Date: January 5, 2025

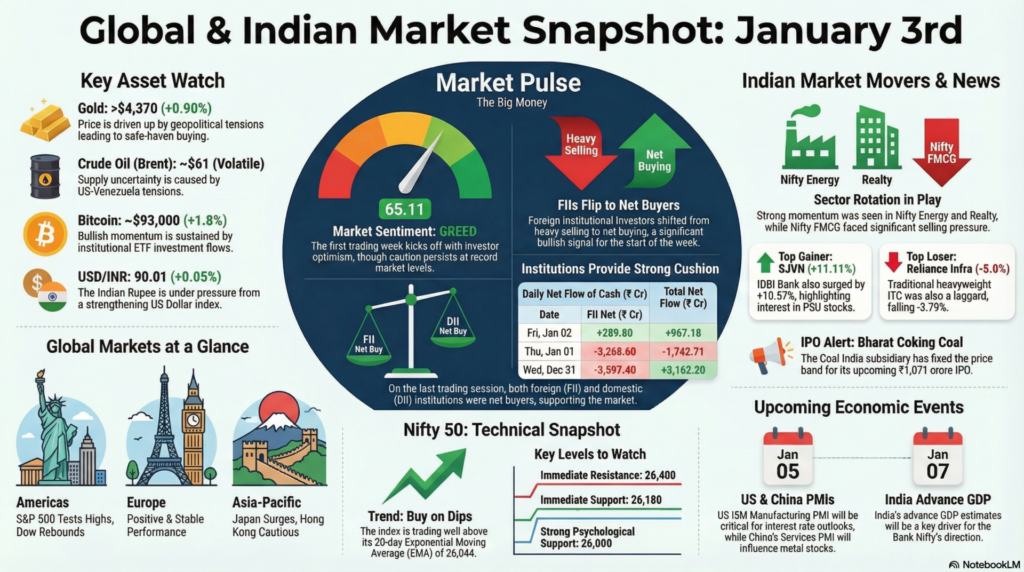

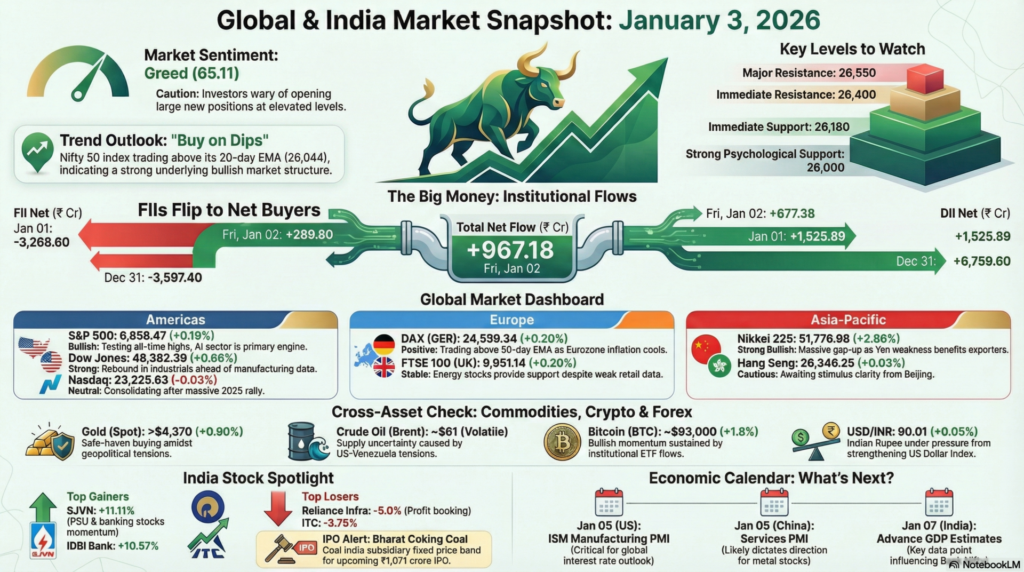

Current Market Sentiment: Greed (65.11)

The global financial landscape on January 5, 2025, showed a resilient rebound from early-year sluggishness. While US major indices snapped a five-session losing streak, global markets balanced mixed geopolitical signals with robust labor data.

