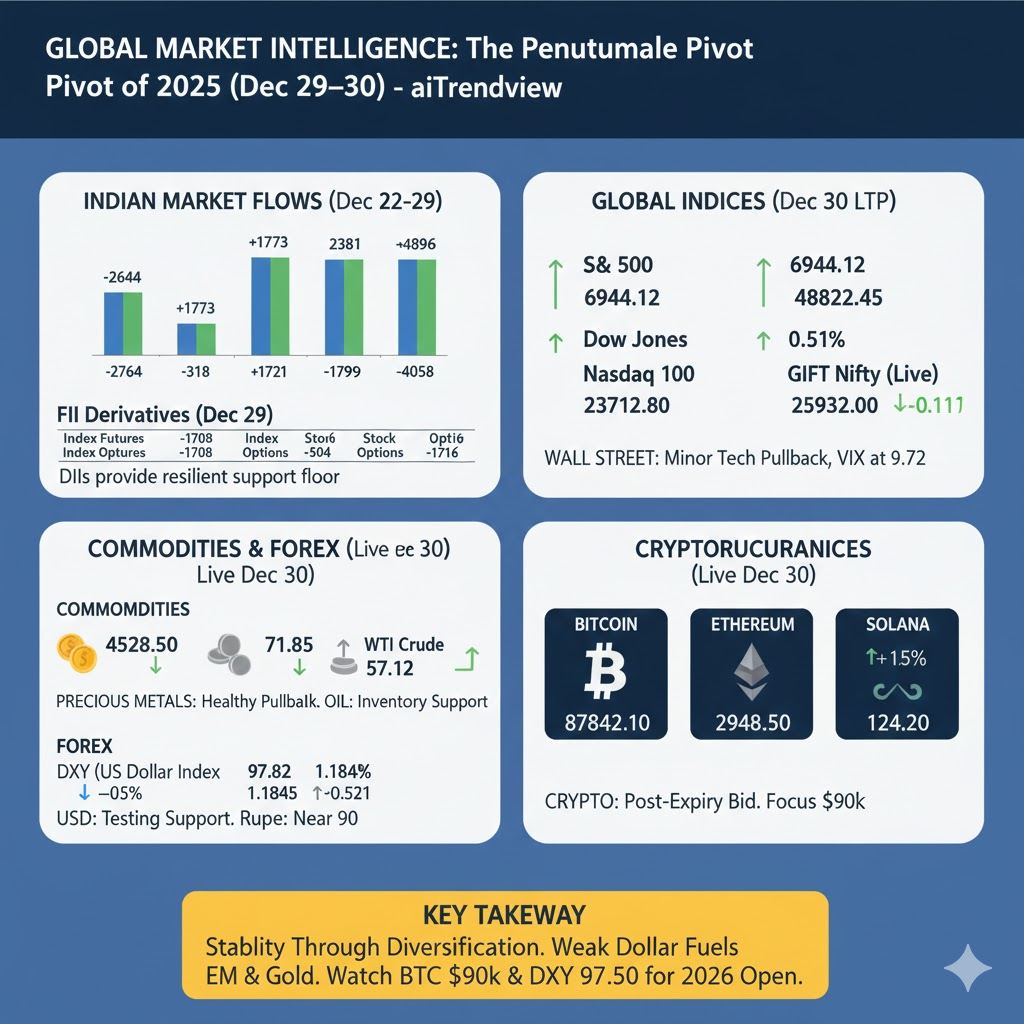

The global financial markets are entering the final 48 hours of 2025 in a state of high-conviction “window dressing.” As of Tuesday, December 30, the primary theme is institutional cleanup—fund managers are solidifying their positions in the year’s winners (AI Tech and Gold) while shedding laggards (Energy and high-beta Crypto). Following a minor pullback on Wall Street on Monday, the Asian session showed resilience today, with the GIFT Nifty signaling a flat-to-positive opening for the Indian bourses despite some profit-booking in large-cap IT.

