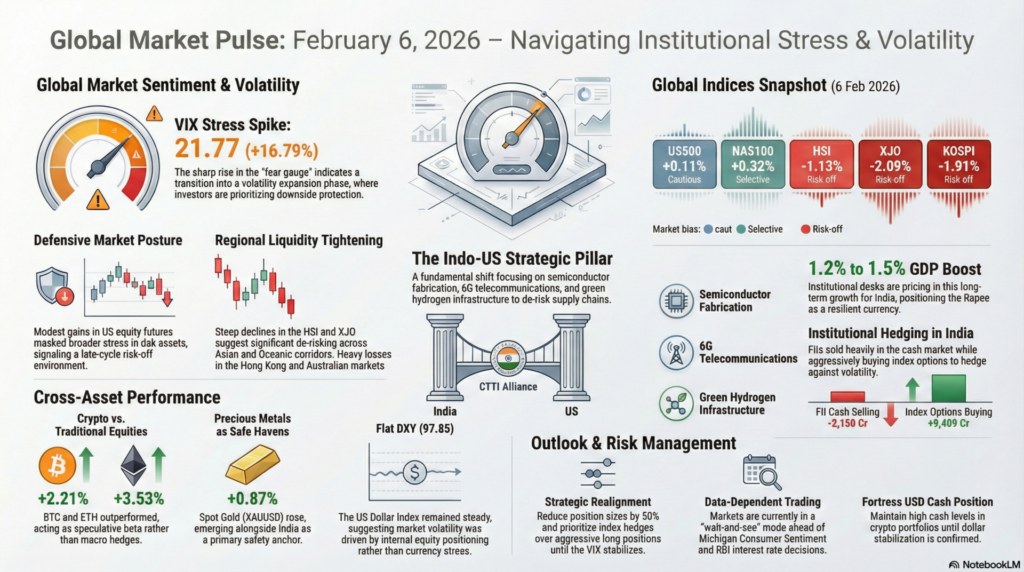

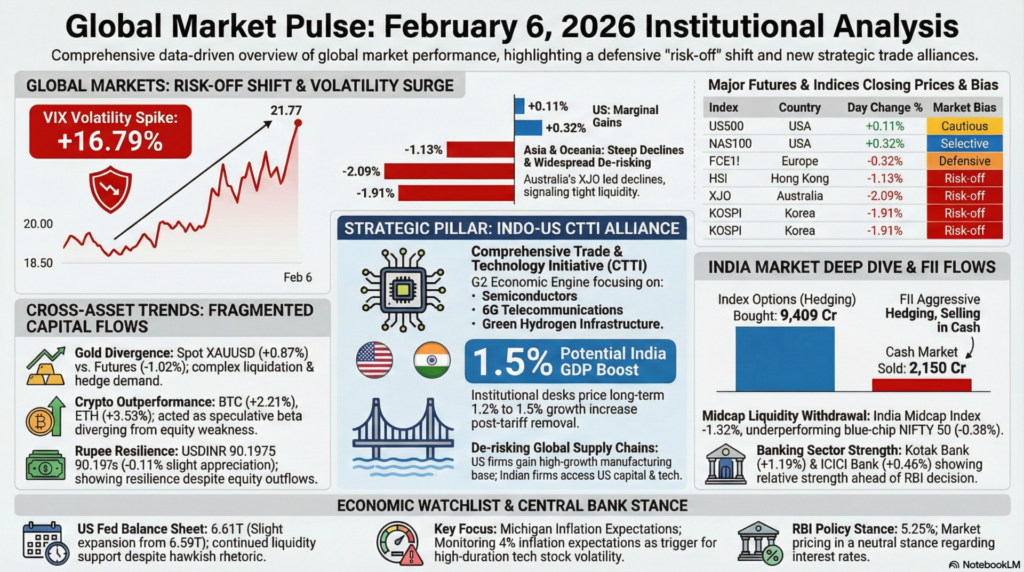

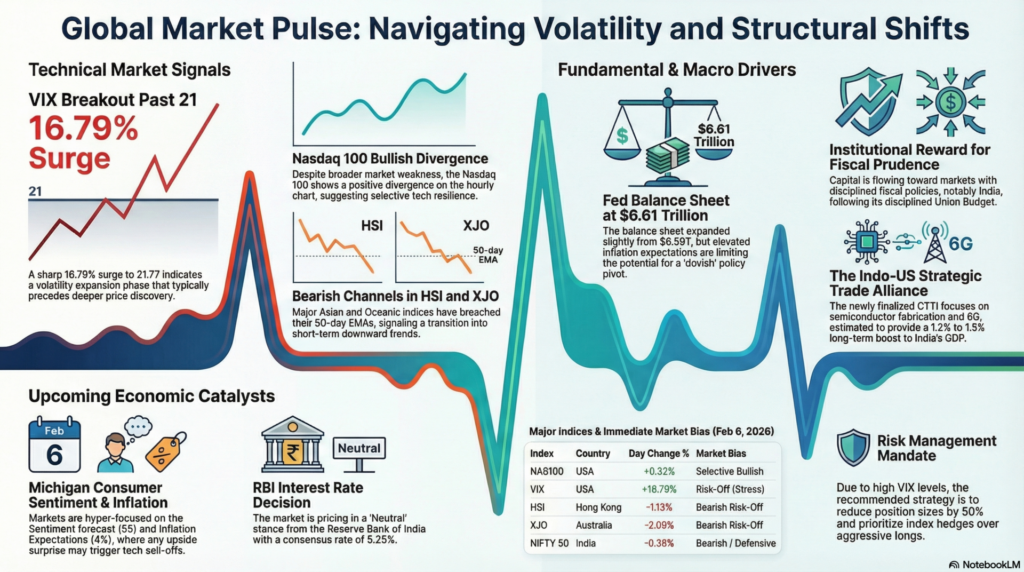

Global markets on 6 February 2026 exhibited a mixed but ultimately defensive posture, where modest gains in US equity futures masked broader stress in risk assets. While US500, US30, and NAS100 closed slightly higher, the sharp 16.79% surge in VIX to 21.77 signaled a clear rise in tail risk, indicating that investors were hedging rather than building directional exposure. Asian equities broadly weakened, led by steep declines in Australia (XJO), Korea (KOSPI), and Hong Kong (HSI), suggesting that regional liquidity conditions were tightening even as Wall Street remained superficially calm.

Cross-asset signals reinforced a late-cycle risk-off environment. The US Dollar Index was largely flat, commodities were split, and flows in India revealed defensive positioning — FIIs sold heavily in cash and stock futures while aggressively buying index options. This configuration typically precedes volatility rather than smooth trending markets. Overall, the market structure pointed to fragile risk sentiment, data-dependent trading, and a bias toward downside protection rather than expansionary risk-taking.

