In the ever-evolving landscape of global finance, 2025 has acted as the “Settlement Era” for digital assets. As we project into fiscal year 2026, the cryptocurrency sector is transitioning from a speculative retail niche into a high-integrity institutional asset class. This transformation is driven by regulatory clarity, advanced layer-2 scalability, and the integration of Real World Assets (RWA).

The following report provides an advanced cross-sectional analysis of the crypto market’s trajectory for 2026, intended for institutional desks, private equity, and sophisticated retail traders.

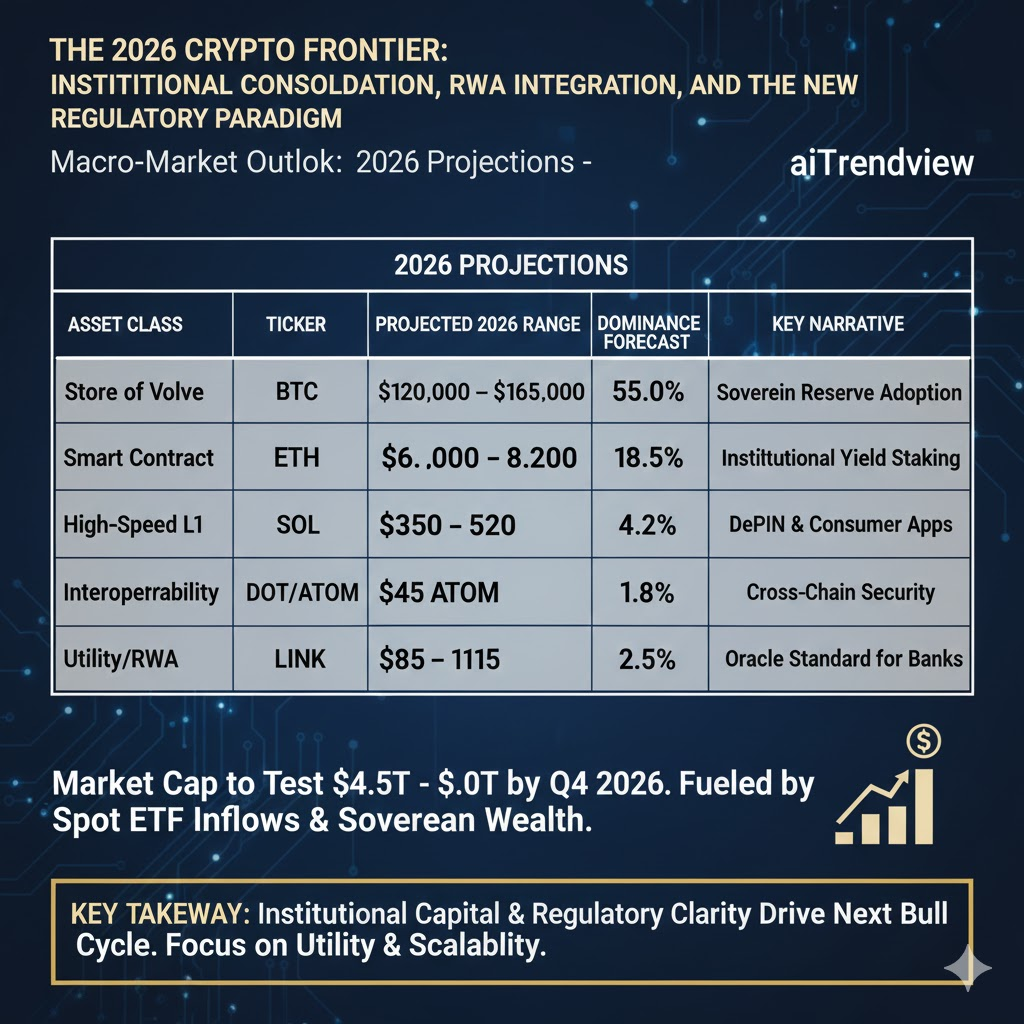

The market cap of digital assets is expected to test $4.5T – $5.0T by Q4 2026, fueled by the second wave of Spot ETF inflows and sovereign wealth fund allocations.

| Asset Class | Ticker | Projected 2026 Range | Dominance Forecast | Key Narrative |

| Store of Value | BTC | $120,000 – $165,000 | 55.0% | Sovereign Reserve Adoption |

