Market Pulse: Geopolitical Resilience & The New Energy Frontier

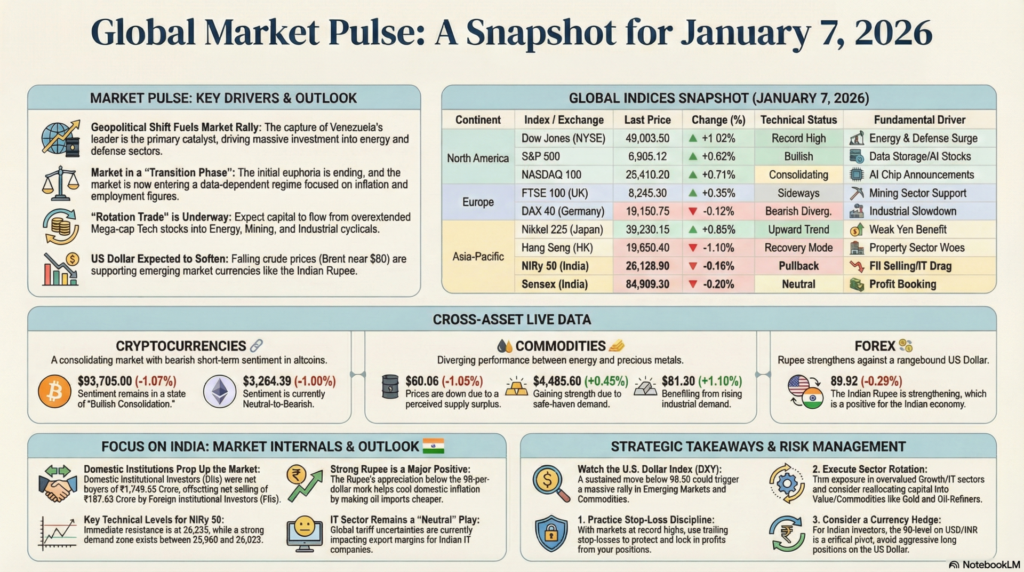

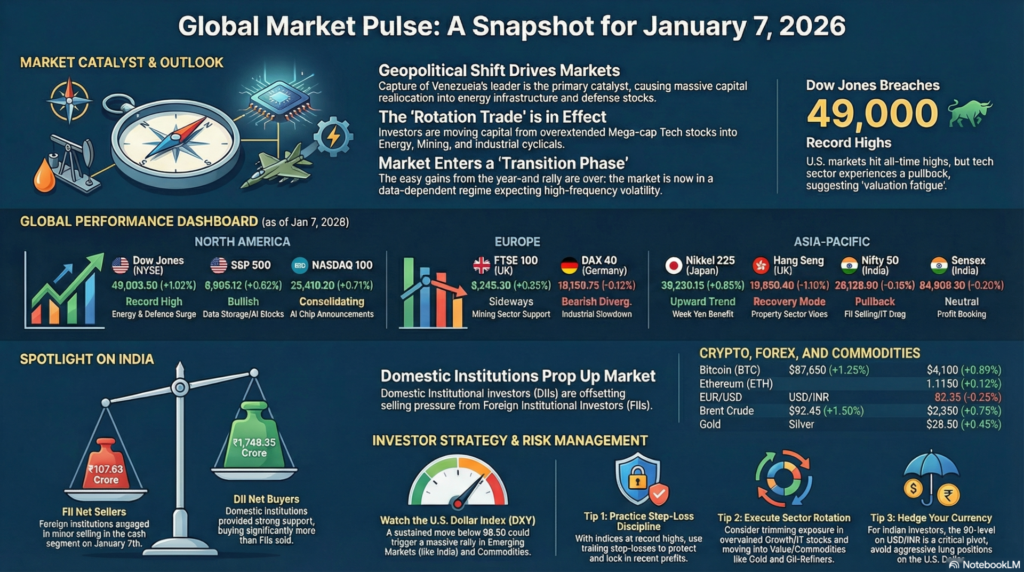

The global financial landscape on January 7, 2026, is navigating a complex intersection of historic geopolitical shifts and evolving economic data. The recent capture of Venezuelan leader Nicolás Maduro by U.S. forces continues to be the primary catalyst, driving a massive reallocation of capital into energy infrastructure and defense sectors. While U.S. indices like the Dow Jones have breached the historic 49,000 mark, a palpable sense of “valuation fatigue” is emerging in the tech sector. Investors are pivotally balanced between the “AI productivity boom” and a “commodity supply-chain recalibration.”

Market Outlook: We anticipate a period of high-frequency volatility as the market digests the ADP Employment data and ISM Services PMI. The initial “risk-on” euphoria following the Venezuela news is transitioning into a disciplined evaluation of inflationary risks. Expect the US Dollar to remain soft as the Rupee and other emerging market currencies find support from falling crude prices (Brent near $60). A “rotation trade” is likely, where capital flows out of overextended Mega-cap Tech and into Energy, Mining, and Industrial cyclicals.

