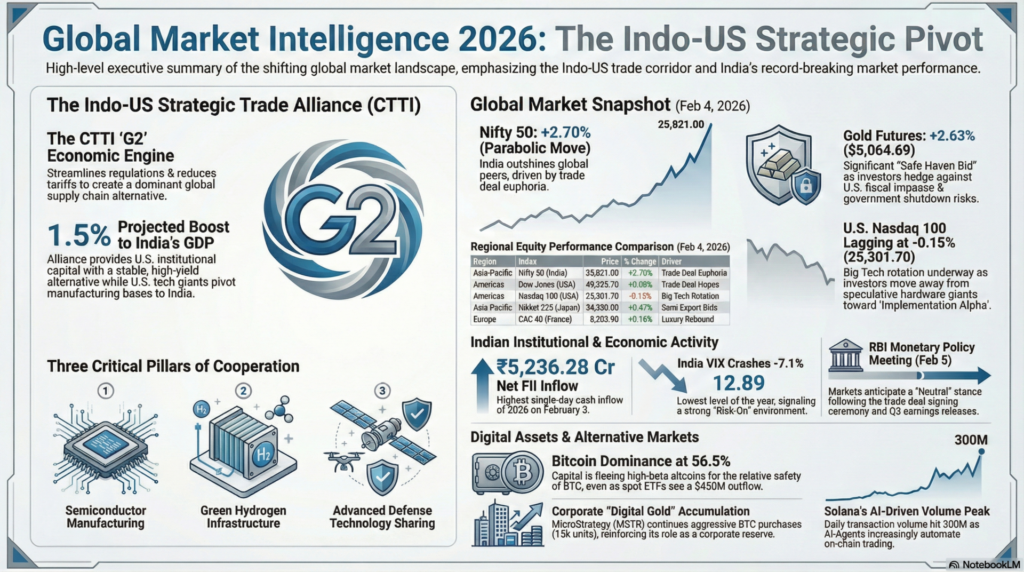

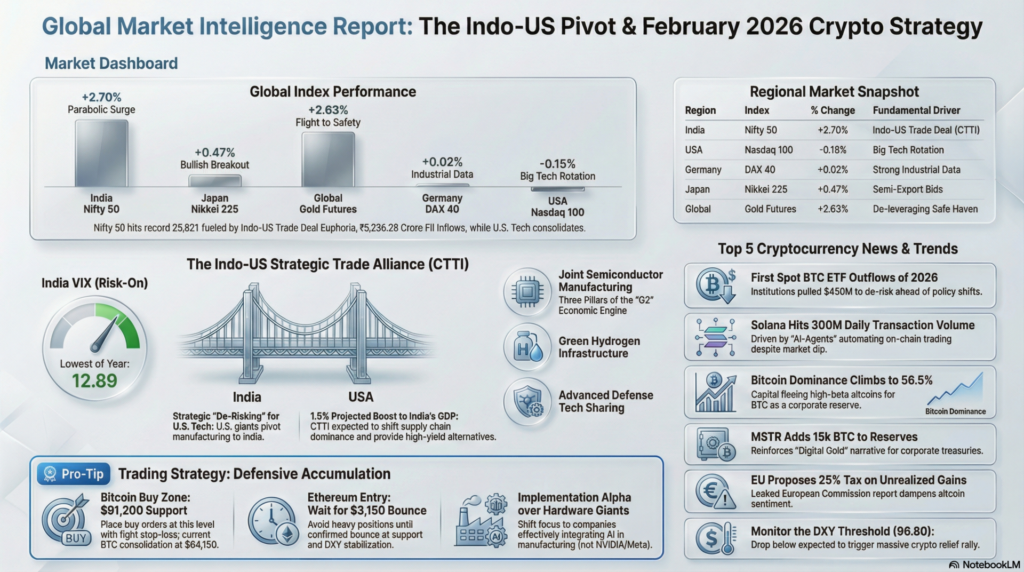

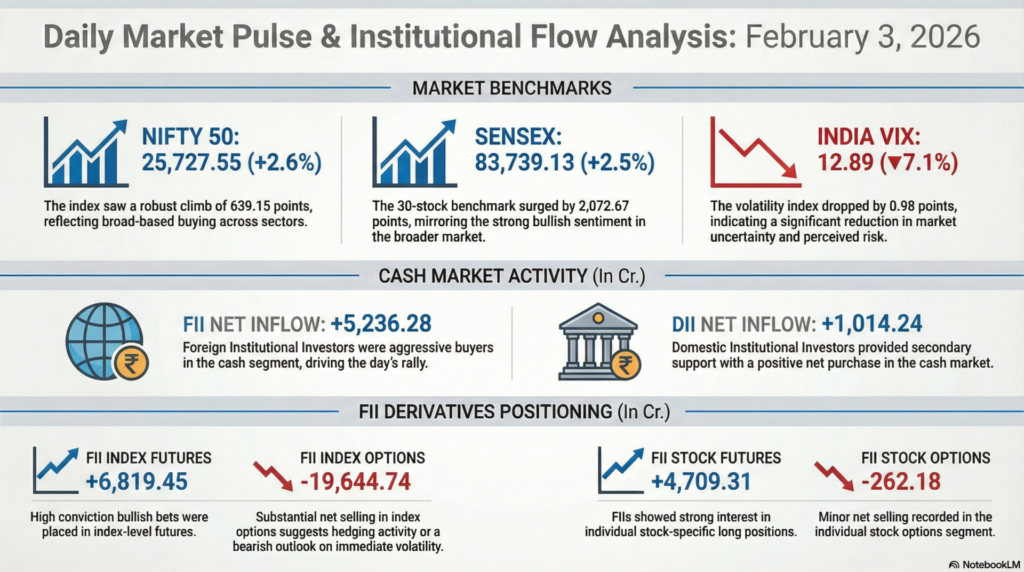

As of February 4, 2026, the financial markets are navigating a significant structural shift, primarily driven by the strengthening economic corridor between the United States and India. While U.S. technology futures are showing slight consolidation after a period of intense growth, the Indian markets have entered a parabolic phase, with the Nifty 50 surging +2.70% to a record 25,821. This divergence reflects a strategic reallocation of global capital into “high-growth fiscal oases” as Western investors hedge against domestic policy shifts and a brief government shutdown.

Market Reaction: We anticipate a “High-Volatility Bullish” trend for the Indian market, sustained by record-breaking DII and FII inflows. Globally, the VIX at 18.00 suggests moderate risk, but the flight to safety is currently favoring Gold and the Indo-US trade narrative over traditional tech-heavy growth. For the remainder of the week, expect the Indian market to outperform its global peers, while U.S. markets likely consolidate around the 6,900 level for the S&P 500 as investors await clarity on the Federal Reserve’s next move under the new leadership transition.

