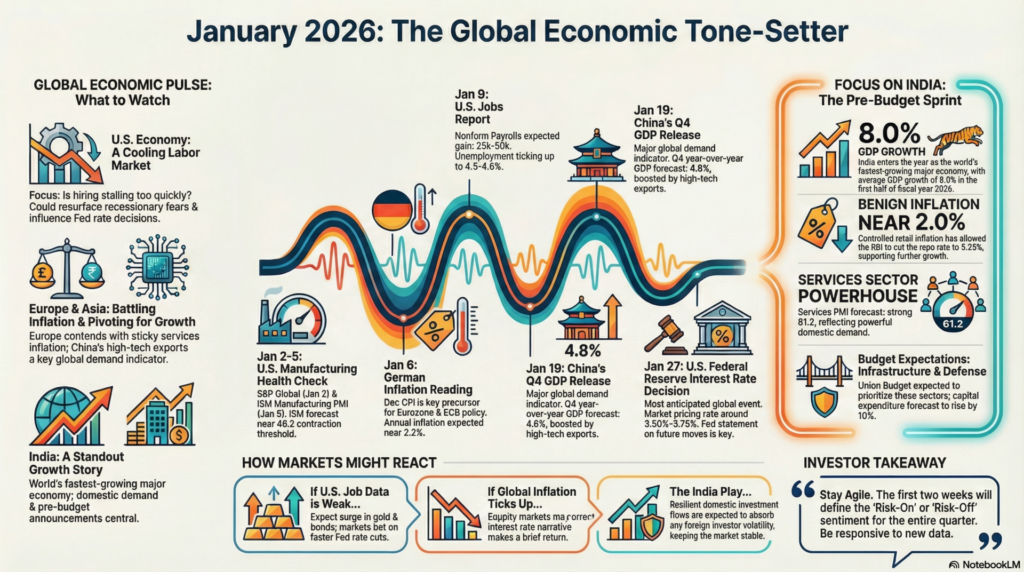

As we cross the threshold into January 2026, the financial markets are bracing for a month packed with high-stakes data releases and central bank decisions. From the cooling of the U.S. labor market to India’s pre-budget anticipation, January is set to be the decisive “tone-setter” for the first half of the year.

This blog breaks down the critical announcements shown in the latest economic calendars and their projected impact on global and domestic markets.