| Continent | Index / Exchange | Last Price | Change (%) | Technical Status | Fundamental Driver |

| North America | Dow Jones (NYSE) | 49,003.50 | +1.02% | Record High | Energy & Defense Surge |

| S&P 500 | 6,905.12 | +0.62% | Bullish | Data Storage/AI Stocks | |

| NASDAQ 100 | 25,410.20 | +0.71% | Consolidating | AI Chip Announcements | |

| Europe | FTSE 100 (UK) | 8,245.30 | +0.35% | Sideways | Mining Sector Support |

| DAX 40 (Germany) | 19,150.75 | -0.12% | Bearish Diverg. | Industrial Slowdown | |

| Asia-Pacific | Nikkei 225 (Japan) | 39,230.15 | +0.85% | Upward Trend | Weak Yen Benefit |

| Hang Seng (HK) | 19,850.40 | -1.10% | Recovery Mode | Property Sector Woes | |

| Nifty 50 (India) | 26,128.90 | -0.16% | Pullback | FII Selling/IT Drag | |

| Sensex (India) | 84,909.30 | -0.20% | Neutral | Profit Booking |

| Asset Class | Instrument | Live Price | Change (%) | Sentiment |

| Crypto | Bitcoin (BTC) | $93,705.00 | -1.07% | Bullish Consolidation |

| Ethereum (ETH) | $3,264.39 | -1.00% | Neutral-Bearish | |

| Solana (SOL) | $139.41 | -1.23% | Support Testing | |

| Forex | EUR/USD | 1.1705 | -0.06% | Rangebound |

| USD/INR | 89.92 | -0.29% | Rupee Strengthening | |

| USD/JPY | 156.46 | +0.02% | Yen Weakness | |

| Commodities | Brent Crude | $60.06 | -1.05% | Supply Surplus |

| Gold (Spot) | $4,485.60 | +0.45% | Safe Haven Demand | |

| Silver (Spot) | $81.30 | +1.10% | Industrial Demand |

North America (NYSE/NASDAQ):

The U.S. markets are currently defying gravity, with the Dow Jones hitting all-time highs above 49,000. Fundamental strength is coming from the energy sector (notably Chevron) following the Venezuela intervention, while technical indicators show a “melting up” phase. Despite the rally, AI leaders like Nvidia and AMD saw minor pullbacks after CES 2026 announcements, suggesting the “buy on rumor, sell on news” phenomenon is in play.

Europe (LSE/Euronext/DAX):

European bourses are exhibiting a mixed performance as the region grapples with lackluster manufacturing data. Fundamentally, the market is awaiting clearer signals on ECB’s next rate move, while technical charts for the DAX suggest a “Head and Shoulders” pattern forming, indicating potential short-term downside. Economic data remains stagnant, with German industrial orders failing to meet expectations.

Asia (TSE/HKEX/NSE):

Asian markets are being pulled in two directions: Japan’s Nikkei is buoyed by corporate reform optimism and a favorable currency tailwind, while Hong Kong’s Hang Seng remains under pressure due to domestic real estate defaults. In India, the Nifty is undergoing a healthy “mean reversion” after touching record highs. Fundamentally, the region is benefiting from cheaper energy costs as global oil prices cool.

Institutional Activity (Jan 7, 2026)

Technical & Fundamental Outlook (India)

The Nifty 50 faces immediate resistance at 26,235, with a strong demand zone established between 25,960 and 26,023. Fundamentally, the Indian Rupee’s appreciation below the 90-mark is a massive positive for oil importers and should help cool domestic inflation. However, the IT sector remains a “neutral” play due to global tariff uncertainties impacting export margins.

Economic Calendar (Upcoming Announcements)

| Date | Event | Expected Impact |

| Jan 7 | ADP Nonfarm Employment (US) | High Volatility |

| Jan 7 | ISM Non-Manufacturing PMI (US) | Medium Impact |

| Jan 8 | Initial Jobless Claims (US) | High Impact |

| Jan 9 | Employment Situation (NFP) (US) | Major Trend Setter |

How to View the Global Markets Today:

The market is in a “Transition Phase.” The easy gains from the year-end rally are over, and the market is now entering a data-dependent regime. You should view today’s slight pullbacks in the Indian and Asian markets as a healthy consolidation rather than a trend reversal.

Important Takeaway:

Watch the U.S. Dollar Index (DXY). A sustained move below 98.50 will trigger a massive rally in Emerging Markets (India, Brazil, SE Asia) and Commodities. Conversely, any upside surprise in US employment data could strengthen the Dollar and pressure equity valuations.

Risk Management:

aiTrendview Global Disclaimer

This aiTrendview report is an AI-generated document provided exclusively for educational and training purposes and shall not be construed as investment, financial, legal, or tax advice in any jurisdiction.

aiTrendview and its affiliates are not SEBI-registered research analysts, investment advisers, or portfolio managers, and all information herein is automatically compiled from publicly available sources that may contain errors, delays, or omissions.

Users must independently verify all data before making any financial, commercial, or legal decisions, as no market values, performance figures, or trends contained in this report constitute guarantees or forward-looking statements.

Nothing in this publication should be interpreted as a solicitation, recommendation, or endorsement to buy, sell, or hold any security.

aiTrendview, its creators, and all associated AI systems disclaim all liability for losses or consequences arising from the use or reliance upon this content, and users accept full personal responsibility for all actions taken based on it.

Unauthorized reproduction, distribution, or modification of this AI-generated material is strictly prohibited under international copyright, compliance, and intellectual-property laws.

1) or fractional share

Investing in the stock markets carries risk: the value of investments can go up as well as down and you may receive back less than your original investment. Individual investors should make their own decisions or seek independent advice.