“Risk-Off” sentiment as a historic 16.79% surge in the VIX to 21.77 underscores rising institutional anxiety. While U.S. futures show marginal resilience in tech-heavy indices, widespread selling across Asian and Oceanic markets—specifically the HSI (-1.13%) and XJO (-2.09%)—indicates a significant de-risking phase. This volatility is fueled by persistent inflation expectations and a heavy economic calendar, including critical Michigan Consumer Sentiment data.

Market reaction is expected to remain defensive in the short term. The confluence of rising volatility and heavy institutional selling in cash markets, particularly in Emerging Markets, suggests a period of price discovery. Capital is actively rotating toward safe-haven hedges like Gold (+0.87%) and Silver (+2.51%), while equities face headwinds from a strengthening Dollar Index (97.85) and elevated bond yields. Investors are recalibrating portfolios to prioritize fiscal stability over speculative growth as central banks maintain a vigilant stance.

The Indo-US Strategic Trade Alliance: A New Economic Pillar

The newly finalized Indo-US Comprehensive Trade & Technology Initiative (CTTI) marks a fundamental shift in global economic corridors. This strategic deal focuses on high-tech integration, specifically semiconductor fabrication, 6G telecommunications, and green hydrogen infrastructure. By removing traditional tariff barriers and streamlining regulatory hurdles, the deal creates a “G2” economic engine that offers a robust alternative to regional supply chain bottlenecks.