| Smart Contract | ETH | $6,500 – $8,200 | 18.5% | Institutional Yield Staking |

| High-Speed L1 | SOL | $350 – $520 | 4.2% | DePIN & Consumer Apps |

| Interoperability | DOT/ATOM | $45 – $65 | 1.8% | Cross-Chain Security |

| Utility/RWA | LINK | $85 – $115 | 2.5% | Oracle Standard for Banks |

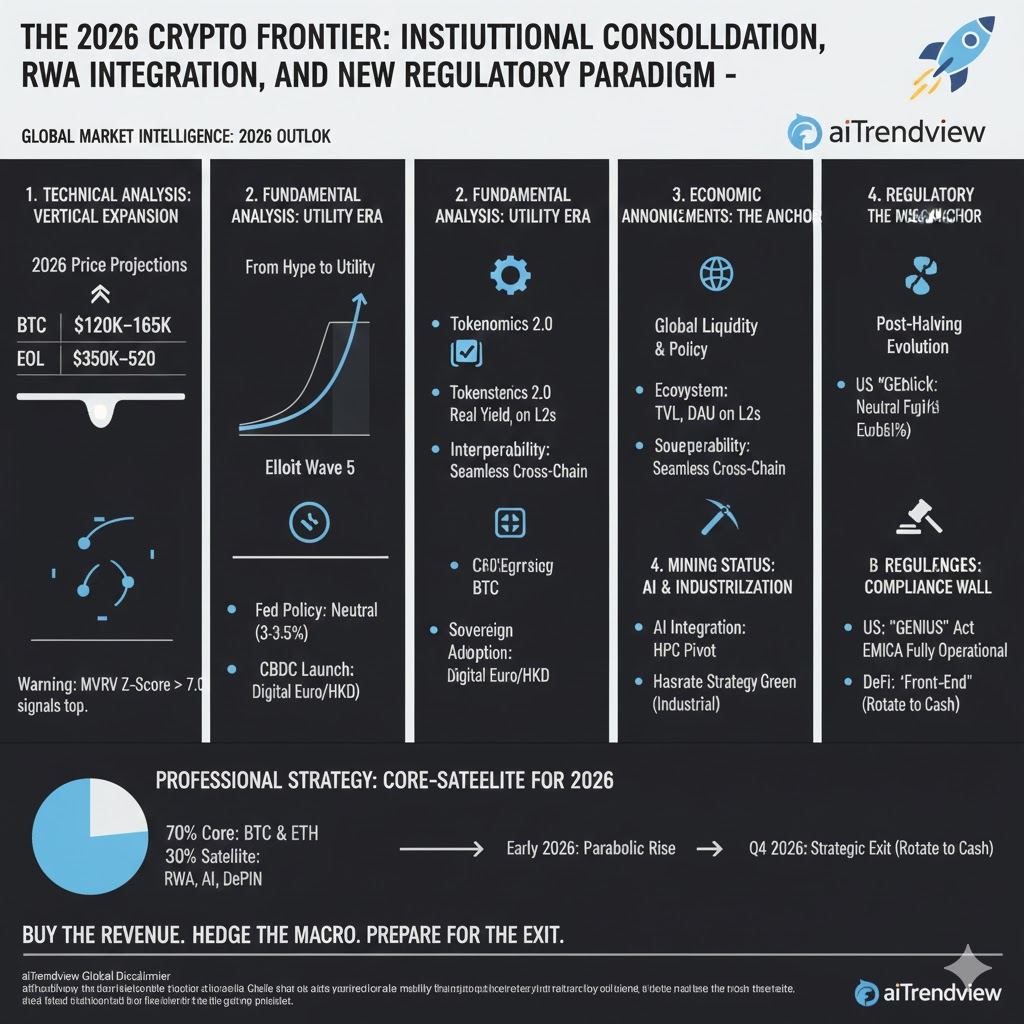

From a technical standpoint, 2026 is anticipated to be the “Vertical Expansion” phase of the current four-year cycle.

In 2026, fundamentals will decouple from “meme-based” price action.

Crypto in 2026 will no longer trade in a vacuum; it is now a sensitive barometer of Global Liquidity (M2).

Post-2024 halving, the mining landscape in 2026 will be unrecognizable to early adopters.

The most significant headwind for 2026 is the finalized implementation of global frameworks.

Investors should adopt a Core-Satellite Portfolio strategy.

As liquidity reaches a crescendo in late 2026, the objective is strategic exit. Professional desks will look for a “blow-off top” to rotate back into fixed-income or cash equivalents, waiting for the inevitable 2027 cyclical correction.

aiTrendview Global Disclaimer

This aiTrendview report is an AI-generated document provided exclusively for educational and training purposes and shall not be construed as investment, financial, legal, or tax advice in any jurisdiction.

aiTrendview and its affiliates are not SEBI-registered research analysts, investment advisers, or portfolio managers, and all information herein is automatically compiled from publicly available sources that may contain errors, delays, or omissions.

Users must independently verify all data before making any financial, commercial, or legal decisions, as no market values, performance figures, or trends contained in this report constitute guarantees or forward-looking statements.

Nothing in this publication should be interpreted as a solicitation, recommendation, or endorsement to buy, sell, or hold any security.

aiTrendview, its creators, and all associated AI systems disclaim all liability for losses or consequences arising from the use or reliance upon this content, and users accept full personal responsibility for all actions taken based on it.

Unauthorized reproduction, distribution, or modification of this AI-generated material is strictly prohibited under international copyright, compliance, and intellectual-property laws.

1) or fractional share

Investing in the stock markets carries risk: the value of investments can go up as well as down and you may receive back less than your original investment. Individual investors should make their own decisions or seek independent advice.