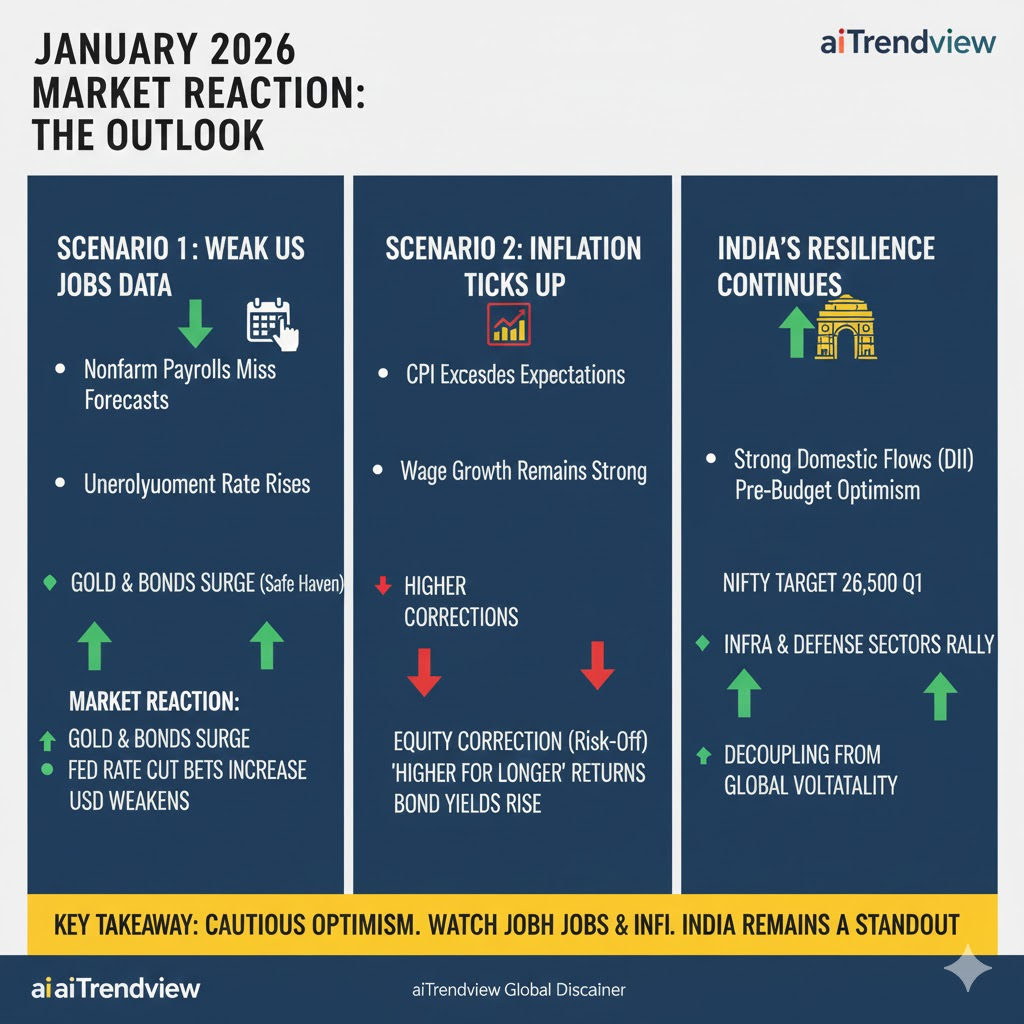

The U.S. economy remains the primary anchor for global sentiment. January 2026 presents a mix of manufacturing resilience and a loosening labor market that will likely dictate the Federal Reserve’s next moves.

Global diversification is key as Europe battles “sticky” services inflation and China attempts a structural pivot.

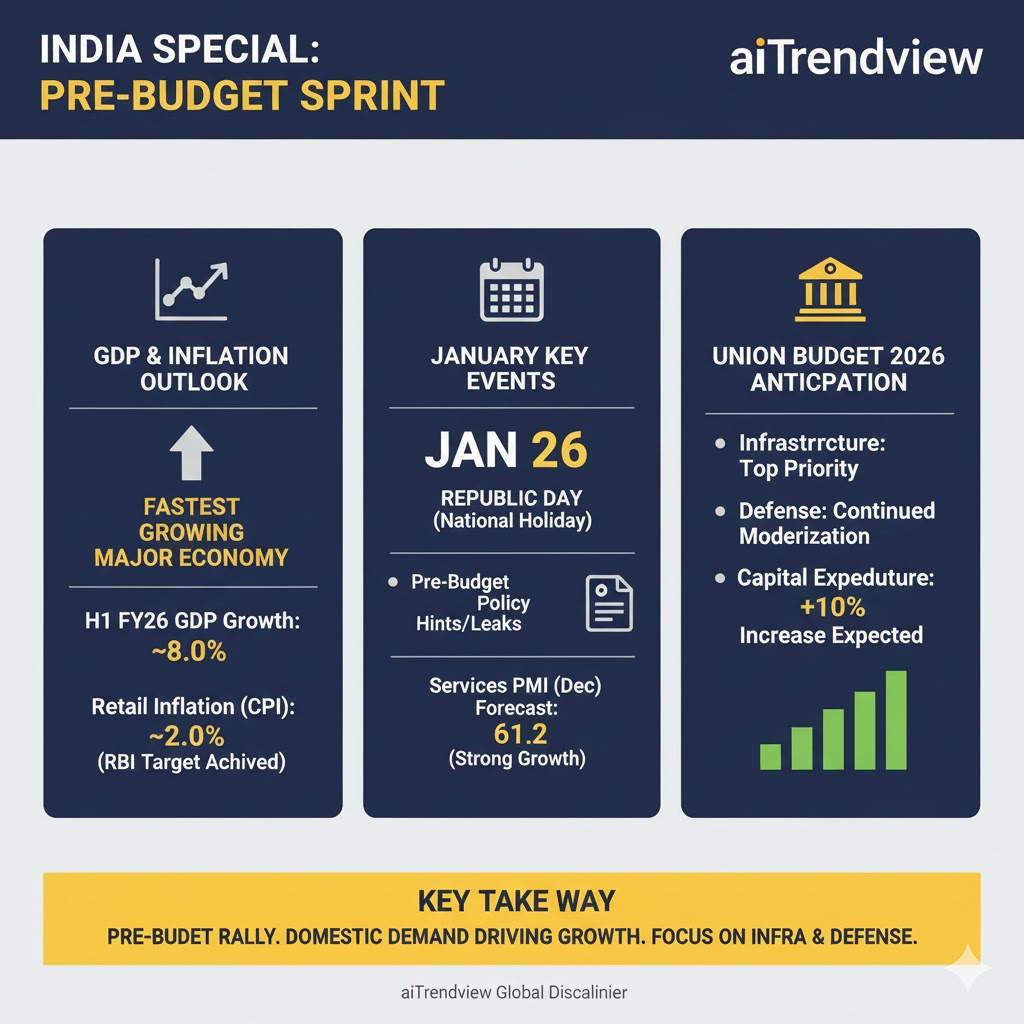

While global investors focus on the Fed, the Indian market will be entirely fixated on domestic growth and the upcoming Union Budget 2026 (traditionally presented in February).