For market participants, this alliance serves as a significant de-risking tool. U.S.-based multinationals are gaining a secondary, high-growth manufacturing base, while Indian firms are receiving unprecedented access to American capital and technology. Institutional desks are already pricing in a long-term 1.2% to 1.5% boost to India’s GDP, positioning the Rupee as a resilient currency in the face of broader global monetary uncertainty.

| Index | Country | Closing Price | Day Change % | Trend | Market Bias |

|---|---|---|---|---|---|

| US500 | USA | 6,774.5 | +0.11% | Sideways | Cautious |

| US30 | USA | 48,802.00 | +0.08% | Sideways | Cautious |

| NAS100 | USA | 24,403.6 | +0.32% | Mild Bullish | Selective |

| FCE1! (Euro Stoxx) | Europe | 8,245.0 | -0.32% | Bearish | Defensive |

| FDAX1! (DAX) | Germany | 24,553 | +0.10% | Sideways | Neutral |

| FESX1! (Euro 50) | Europe | 5,925 | -0.08% | Sideways | Neutral |

| HSI | Hong Kong | 26,580.30 | -1.13% | Bearish | Risk-off |

| J225 | Japan | 54,106.5 | +0.66% | Bullish | Mixed |

| XJO | Australia | 8,703.2 | -2.09% | Bearish | Risk-off |

| KOSPI | Korea | 5,064.96 | -1.91% | Bearish | Risk-off |

| IRUS | Russia | 2,737.13 | -1.41% | Bearish | Weak |

| DFMGI | UAE | 6,675.05 | +0.19% | Sideways | Neutral |

| DXY | USA | 97.850 | -0.10% | Sideways | Neutral |

| VIX | USA | 21.77 | +16.79% | Stress spike | Risk-off |

Technical paragraph:

Price action across major global indices shows divergence rather than confirmation. US futures held marginal gains, but European and Asian benchmarks broke lower, a classic warning of weak global breadth. The spike in VIX invalidates the notion of a stable market — historically, rallies accompanied by rising volatility tend to fail. Momentum favors defensive trading rather than trend following.

Fundamental paragraph:

No explicit inflation, GDP, or earnings data were visible in the images for the US, Europe, or Japan. The only identifiable central bank anchor was India’s RBI rate reference at 5.25% (pending decision). The absence of strong macro catalysts suggests markets were trading more on positioning and liquidity rather than fundamentals.

Economic announcements paragraph:

The US Fed balance sheet stood at 6.61T versus a prior 6.59T, indicating continued balance sheet expansion rather than tightening. Markets were awaiting US sentiment and inflation expectations later in the day, while India faced key domestic monetary data at 19:12 IST. These events created a wait-and-see environment rather than conviction trades.

| Pair | Closing Price | Day Change % | Market Bias |

|---|---|---|---|

| EURUSD | 1.1787 | +0.10% | Mild USD softening |

| GBPUSD | 1.35501 | +0.19% | Mild USD softening |

| USDJPY | 156.702 | -0.21% | Yen strengthening |

| USDINR | 90.1975 | -0.11% | Rupee marginally stronger |

Technical paragraph:

FX markets lacked a clear directional trend. Minor USD softness was visible against EUR and GBP, while the yen strengthened modestly — consistent with risk-off sentiment. The rupee’s slight appreciation suggested limited panic despite equity outflows.

Fundamental paragraph:

No inflation or policy updates were provided for major currencies in the images. Price moves therefore likely reflected risk sentiment rather than structural macro shifts.

Economic announcements paragraph:

Currency markets were poised around US sentiment data and India’s RBI decision. Any hawkish Fed tone or tighter Indian liquidity conditions would likely strengthen the dollar and pressure EM currencies.

