat debasement. This is particularly evident in the resilience of Bitcoin above the $90,000 mark, despite high interest rates. The correlation between traditional tech stocks and crypto is decoupling, as the latter increasingly behaves like a “volatility-adjusted gold” rather than a high-beta tech proxy.

Lastly, the global supply chain is undergoing a “permanent localization” phase. The recent geopolitical shifts in South America have proved that dependence on a single region for energy or minerals is a systemic risk. Consequently, the massive Capex seen in Indian and Southeast Asian manufacturing is not just a temporary trend but a multi-decade structural shift that is fundamentally re-weighting the MSCI Emerging Markets index.

North America (NYSE/NASDAQ):

The U.S. markets are currently in a “wait-and-see” mode ahead of the CPI print. While the Dow remains resilient due to the strength in industrials and defense contractors, the Nasdaq is facing heavy distribution.

Europe (LSE/DAX/Euronext):

Europe is outperforming today as energy costs stabilize, providing relief to the heavy manufacturing base in Germany.

Asia (TSE/HKEX/NSE):

The Nikkei continues to lead global gains as the Bank of Japan maintains its accommodative stance. In Hong Kong, markets are reacting positively to fresh liquidity injections by the PBoC.

Institutional Activity (Jan 13):

Economic Calendar (Upcoming Highlights):

| Date | Country | Occasion | Market Status |

| Jan 1 | Global | New Year’s Day | Closed |

| Jan 19 | USA | Martin Luther King Jr. Day | Closed |

| Jan 26 | India | Republic Day | Closed |

Risk Management:

The India VIX is currently at 11.5, suggesting low immediate fear but high potential for a “Volatility Spike.” Investors should avoid aggressive long positions on margin today. A “Hedged” approach is recommended—holding quality large-caps while keeping 20% dry powder in liquid funds or gold to capitalize on potential CPI-induced dips.

How to View the Global Markets Today:

View today as a “Decision Day.” The market is looking for an excuse to either consolidate healthy gains or start a deeper correction. The trend remains structurally bullish, but tactical caution is mandatory.

Important Takeaway:

Follow the “Rotation, Not Recession” mantra. Money isn’t leaving the market; it’s simply moving from “Growth at any price” (Tech) to “Growth at a reasonable price” (Industrials/Energy). Watch the 10-year yield; if it spikes post-CPI, trim tech exposure immediately.

aiTrendview Global Disclaimer

This aiTrendview report is an AI-generated document provided exclusively for educational and training purposes and shall not be construed as investment, financial, legal, or tax advice in any jurisdiction.

aiTrendview and its affiliates are not SEBI-registered research analysts, investment advisers, or portfolio managers, and all information herein is automatically compiled from publicly available sources that may contain errors, delays, or omissions.

Users must independently verify all data before making any financial, commercial, or legal decisions, as no market values, performance figures, or trends contained in this report constitute guarantees or forward-looking statements.

Nothing in this publication should be interpreted as a solicitation, recommendation, or endorsement to buy, sell, or hold any security.

aiTrendview, its creators, and all associated AI systems disclaim all liability for losses or consequences arising from the use or reliance upon this content, and users accept full personal responsibility for all actions taken based on it.

Unauthorized reproduction, distribution, or modification of this AI-generated material is strictly prohibited under international copyright, compliance, and intellectual-property laws.

1) or fractional share

Investing in the stock markets carries risk: the value of investments can go up as well as down and you may receive back less than your original investment. Individual investors should make their own decisions or seek independent advice.