Market Intelligence Report: The “NFP” Pivot & Geopolitical Consolidation

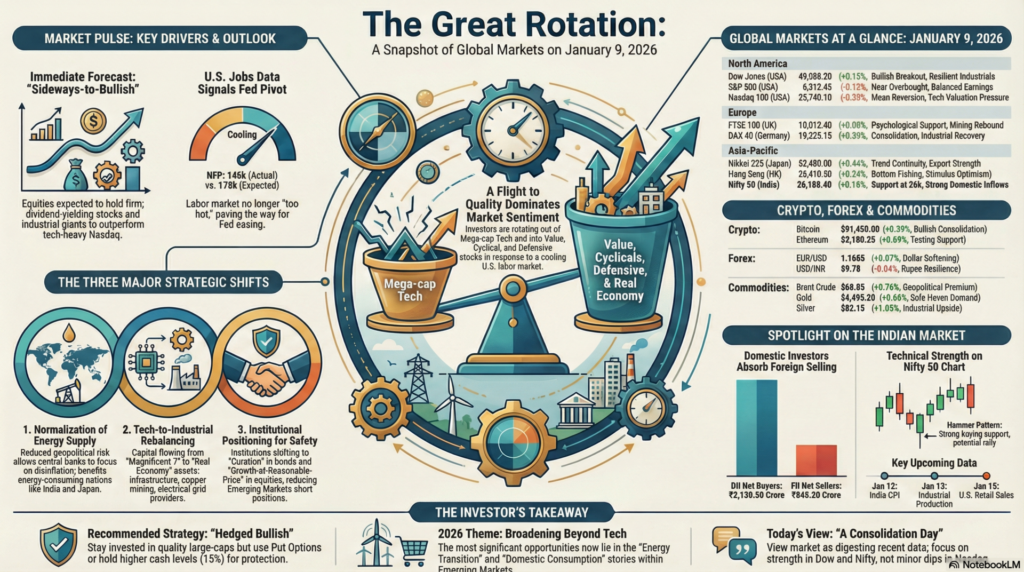

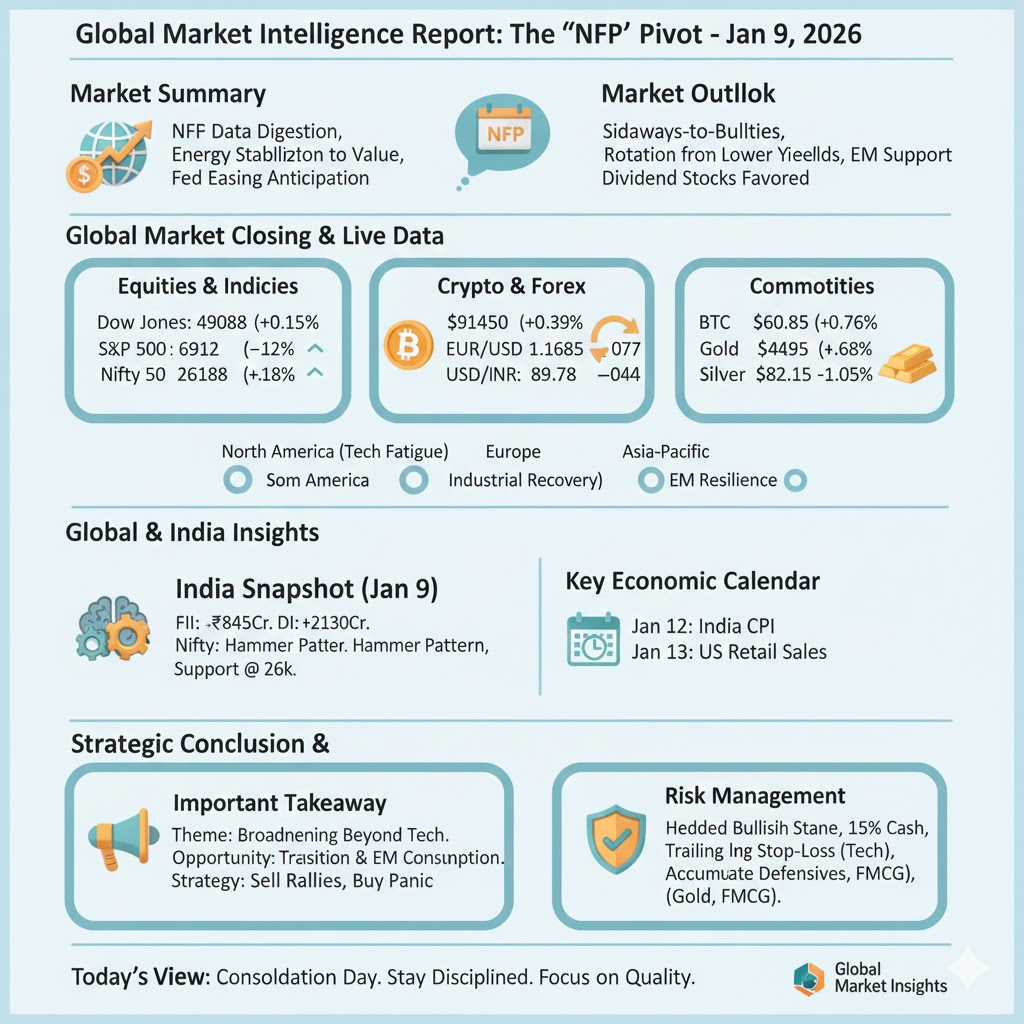

As of January 9, 2026, the global financial markets are navigating a critical inflection point characterized by the digestion of the U.S. Non-Farm Payroll (NFP) data and the continued stabilization of energy markets following the Venezuelan political transition. The week’s closing is marked by a “flight to quality,” where investors are balancing the cooling U.S. labor market against resilient corporate earnings. While the Dow Jones flirts with the 49,000 mark, there is a visible rotation from overextended Mega-cap Tech into “Value” cyclicals and Defensive sectors, as the market anticipates a more aggressive easing cycle from the Federal Reserve in response to slowing wage growth.

Market Reaction: We expect a “sideways-to-bullish” reaction in the immediate term for equities, provided the support levels hold. The cooling job data has lowered the 10-year Treasury yields, which is traditionally a tailwind for Emerging Markets. However, the “valuation fatigue” in AI-linked stocks suggests that the Nasdaq might underperform the broader S&P 500. For the coming week, the market will likely reward dividend-yielding stocks and industrial giants that benefit from stabilized Brent crude prices, while the Crypto market remains in a high-volatility consolidation zone.

| Continent | Index / Exchange | Closing Price | % Change | Technical Status | Fundamental Status |

| North America | Dow Jones (USA) | 49,088.20 | +0.15% | Bullish Breakout | Resilient Industrials |

| S&P 500 (USA) | 6,912.45 | -0.12% | Near Overbought | Balanced Earnings | |