January 2026 will likely be a month of cautious optimism.

Investor Takeaway: Stay agile. The first two weeks of January will define the “Risk-On” or “Risk-Off” sentiment for the entire quarter.

| Date | Time (IST) | Event | Importance & Market Impact |

| Fri, Jan 2 | 20:15 | S&P Global Manufacturing PMI (Dec) | This leading indicator measures the health of the U.S. industrial sector. A reading above 50 signals expansion, while a figure below 50 indicates contraction. |

| Mon, Jan 5 | 20:30 | ISM Manufacturing PMI (Dec) | This report tracks monthly supply and demand trends across multiple U.S. industries. It is a vital barometer that investors use to anticipate broader changes in national GDP and industrial output. |

| Tue, Jan 6 | 18:30 | German CPI (MoM) (Dec) | As Europe’s largest economy, Germany’s inflation data heavily influences European Central Bank (ECB) monetary policy. It serves as a precursor to the overall Eurozone inflation trend. |

| Wed, Jan 7 | 18:45 | ADP Nonfarm Employment Change (Dec) | This provides an early, private-sector look at the U.S. job market ahead of the official government data. It helps markets gauge the strength of hiring and potential inflationary pressures from wage growth. |

| Thu, Jan 8 | 19:00 | Initial Jobless Claims | This weekly count of new unemployment filings serves as a real-time pulse of the U.S. labor market’s health. Unexpected rises can signal economic cooling and influence expectations for Federal Reserve rate cuts. |

| Fri, Jan 9 | 19:00 | Nonfarm Payrolls (Dec) & Unemployment Rate | These are among the most critical monthly macroeconomic reports, directly impacting the U.S. dollar and global stock markets. They are vital tools for the Federal Reserve to determine if interest rates should be adjusted to balance employment and price stability. |

| Tue, Jan 13 | 19:00 | Core CPI (MoM) (Oct) | This measures the rate of price changes for goods and services, excluding volatile food and energy costs. It is the primary gauge the Fed uses to monitor long-term inflation trends and set interest rates. |

| Wed, Jan 14 | 19:00 | PPI (MoM) (Nov) | The Producer Price Index tracks inflation from the perspective of manufacturers and wholesalers. Rising producer costs often lead to higher consumer prices later, acting as an early warning for broader inflation. |

| Thu, Jan 15 | 12:30 | GDP (MoM) (Nov) – UK | This monthly snapshot measures the total value of goods and services produced in the UK, signaling economic growth or stagnation. It is a key factor the Bank of England (BoE) uses when deciding on interest rate changes. |

| Fri, Jan 16 | 12:30 | German CPI (MoM) (Dec) | This final monthly inflation figure for Germany confirms price stability within the Eurozone’s economic engine. It directly impacts the value of the Euro and guides the ECB’s rate-setting committee. |

| Mon, Jan 19 | 07:30 | GDP (YoY) (Q4) – China | As the world’s second-largest economy, China’s growth figures significantly impact global trade and commodity prices. A strong reading can boost global market sentiment, while a weak one often triggers sell-offs in major indices. |

| Wed, Jan 21 | 12:30 | CPI (YoY) (Dec) – UK | This measures the annual inflation rate in the UK, tracking how household costs are changing over time. The BoE is tasked with keeping this near a 2% target, making this release critical for future rate decisions. |

| Tue, Jan 27 | 00:30 | Fed Interest Rate Decision | This is the most anticipated event for global financial markets, determining the cost of borrowing for businesses and households. Rate changes affect everything from stock valuations and bond yields to the global value of the U.S. dollar. |

aiTrendview Global Disclaimer

This aiTrendview report is an AI-generated document provided exclusively for educational and training purposes and shall not be construed as investment, financial, legal, or tax advice in any jurisdiction.

aiTrendview and its affiliates are not SEBI-registered research analysts, investment advisers, or portfolio managers, and all information herein is automatically compiled from publicly available sources that may contain errors, delays, or omissions.

Users must independently verify all data before making any financial, commercial, or legal decisions, as no market values, performance figures, or trends contained in this report constitute guarantees or forward-looking statements.

Nothing in this publication should be interpreted as a solicitation, recommendation, or endorsement to buy, sell, or hold any security.

aiTrendview, its creators, and all associated AI systems disclaim all liability for losses or consequences arising from the use or reliance upon this content, and users accept full personal responsibility for all actions taken based on it.

Unauthorized reproduction, distribution, or modification of this AI-generated material is strictly prohibited under international copyright, compliance, and intellectual-property laws.

1) or fractional share

Investing in the stock markets carries risk: the value of investments can go up as well as down and you may receive back less than your original investment. Individual investors should make their own decisions or seek independent advice.