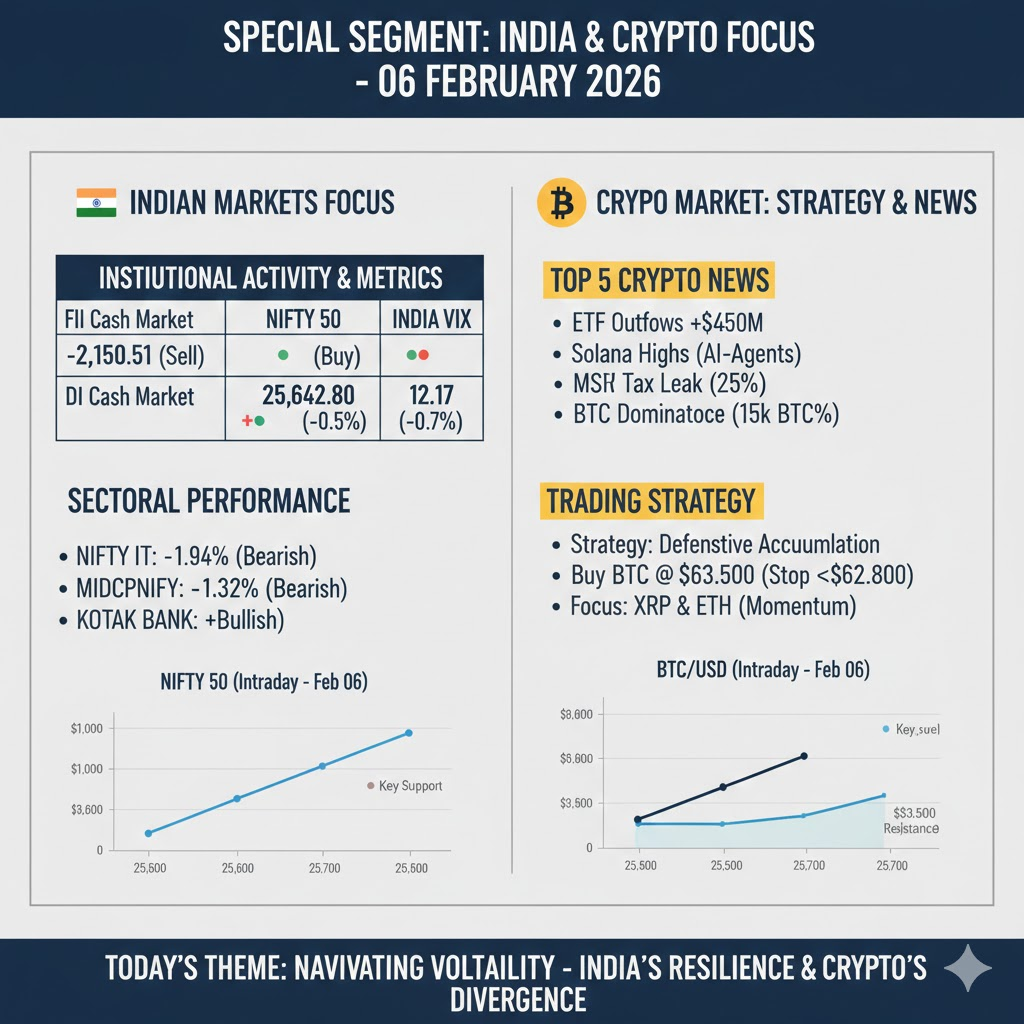

| Asset | Closing Price | Day Change % | Market Bias |

|---|---|---|---|

| BTCUSD | 64,180 | +2.21% | Risk-on vs equities |

| ETHUSD | 1,888.1 | +3.53% | Momentum positive |

| SOLANA | 76.33 | -3.38% | Weak |

| XRPUSDT | 1.2649 | +4.14% | Strong |

| LTCUSD | 49.93 | -1.54% | Weak |

Technical paragraph:

Bitcoin and Ethereum outperformed traditional markets, indicating selective risk appetite within digital assets. XRP showed the strongest momentum, while Solana and Litecoin underperformed, suggesting rotation rather than broad crypto strength.

Fundamental paragraph:

No on-chain or regulatory data were visible in the images. Price behavior appeared driven by speculative flows rather than structural catalysts.