The macro-environment remains supportive as the US Dollar Index (DXY) slides toward multi-month lows (97.82), a move that historically triggers an inflow into Emerging Markets for the “January Effect.” While the S&P 500 remains within striking distance of the psychological 7,000 milestone, all eyes are on the transition from “Safe Haven” gold into “Risk-On” growth assets for the 2026 rotation.

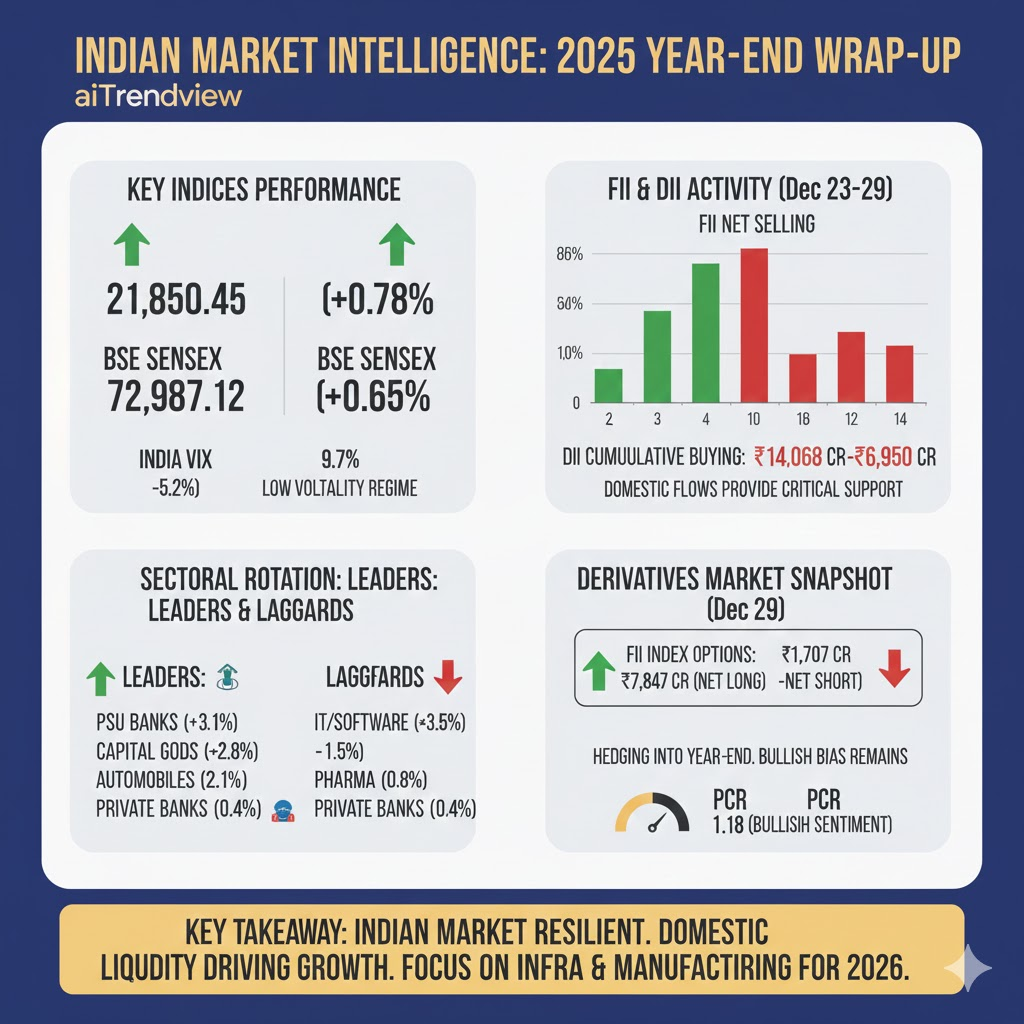

The last five trading sessions in India have been a battleground between Foreign Institutional Investors (FIIs) seeking liquidity and Domestic Institutional Investors (DIIs) providing a robust floor. Notably, while FIIs have been net sellers in the cash segment, they have significantly ramped up their positions in the Index Options segment, suggesting a hedging strategy against potential year-end volatility.