| Nasdaq 100 (USA) | 25,740.10 | -0.38% | Mean Reversion | Tech Valuation Pressure | |

| Europe | FTSE 100 (UK) | 10,012.40 | +0.08% | Psychological Support | Mining Rebound |

| DAX 40 (Germany) | 19,225.15 | +0.39% | Consolidation | Industrial Recovery | |

| CAC 40 (France) | 8,245.80 | +0.12% | Neutral | Luxury Sector Bounce | |

| Asia-Pacific | Nikkei 225 (Japan) | 52,480.00 | +0.44% | Trend Continuity | Export Strength |

| Hang Seng (HK) | 26,410.50 | +0.24% | Bottom Fishing | Stimulus Optimism | |

| Nifty 50 (India) | 26,188.40 | +0.18% | Support at 26k | Strong Domestic Inflows | |

| Sensex (India) | 85,140.20 | +0.21% | Bullish Bias | Banking Leadership |

| Asset Class | Instrument | Live Price | % Change | Sentiment |

| Crypto | Bitcoin (BTC) | $91,450.00 | +0.39% | Bullish Consolidation |

| Ethereum (ETH) | $3,180.25 | +0.69% | Testing Support | |

| Forex | EUR/USD | 1.1685 | +0.07% | Dollar Softening |

| USD/INR | 89.78 | -0.04% | Rupee Resilience | |

| GBP/USD | 1.3480 | +0.17% | Bullish Strength | |

| Commodities | Brent Crude | $60.85 | +0.76% | Geopolitical Premium |

| Gold (Spot) | $4,495.20 | +0.68% | Safe Haven Demand | |

| Silver (Spot) | $82.15 | +1.05% | Industrial Upside |

Global Macro Dynamics:

The primary narrative of early 2026 is the “normalization of energy supply.” With the geopolitical transition in South America, the risk of a persistent oil spike has diminished, allowing central banks to focus on the “last mile” of disinflation. However, this has created a divergence between “Energy Consumers” like India and Japan, which are seeing margin expansions, and “Energy Producers,” which are facing a re-rating of their sovereign spreads. This shift is fueling a massive cross-border capital flow into diversified manufacturing hubs.