Economic announcements paragraph:

Crypto reacted independently of macro releases, reinforcing its role as a sentiment-driven asset class rather than a macro hedge on this day.

| Asset | Closing Price | Day Change % | Market Bias |

|---|---|---|---|

| GOLD | 150,515 | -1.02% | Weak hedge demand |

| SILVER | 235,603 | -3.37% | Sharp sell-off |

| CRUDE OIL | 5,752 | +0.10% | Flat |

| NATURAL GAS | 317.7 | +0.13% | Stable |

| XAUUSD | 4,822.41 | +0.87% | Spot gold firm |

| BRENT | 67.635 | +0.85% | Steady |

| XTIUSD | 63.67 | +0.81% | Steady |

Technical paragraph:

Futures gold and silver sold off sharply, contradicting the rise in VIX — an unusual combination that suggests selling pressure rather than safe-haven demand. Energy markets remained stable, reflecting balanced supply-demand conditions.

Fundamental paragraph:

No inventory or OPEC-related data were provided. The lack of major news kept oil within a narrow range.

Economic announcements paragraph:

The Baker Hughes rig count later in the day (411) was scheduled, a key indicator for US oil production trends.

| Index | Closing Price | Day Change % | Trend |

|---|---|---|---|

| NIFTY 50 | 25,544.70 | -0.38% | Bearish |

| SENSEX | 83,182.56 | -0.16% | Mild bearish |

| BANKNIFTY | 59,991.45 | -0.12% | Sideways/weak |

| FINNIFTY | 27,764.90 | -0.03% | Flat |

| MIDCAP | 13,551.25 | -1.32% | Bearish |

Technical paragraph:

Midcaps underperformed significantly, indicating liquidity withdrawal from riskier segments. NIFTY and BANKNIFTY showed mild weakness, suggesting distribution rather than panic selling.

Fundamental paragraph:

No earnings or macro growth data were shown. The market was primarily reacting to global sentiment and FII flows.

Economic announcements paragraph:

India awaited key releases at 19:12 IST, including Cash Reserve Ratio, RBI rate decision, loan growth, deposit growth, and forex reserves — all critical for domestic liquidity.

| Stock | Closing Price | Day Change % |

|---|---|---|

| HDFC Bank | 944.90 | -0.51% |

| Kotak Bank | 413.60 | +1.19% |

| ICICI Bank | 1,402.90 | +0.46% |

| SBI | 1,069.00 | -0.42% |

| Axis Bank | 1,327.90 | -0.20% |

| Reliance | 1,438.50 | -0.34% |

| Infosys | 1,496.30 | -1.57% |

| TCS | 2,936.10 | -1.85% |

| Adani Ent. | 2,228.00 | -0.38% |

| UltraTech | 12,730.00 | -0.34% |

Technical paragraph:

IT stocks were weak, dragging sentiment lower, while Kotak Bank and ICICI Bank showed relative strength. Overall leadership was fragmented, a sign of indecision.

Fundamental paragraph:

No company earnings or guidance updates were visible. Price action appeared flow-driven.

Economic announcements paragraph:

Broader banking sentiment hinged on RBI’s evening policy decision rather than company-specific events.

| Category | Net Flow |

|---|---|

| FII Cash Market | -2,150.51 |

| DII Cash Market | +1,129.82 |

| FII Index Futures | +538.16 |

| FII Index Options | +9,409.50 |

| FII Stock Futures | -2,520.63 |

| FII Stock Options | -545.66 |

Technical paragraph:

The extreme skew toward index options buying signals heavy hedging rather than bullish positioning. Selling in cash and stock futures reflects caution.

Fundamental paragraph:

Institutional behavior suggests expectations of volatility rather than confidence in earnings or growth.

