The financial world crossed into January 1, 2026, with a stark contrast between East and West. While major global exchanges in the US, UK, Europe, and Asia remained shuttered for the New Year holiday, the Indian Stock Markets stood as a global outlier, commencing the first trading session of the year with resilience and positive momentum. This opening session marks the transition from a tech-led 2025 into a year expected to be defined by uneven monetary policy, the deepening of the AI supercycle, and intensifying market polarization.

Below is the comprehensive pulse of global market data, technical levels, and institutional activity as we begin the first quarter of 2026.

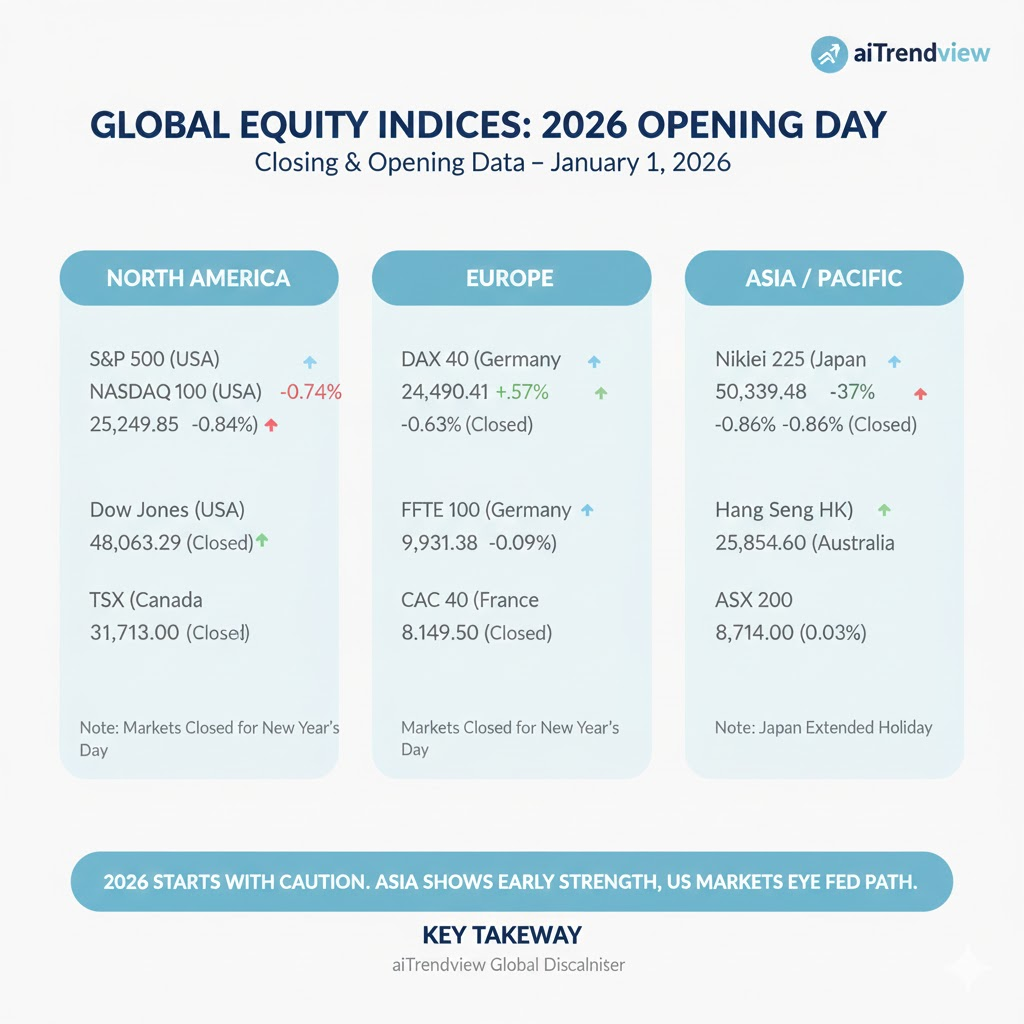

Note: Most global indices reflect closing data from Dec 31, 2025, as markets were closed on Jan 1, 2026.

| Continent | Index | Value | Change (%) | Status / Exchange Holiday |

| North America | S&P 500 (USA) | 6,845.50 | -0.74% | Closed (New Year’s Day) |

| Dow Jones (USA) | 48,063.29 | -0.63% | Closed (New Year’s Day) | |

| NASDAQ 100 (USA) | 25,249.85 | -0.84% | Closed (New Year’s Day) | |

| TSX (Canada) | 31,713.00 | -0.48% | Closed (New Year’s Day) | |

| Europe | DAX 40 (Germany) | 24,490.41 | +0.57% | Closed (New Year’s Day) |

| FTSE 100 (UK) | 9,931.38 | -0.09% | Closed (New Year’s Day) | |

| CAC 40 (France) | 8,149.50 | -0.23% | Closed (New Year’s Day) | |

| Asia / Pacific | Nikkei 225 (Japan) | 50,339.48 | -0.37% | Closed (Extended Holiday) |

