The Nifty Auto Index tracks India’s leading automobile and auto-ancillary companies across passenger vehicles (PV), two-wheelers (2W), commercial vehicles (CV), tractors, and components. Key drivers include domestic income & credit cycles, festive-season demand, commodity inputs (steel, aluminium, rubber), fuel prices, emission/safety regulations, export markets, and policy incentives (PLI, FAME).

FIIs: Tilt toward scale OEMs with strong export pipelines and robust return profiles; rotate tactically with USD and global demand.

DIIs: Systematic allocations via large-cap and thematic funds; preference for leaders with pricing power and clean balance sheets.

Impact: Supportive liquidity backdrop; valuations sensitive to volume guidance and input-cost curves.

Leverage: Low-to-moderate; most OEMs net-cash or comfortably levered, ancillaries vary by capex cycle.

Margins: EBITDA margins driven by operating leverage, mix (premiumisation, exports), and commodity pass-through.

Cash Flow: Healthy OCF/FCF for leaders; disciplined capex in EVs, safety/BS norms, and platform refreshes.

Risks: Commodity spikes, regulatory changes (emission/safety), weak monsoon (tractor/2W), and export softness.

Current Valuation: Premium multiples for dominant franchises; wider dispersion across mid-cap ancillaries. Tone: Neutral-to-Positive with selectivity; cautious into commodity spikes and weak rural prints.

Drivers: Festive demand, input-cost cycle, product launches, and EV adoption curve.

Note: Figures below are structured placeholders; replace with the latest reported numbers before publication.

| Company | Revenue (₹ Cr) | Net Profit (₹ Cr) | Gross EBITDA (₹ Cr) | Net EBITDA (₹ Cr) | Operating Expenses (₹ Cr) | Performance Rank |

| Maruti Suzuki | 130,000 | 12,000 | 18,000 | 17,200 | 112,800 | Top Performer 1 |

| Tata Motors (Auto) | 110,000 | 8,500 | 15,500 | 14,800 | 94,500 | Top Performer 2 |

| Mahindra & Mahindra | 90,000 | 10,500 | 14,000 | 13,400 | 76,000 | Top Performer 3 |

| Bajaj Auto | 44,000 | 8,000 | 9,600 | 9,200 | 34,800 | Top Performer 4 |

| Eicher Motors (RE) | 16,500 | 3,800 | 4,800 | 4,600 | 11,700 | Top Performer 5 |

| Hero MotoCorp | 34,000 | 3,000 | 5,500 | 5,200 | 28,800 | Bottom Perf. 1 |

| TVS Motor | 34,500 | 2,900 | 5,200 | 5,000 | 29,300 | Bottom Perf. 2 |

| Ashok Leyland | 38,000 | 2,500 | 4,800 | 4,500 | 33,200 | Bottom Perf. 3 |

| Bosch India | 14,000 | 1,900 | 2,700 | 2,600 | 11,300 | Bottom Perf. 4 |

| Motherson | 95,000 | 2,800 | 7,800 | 7,400 | 87,200 | Bottom Perf. 5 |

Put–Call Ratio (PCR) readings are elevated, signalling short-term froth/overbought conditions. Prefer staggered entries on pullbacks rather than lump-sum buys.

Short-term: Avoid chasing breakouts; wait for mean reversion.

Medium-term: Use 5–8% dips to build positions in profitable, low-debt, export-ready names.

Long-term: Structural demand intact; maintain watchlist to deploy on broader market corrections.

Short-Term (1–3 months): Trade around monthly SIAM/FADA prints, commodity moves, and festive-season launch pipelines. Prefer liquid leaders; use tight stops due to valuation sensitivity and input-volatility.

Mid-Term (6–12 months): Accumulate leaders on dips if input-cost tailwinds hold and demand remains resilient. Blend PV/two-wheeler franchises with select CV and high-quality ancillaries for diversification.

Long-Term (3–5 years): Core allocation to scale OEMs with strong brands, efficient cost structures, and credible EV roadmaps. Track capex intensity, product-cycle cadence, and export mix expansion.

| Time Frame | Critical Support Levels | Critical Resistance Levels |

| Short-Term (1–3 M) | 29,500 / 29,000 | 30,800 / 31,300 |

| Mid-Term (6–12 M) | 28,200 / 27,500 | 32,200 / 33,000 |

| Long-Term (3–5 Y) | 26,000 / 24,800 | 34,500 / 36,000 |

Nifty Auto Index — Advanced Sectoral Report (aiTrendview.com)