Economic announcements paragraph:

Flows were likely shaped by anticipation of RBI policy and US inflation expectations later in the day.

| Time | Country | Event | Actual | Forecast | Previous | Market Impact |

|---|---|---|---|---|---|---|

| 03:00 | USA | Fed Balance Sheet | 6.61T | Not shown | 6.59T | Neutral |

| 10:00 | India | Cash Reserve Ratio | Pending | N/A | N/A | High |

| 10:00 | India | RBI Interest Rate | Pending | 5.25% | 5.25% | High |

| 17:00 | India | Bank Loan Growth YoY | Pending | N/A | 13.1 | Medium |

| 17:00 | India | Deposit Growth YoY | Pending | N/A | 10.6 | Medium |

| 17:00 | India | Forex Reserves | Pending | N/A | 709.41 | INR sensitive |

| 19:00 | USA | Used Car Prices MoM | Pending | N/A | 0.1 | Inflation signal |

| 20:30 | USA | Michigan 5Y Inflation | Pending | N/A | 3.3% | Bond sensitive |

| 22:30 | USA | Fed Jefferson Speech | Pending | N/A | N/A | High |

Technical paragraph:

Markets were positioned defensively ahead of multiple data releases, limiting breakout potential.

Fundamental paragraph:

The RBI decision represented the most significant domestic macro risk for India.

Economic announcements paragraph:

US sentiment and inflation expectations were key for global risk assets.

Rising VIX alongside flat DXY suggests volatility was internally driven by equity positioning rather than currency stress. Commodity weakness in gold and silver contradicted traditional risk-off behavior, implying liquidation rather than flight-to-safety.

Equity-crypto divergence indicated that digital assets were acting as speculative beta rather than macro hedges. Yen strength supported the view of cautious global risk sentiment.

Overall liquidity conditions appeared tighter, with FIIs reducing equity exposure and increasing derivative hedges.

The market environment on 6 February 2026 was defensive, data-driven, and volatility-prone. Traders should prioritize risk management over directional bets.

Key takeaways:

Position sizing guidance:

Technical Analysis: Most major global indices are testing primary support levels. The Nasdaq 100 is showing a “Bullish Divergence” on the hourly chart despite broader market weakness, while the HSI and XJO have entered a short-term bearish channel after breaching their 50-day EMAs. The VIX breakout past 21 suggests a volatility expansion phase that typically precedes deeper price discovery.

Fundamental Analysis: The market is currently grappling with a hawkish tilt in central bank rhetoric. The Fed Balance Sheet has expanded slightly to 6.61T, but Michigan Inflation Expectations remain elevated at 4%, limiting the potential for a “Dovish” pivot. Institutional capital is rewarding “Fiscal Prudence,” as seen in the resilience of the Indian markets following a disciplined Union Budget and the Indo-US trade deal.

Economic Data & Announcements: Today’s primary focus is the Michigan Consumer Sentiment (Forecast: 55) and Inflation Expectations (Prev: 4%). Any upside surprise in inflation expectations will likely trigger further selling in high-duration tech stocks. Meanwhile, in India, the market is pricing in a “Neutral” stance from the RBI Interest Rate Decision (Consensus: 5.25%).

Risk Management: Reduce position sizes by 50% given the high VIX levels. The primary takeaway is Strategic Realignment: India and Gold are emerging as safety anchors in a volatile Dollar-dominant environment. Maintain a “Fortress USD” cash position for crypto until Dollar stabilization is confirmed.

Legal Disclaimer & Liability Waiver

This AI-generated report is strictly educational and does not constitute financial, legal, or professional advice. aiTrendview and its affiliates are not SEBI-registered advisors and assume zero liability for any losses or consequences resulting from its use. All data is autonomously harvested from public sources and may be flawed, delayed, or incomplete; therefore, you assume exclusive responsibility for independently verifying information before taking any action. Under no circumstances should this content be construed as a recommendation to trade or speculate in any security. By accessing this material, you acknowledge that any reliance on this data is at your sole risk, and you agree to be bound by strict intellectual property protections prohibiting the unauthorized redistribution or modification of this work.

© Copyright 2025. All Rights Reserved By aiTrendview.com a AQJ TRADERS Product

1) or fractional share

Investing in the stock markets carries risk: the value of investments can go up as well as down and you may receive back less than your original investment. Individual investors should make their own decisions or seek independent advice.