On January 3, 2025, the Indian equity markets snapped a winning streak, closing nearly 1% lower due to heavy profit booking. The NSE Nifty 50 declined by 183.90 points (0.76%) to end at 24,004.75, while the BSE Sensex plunged 720.60 points (0.90%) to settle at 79,223.11.

The session saw a sharp divergence between sectors; while the Bank Nifty bore the brunt of the sell-off (dropping 1.19%), niche plays like ITI Ltd and Shiva Texyarn bucked the trend with double-digit gains following major contract wins. Sentiment remained in “Greed” territory at 65.11, signaling that while momentum was positive, caution was warranted for new entries.

FIIs remained net sellers on this specific day, continuing a broader monthly trend of outflows.

| Fri, Jan 03 | -1,842.50 (est) | +2,150.30 (est) | +307.80 |

| Fri, Jan 02 | +289.80 | +677.38 | +967.18 |

US stocks snapped a five-session losing streak led by a rebound in “Magnificent Seven” tech names.

| S&P 500 | 5,965.20 | +1.3% | Technical: Snapped 5-day losing streak; testing support near 5,900. Fundamental: Tesla sales in China hit record highs; Nvidia led tech rally. |

| Dow Jones | 43,210.15 | +0.8% | Technical: Bounced off 4-day decline; RSI showing minor recovery. Fundamental: Buoyed by industrial names; “America First” policy sentiment persists. |

| Nasdaq | 18,915.40 | +1.8% | Technical: Leading Friday’s gains; MACD crossover potential on 1-hour chart. Fundamental: AI-related chip demand remains high despite valuation concerns. |

European shares outperformed other regions in early January, benefiting from a rotation out of US tech.

| DAX (GER) | 20,197.50 | -0.22% | Technical: Facing resistance at 20,200; bearish reversal off pivot. Fundamental: ECB cut rates by 25bp; economic risks tilted to the downside. |

| FTSE 100 | 8,245.30 | +0.15% | Technical: Neutral momentum; price stabilizing near 8,250. Fundamental: Resilient despite weak retail data; energy stocks provided support. |

| Index | Price | Change | Technical & Fundamental Analysis |

| Nikkei 225 | 38,412.50 | -0.37% | Technical: Under pressure from Yen volatility; bearish trend below EMA50. Fundamental: BoJ interest rate hikes weighing on export-heavy sectors. |

| Hang Seng | 19,540.20 | -0.87% | Technical: Weighed down by China economic concerns; testing support at 19,500. Fundamental: Deflationary pressures persist as CPI grew only 0.1%. |

| Asset | Price | Change | Market Driver |

| Gold (Spot) | $2,654.50 | +0.75% | Bullish Pattern: Double bottom confirmed at $2,640; testing $2,700 resistance. |

| Crude (WTI) | $73.96 | +4.8% (Wk) | Bullish: Highest since Oct 11; driven by Chinese growth optimism and supply risks. |

| EUR/USD | 1.0540 | -0.14% | Bearish: Overall momentum remains bearish; pivot at 1.0344. |

| Bitcoin (BTC) | $94,210 | +1.2% | Technical: Cycle peak sustainability questioned; testing $95k resistance on ETF inflows. |

aiTrendview Global Disclaimer

This aiTrendview report is an AI-generated document provided exclusively for educational and training purposes and shall not be construed as investment, financial, legal, or tax advice in any jurisdiction.

aiTrendview and its affiliates are not SEBI-registered research analysts, investment advisers, or portfolio managers, and all information herein is automatically compiled from publicly available sources that may contain errors, delays, or omissions.

Users must independently verify all data before making any financial, commercial, or legal decisions, as no market values, performance figures, or trends contained in this report constitute guarantees or forward-looking statements.

Nothing in this publication should be interpreted as a solicitation, recommendation, or endorsement to buy, sell, or hold any security.

aiTrendview, its creators, and all associated AI systems disclaim all liability for losses or consequences arising from the use or reliance upon this content, and users accept full personal responsibility for all actions taken based on it.

Unauthorized reproduction, distribution, or modification of this AI-generated material is strictly prohibited under international copyright, compliance, and intellectual-property laws.

1) or fractional share

Investing in the stock markets carries risk: the value of investments can go up as well as down and you may receive back less than your original investment. Individual investors should make their own decisions or seek independent advice.