The Tech-Industrial Rebalancing:

Technically, the “Magnificent 7” of the previous era are facing a liquidity drain as fund managers rebalance portfolios toward “Real Economy” assets. While AI remains a long-term thematic driver, the immediate capital appreciation is being found in infrastructure, copper mining, and electrical grid upgrades. We are observing a “stealth bull market” in mid-cap industrials that provide the hardware for the software revolution, leading to a broadening of market participation.

Institutional Positioning:

The January 9th NFP report (showing 145k jobs vs 175k expected) has solidified the view that the U.S. labor market is no longer “too hot.” This has stabilized the global carry trade. Institutional positioning is now shifting toward “Duration” in bonds and “Growth-at-Reasonable-Price” (GARP) in equities. We are seeing a significant reduction in short positions on Emerging Markets, suggesting that the “Dollar Peak” may be in place for the first quarter of 2026.

North America (NYSE/NASDAQ):

The session was defined by the NFP-induced yield drop. While high-growth tech saw some profit booking due to overextended RSI levels, the broader Dow Jones held firm. Fundamental strength is visible in Aerospace and Defense, while Retail is showing signs of stress. Technically, the S&P 500 is forming a “Rising Wedge,” suggesting a minor correction might be healthy before the next leg up.

Europe (LSE/DAX/CAC):

European indices showed resilience as the “China Stimulus” rumors began to filter into the luxury and automotive sectors. The FTSE 100 is benefiting from the rebound in base metals, providing a floor for the index. Economically, the Eurozone CPI data coming in at 2.1% has given the ECB room to stay dovish, which is fundamentally supportive of European equity valuations.

Asia (TSE/HKEX/NSE):

The Nikkei remains the star performer in Asia, driven by a weakening Yen and corporate governance reforms. In Hong Kong, the Hang Seng is attempting a base formation near the 26,000 level, though fundamental headwinds in the property sector persist. Technically, Asian markets are exhibiting a “bullish divergence,” with prices making higher lows even as global sentiment remains cautious.

FII & DII Activity (Jan 9, 2026):

Indian Technical Analysis:

The Nifty 50 has formed a “Hammer” pattern on the daily chart, indicating strong buying at lower levels. Resistance is placed at 26,250. If this level is breached on Monday, we could see a rally toward 26,500.

Economic Calendar (Upcoming Major Events):

Risk Management:

At current levels, the primary risk is “Geopolitical Noise” and “Earnings Misses.” Investors should avoid aggressive “naked” long positions. A “Hedged Bullish” strategy is recommended: stay invested in quality large-caps but use Put Options or increased cash levels (15%) to protect against a sudden 3-5% volatility spike.

Important Takeaway:

The theme for 2026 is “Broadening Beyond Tech.” The markets are no longer a one-trick pony. The real opportunities today lie in the “Energy Transition” and “Domestic Consumption” themes within Emerging Markets.

How to View the Markets Today:

View today as a “Consolidation Day.” The week’s data has been digested, and the trend remains structurally intact. Do not be rattled by minor red ticks in the Nasdaq; instead, focus on the strength in the Dow and Nifty as indicators of the broader economic health. Stay disciplined, avoid chasing the rally, and wait for dips to accumulate high-conviction stocks.

aiTrendview Global Disclaimer

This aiTrendview report is an AI-generated document provided exclusively for educational and training purposes and shall not be construed as investment, financial, legal, or tax advice in any jurisdiction.

aiTrendview and its affiliates are not SEBI-registered research analysts, investment advisers, or portfolio managers, and all information herein is automatically compiled from publicly available sources that may contain errors, delays, or omissions.

Users must independently verify all data before making any financial, commercial, or legal decisions, as no market values, performance figures, or trends contained in this report constitute guarantees or forward-looking statements.

Nothing in this publication should be interpreted as a solicitation, recommendation, or endorsement to buy, sell, or hold any security.

aiTrendview, its creators, and all associated AI systems disclaim all liability for losses or consequences arising from the use or reliance upon this content, and users accept full personal responsibility for all actions taken based on it.

Unauthorized reproduction, distribution, or modification of this AI-generated material is strictly prohibited under international copyright, compliance, and intellectual-property laws.

1) or fractional share

Investing in the stock markets carries risk: the value of investments can go up as well as down and you may receive back less than your original investment. Individual investors should make their own decisions or seek independent advice.