| Hang Seng (HK) | 25,854.60 | +0.86% | Closed (New Year’s Day) | |

| ASX 200 (Australia) | 8,714.00 | -0.03% | Closed (New Year’s Day) |

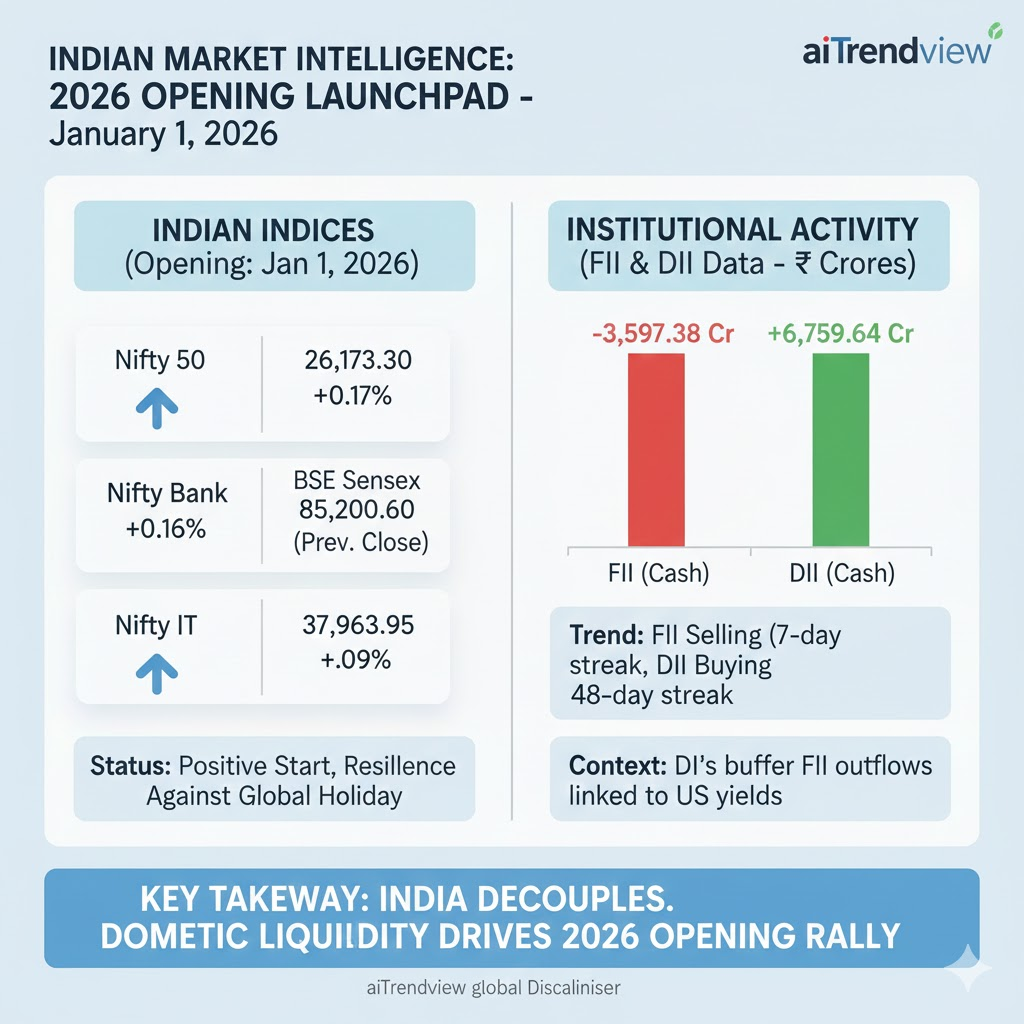

While global peers were closed, the Indian markets opened for a full trading session on January 1, 2026, showing steady investor confidence.

| Index | Opening Value | Change (%) | Status / Key Sector |

| Nifty 50 | 26,173.30 | +0.17% | Steady near record levels |

| BSE Sensex | 85,220.60 | +0.64% (Prev. Close) | Positive start to the year |

| Nifty Bank | 59,674.80 | +0.16% | Sustaining support zones |

| Nifty IT | 37,963.95 | +0.09% | Selective buying |

| Segment | Dec 31 Activity (Net) | Trend / Context |

| FII (Cash) | -3,597.38 Cr | Selling streak extended to 7 sessions |

| DII (Cash) | +6,759.64 Cr | 48th consecutive session of buying |

| Total Dec FII Flow | -34,349.62 Cr | Highest monthly selling since Sept 2025 |

| Asset Class | Instrument | Live Price | Status | Context |

| Crypto | Bitcoin (BTC) | $88,412.50 (Est) | Active | Spot Crypto remains open 24/7 during holidays. |

| Forex | U.S. Dollar Index | 98.28 | Active | FX markets open late on Jan 1 at 17:05 (approx 10:30 PM IST). |

| USD/INR | 89.42 (LTP) | Closed | Currency derivatives market closed for holiday. | |

| Commodities | Gold (Spot) | $4,522.40 (LTP) | Closed | Reopening late Jan 1 (11 PM). |

| Silver (Spot) | $71.95 (LTP) | Closed | Extreme year-end volatility noted in Dec. | |

| WTI Crude | $57.25 (LTP) | Closed | Reopening late Jan 1 (11 PM). |

January 2026 sits at a critical intersection of monetary policy and corporate earnings reality. While Indian indices begin the year on a positive note, global risk appetite is currently being tested by high valuations and data dependency from the Fed. Focus remains on quality stocks and sector-specific catalysts like the India-Australia trade agreement.

This aiTrendview report is an AI-generated document provided exclusively for educational and training purposes and shall not be construed as investment, financial, legal, or tax advice in any jurisdiction.

aiTrendview and its affiliates are not SEBI-registered research analysts, and all information herein is automatically compiled from public sources. Users must independently verify all data. Nothing in this publication constitutes a recommendation to buy, sell, or hold any security. aiTrendview disclaims all liability for losses arising from reliance on this content. Unauthorized reproduction or modification is strictly prohibited.

1) or fractional share

Investing in the stock markets carries risk: the value of investments can go up as well as down and you may receive back less than your original investment. Individual investors should make their own decisions or seek independent advice.