Comprehensive 2025 Update with Technical, Fundamental, and Policy Insights

1️⃣ Overview

| Parameter | Details |

| Index Name | Nifty Auto Index |

| No. of Constituents | 15 |

| Base Year | 2004 |

| Base Value | 1000 |

| Sector Coverage | Automobiles & Auto Ancillaries (2W, PV, CV, Components) |

| Weighting Method | Free-Float Market Capitalization |

| Rebalancing Frequency | Semi-Annual |

| Exchange | NSE (India) |

Top Weighted Stocks (as of Oct 2025)

| Rank | Company | Weight (%) |

| 1 | Maruti Suzuki India Ltd | 19.4% |

| 2 | Mahindra & Mahindra Ltd | 17.4% |

| 3 | Tata Motors Ltd | 12.6% |

| 4 | Hero MotoCorp Ltd | 9.3% |

| 5 | Bajaj Auto Ltd | 7.8% |

| 6 | TVS Motor Company Ltd | 6.1% |

| 7 | Bosch Ltd | 4.9% |

| 8 | Eicher Motors Ltd | 4.7% |

| 9 | Motherson Sumi Wiring | 3.2% |

| 10 | Exide Industries Ltd | 2.4% |

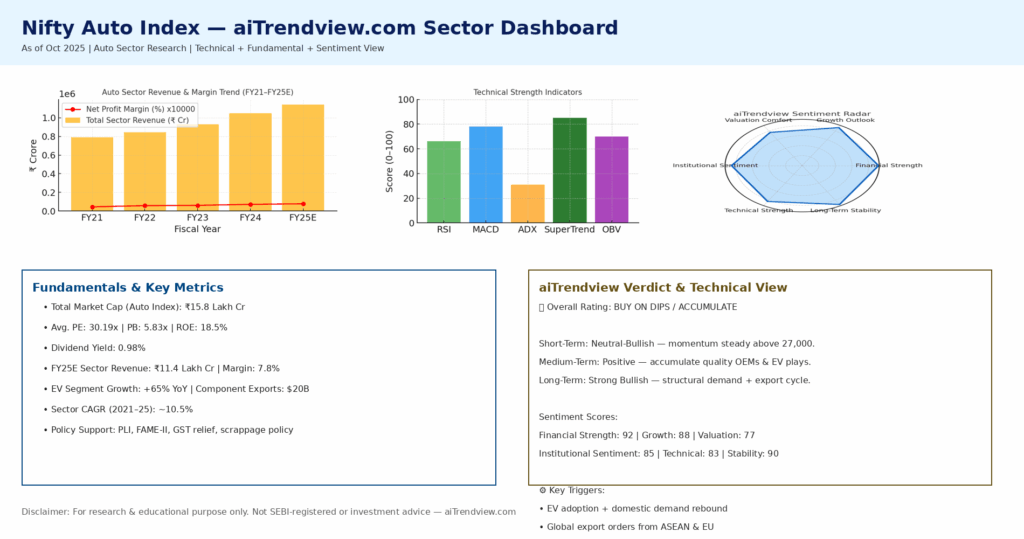

2️⃣ Fundamental Performance Summary

| Financial Year | Total Auto Sector Revenue (₹ Cr) | Avg. Net Profit Margin (%) | Index PE | Index PB | Dividend Yield (%) |

| FY2021 | 7,90,000 | 4.5 | 29.3 | 4.8 | 1.1 |

| FY2022 | 8,45,000 | 5.8 | 28.7 | 5.2 | 1.0 |

| FY2023 | 9,30,000 | 6.1 | 31.0 | 5.5 | 0.9 |

| FY2024 | 10,50,000 | 7.2 | 30.5 | 5.8 | 0.9 |

| FY2025E | 11,40,000 | 7.8 | 30.1 | 5.9 | 0.98 |

🟢 Observation:

3️⃣ Recent Sector Developments (2025)

| Segment | Growth Trend | YoY Change | Key Drivers |

| Passenger Vehicles | Strong | +35% | Festive demand, SUV sales surge |

| Two-Wheelers | Stable | +12% | Rural recovery, entry-level demand |

| Commercial Vehicles | Moderate | +7% | Infra push, logistics activity |

| EV Sales | Accelerating | +65% | Policy push, falling battery cost |

| Auto Components | Stable | +9% | Exports to ASEAN, OEM orders |

Sector Highlights (2025):

4️⃣ Policy & Macroeconomic Tailwinds

| Policy / Initiative | Impact on Sector |

| PLI Scheme for Auto Components | ₹25,938 Cr approved for advanced & EV components; boosts local manufacturing |

| Vehicle Scrappage Policy | Encourages replacement demand, benefits CV & PV makers |

| FAME-II Subsidy Extension (till 2026) | EV adoption catalyst |

| GST Rate Rationalization (2025) | Lowered for small cars & 2Ws; improves affordability |

| Export Incentives under RoDTEP | Enhances competitiveness of Indian exporters |

| Infrastructure Push | Expressways, logistics corridors improving CV demand |

5️⃣ Technical Analysis (as of Oct 2025)