| Date | FII Cash (Net) | DII Cash (Net) | Combined Impact |

| Dec 29 | -2,759.89 | +2,643.85 | -116.04 |

| Dec 26 | -317.56 | +1,772.56 | +1,455.00 |

| Dec 24 | -1,721.30 | +2,381.30 | +660.00 |

| Dec 23 | -1,794.80 | +3,812.40 | +2,017.60 |

| Dec 22 | -457.30 | +4,058.20 | +3,600.90 |

| Date | Index Futures | Index Options | Stock Futures | Stock Options |

| Dec 29 | -1,707.70 | -1,986.40 | -503.60 | -1,715.80 |

| Dec 26 | -1,130.70 | +7,847.90 | +1,166.30 | +119.20 |

| Dec 24 | +1,032.40 | -1,606.90 | +879.20 | +907.00 |

| Dec 23 | +2,097.90 | -5,206.40 | +1,847.30 | +1,342.50 |

| Dec 22 | +2,675.70 | +3,262.00 | +1,142.30 | -59.40 |

| Index | Closing/LTP | Day Change | Perspective |

| S&P 500 (ES) | 6,944.12 | -0.35% | Minor Tech Pullback |

| Dow Jones (YM) | 48,822.45 | -0.51% | Value Sell-off |

| Nasdaq 100 (NQ) | 23,712.80 | -0.50% | AI Consolidation |

| GIFT Nifty (Live) | 25,932.00 | -0.11% | Cautious Start |

| Nikkei 225 | 50,580.00 | -0.40% | Seven-day Rally Paused |

| Asset | Live Price | Change (%) | Trend |

| Gold (Spot) | $4,528.50/oz | -0.45% | Off Record Highs |

| Silver (Spot) | $71.85/oz | -1.10% | Healthy Pullback |

| WTI Crude | $57.12/bbl | +0.35% | Inventory Support |

| US Dollar Index | 97.82 | -0.05% | Testing Support |

| USD/INR | 89.98 | +0.09% | Near All-Time High |

| Asset | Live Price (USD) | 24h Change | Sentiment |

| Bitcoin (BTC) | $87,842.10 | +0.42% | Accumulation |

| Ethereum (ETH) | $2,948.50 | +0.15% | Consolidating |

| Solana (SOL) | $124.20 | +0.55% | Holding $120 |

As of midday December 30, the market message is clear: Stability through Diversification. While FIIs are trimming cash positions in India, DIIs are providing a resilient safety net. Global indices are taking a breather from record highs, but the weakening Dollar remains a powerful tailwind for 2026. For the next 48 hours, volatility will be concentrated in the F&O monthly expiry; investors should focus on maintaining core positions in AI-driven tech and precious metals while ignoring the pre-holiday “noise.”

aiTrendview Global Disclaimer

This aiTrendview report is an AI-generated document provided exclusively for educational and training purposes and shall not be construed as investment, financial, legal, or tax advice in any jurisdiction.

aiTrendview and its affiliates are not SEBI-registered research analysts, investment advisers, or portfolio managers, and all information herein is automatically compiled from publicly available sources that may contain errors, delays, or omissions.

Users must independently verify all data before making any financial, commercial, or legal decisions, as no market values, performance figures, or trends contained in this report constitute guarantees or forward-looking statements.

Nothing in this publication should be interpreted as a solicitation, recommendation, or endorsement to buy, sell, or hold any security.

aiTrendview, its creators, and all associated AI systems disclaim all liability for losses or consequences arising from the use or reliance upon this content, and users accept full personal responsibility for all actions taken based on it.

Unauthorized reproduction, distribution, or modification of this AI-generated material is strictly prohibited under international copyright, compliance, and intellectual-property laws.

1) or fractional share

Investing in the stock markets carries risk: the value of investments can go up as well as down and you may receive back less than your original investment. Individual investors should make their own decisions or seek independent advice.