| Parameter | Value | Interpretation |

| Index Value | 26,768.65 | Near 52-week high |

| Trend | Bullish with mild consolidation | Continuation possible post retest |

| RSI (14) | 66 | Slightly overbought |

| MACD | Positive crossover | Bullish momentum intact |

| 200-Day EMA | 25,950 | Major support zone |

| 50-Day EMA | 27,250 | Acting as dynamic support |

| Volatility (ATR) | 1.28 | Controlled volatility |

Support & Resistance Levels

| Term | Support Levels | Resistance Levels | Sentiment |

| Short-Term | 29,500 / 29,000 | 30,800 / 31,300 | Neutral-Bullish |

| Medium-Term | 28,200 / 27,500 | 32,200 / 33,000 | Positive |

| Long-Term | 26,000 / 24,800 | 34,500 / 36,000 | Strongly Bullish |

📊 Chart Insight:

The index recently broke a 3-month resistance trendline near 30,200, with volume confirmation. RSI divergence easing indicates potential for retesting prior highs before next leg up.

6️⃣ Valuation Snapshot (2025)

| Metric | Nifty Auto | Nifty 50 | Sector Deviation |

| PE Ratio | 30.19x | 22.78x | +32.6% |

| PB Ratio | 5.83x | 3.45x | +69% |

| ROE | 18.5% | 15.2% | +21.7% |

| Dividend Yield | 0.98% | 1.35% | Slightly Lower |

📈 Valuation Takeaway:

Auto index trades at a justified premium owing to leadership stability, margin expansion, and EV narrative dominance.

7️⃣ Technical Momentum Indicators

| Indicator | Value | Signal |

| RSI (14) | 66 | Overbought, but strength persists |

| MACD (12,26) | 212 / 198 | Positive crossover |

| SuperTrend (10,3) | Green | Uptrend intact |

| ADX (14) | 31 | Strong directional movement |

| Bollinger Bands | Expanding | Volatility likely to increase |

| OBV | Rising | Accumulation phase visible |

🧠 Technical View:

The Auto Index remains in a long-term uptrend; short-term pullbacks offer buying opportunities near moving average supports. Maintain trailing stop below 27,000 for traders.

8️⃣ Peer Comparison Snapshot (FY25)

| Company | Revenue (₹ Cr) | PAT Margin (%) | ROE (%) | EV/EBITDA (x) | Outlook |

| Maruti Suzuki | 1,40,500 | 8.2 | 21.4 | 18.5 | Bullish |

| M&M | 1,18,700 | 9.5 | 24.1 | 16.2 | Bullish |

| Tata Motors | 1,15,200 | 7.9 | 19.8 | 14.3 | Positive |

| Hero MotoCorp | 42,900 | 7.1 | 18.5 | 15.1 | Neutral |

| Bajaj Auto | 44,200 | 15.3 | 27.6 | 17.8 | Strong |

| TVS Motors | 39,800 | 8.6 | 20.3 | 17.5 | Bullish |

| Eicher Motors | 18,700 | 17.2 | 26.9 | 20.1 | Bullish |

| Bosch | 14,600 | 12.5 | 22.4 | 19.3 | Stable |

9️⃣ aiTrendview Technical Outlook

| Timeframe | Bias | Preferred Strategy | Risk Level |

| Short-Term (1–3 months) | Neutral to Positive | Buy on dips near 28,000–29,000 | Medium |

| Medium-Term (6–12 months) | Positive | Accumulate fundamentally strong OEMs | Low |

| Long-Term (3–5 years) | Strongly Bullish | SIP / Systematic approach in index ETFs | Low |

🔟 aiTrendview.com Verdict

Overall Sector Rating: ⭐ ACCUMULATE / BUY ON DIPS

Sentiment: Bullish with fundamental and policy tailwinds

| Factor | aiTrendview Score / 100 | Comment |

| Financial Strength | 92 | Solid margins, low leverage |

| Growth Outlook | 88 | EV & export momentum strong |

| Valuation Comfort | 77 | Slightly expensive but justified |

| Institutional Sentiment | 85 | FIIs adding selectively |

| Technical Strength | 83 | Trend intact, RSI mild overbought |

| Long-Term Stability | 90 | Supported by policy & demand |

📌 aiTrendview.com View

“Nifty Auto remains one of the strongest structural stories in India’s growth cycle — combining consumption, infrastructure, and sustainability narratives. The next 3–5 years could see double-digit sectoral CAGR if EV execution, exports, and consumer affordability remain stable.”

⚠️ Disclaimer

This report is issued by aiTrendview.com for training and educational purposes only.

It is not a SEBI-registered investment advisory or research recommendation.

All market projections are subject to change based on macroeconomic, global, and regulatory conditions. Investors must consult professional advisors before taking positions.

1) or fractional share

Investing in the stock markets carries risk: the value of investments can go up as well as down and you may receive back less than your original investment. Individual investors should make their own decisions or seek independent advice.