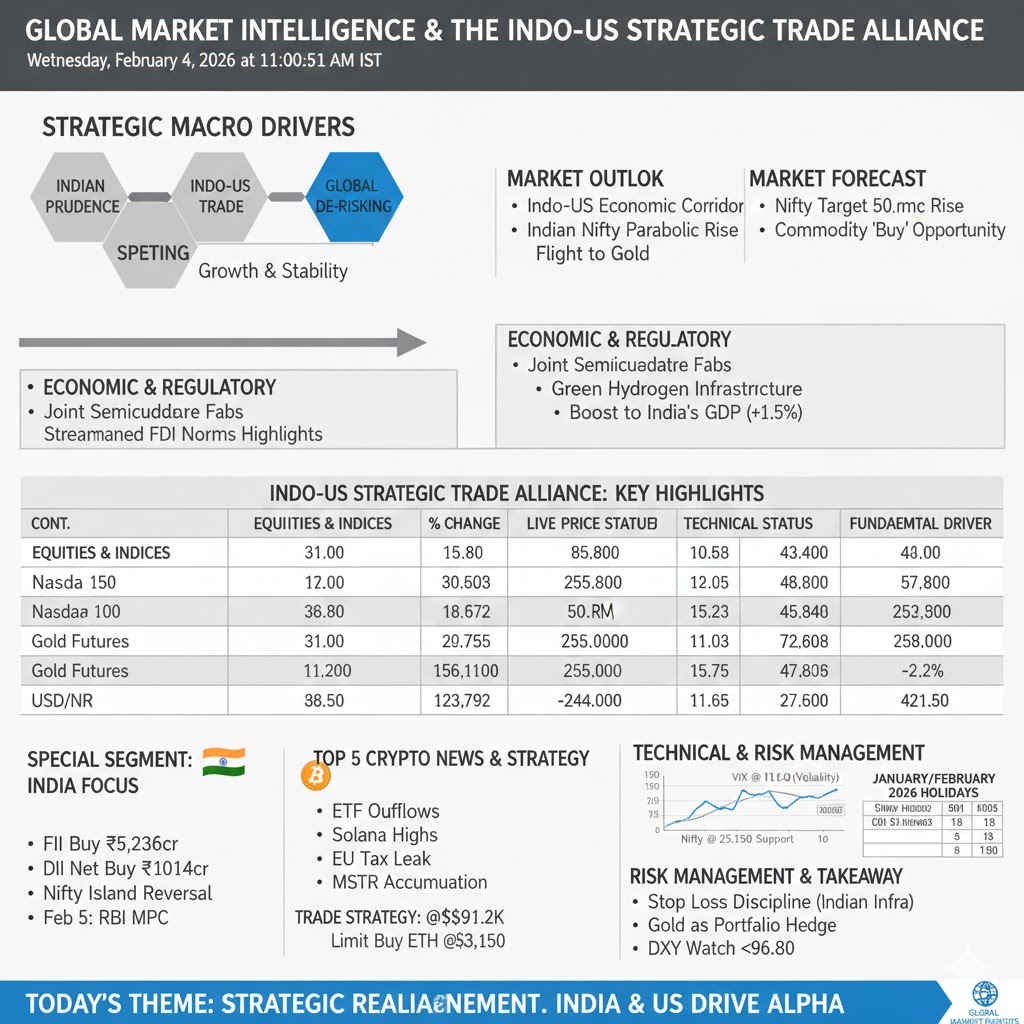

The recently announced Indo-US Comprehensive Trade & Technology Initiative (CTTI) marks a historic turning point in bilateral relations. This deal focuses on three critical pillars: joint semiconductor manufacturing, green hydrogen infrastructure, and advanced defense technology sharing. By streamlining regulatory hurdles and reducing tariffs on high-tech exports, the deal effectively creates a “G2” economic engine that challenges existing global supply chain dominance.

For market participants, this alliance is the ultimate “De-Risking” tool. U.S. tech giants are now aggressively pivoting their manufacturing bases to India, while Indian IT and pharmaceutical firms are gaining unprecedented access to the American consumer market. This synergy is not just a diplomatic victory; it is a fundamental shift that is expected to add an estimated 1.5% to India’s GDP and provide a stable, high-yield alternative for American institutional capital during periods of domestic volatility.

| Continent | Index / Exchange | Live/Futures Price | % Change | Technical Status | Fundamental Driver |

| Americas | Dow Jones (USA) | 49,285.70 | +0.09% | Testing 50-DMA | Trade Deal Hopes |

| S&P 500 (USA) | 6,918.00 | 0.00% | Consolidation | Yield Stability | |

| Nasdaq 100 (USA) | 25,301.70 | -0.15% | Below 10-EMA | Big Tech Rotation | |

| Europe | FTSE 100 (UK) | 10,290.00 | +0.11% | Key Support Held | Energy Bids |

| DAX 40 (Germany) | 24,867.00 | +0.02% | Rangebound | Industrial Data | |

| CAC 40 (France) | 8,203.90 | +0.16% | Bullish Pivot | Luxury Rebound | |

| Asia-Pacific | Nikkei 225 (Japan) | 54,380.00 | +0.47% | Bullish Breakout | Semi-Export Bids |

| Hang Seng (HK) | 26,701.50 | +0.34% | Testing Resistance | China Stimulus | |

| Nifty 50 (India) | 25,821.00 | +2.70% | Parabolic Move | Trade Deal Euphoria |

| Asset Class | Instrument | Live Price | % Change | Technical View |

| Crypto | Bitcoin (BTC) | $94,150.00 | +0.80% | Consolidating at $94k |

| Forex | Dollar Index | 97.28 | -0.02% | Topping Out |

| USD/INR | 89.12 | -0.45% | Rupee Strength | |

| Commodities | Gold Futures | $5,064.69 | +2.63% | Safe Haven Bid |

| Brent Crude | $67.67 | +0.50% | Sideways |

Institutional Activity (Feb 3 – Closing Report):

Economic Calendar (India Focus):

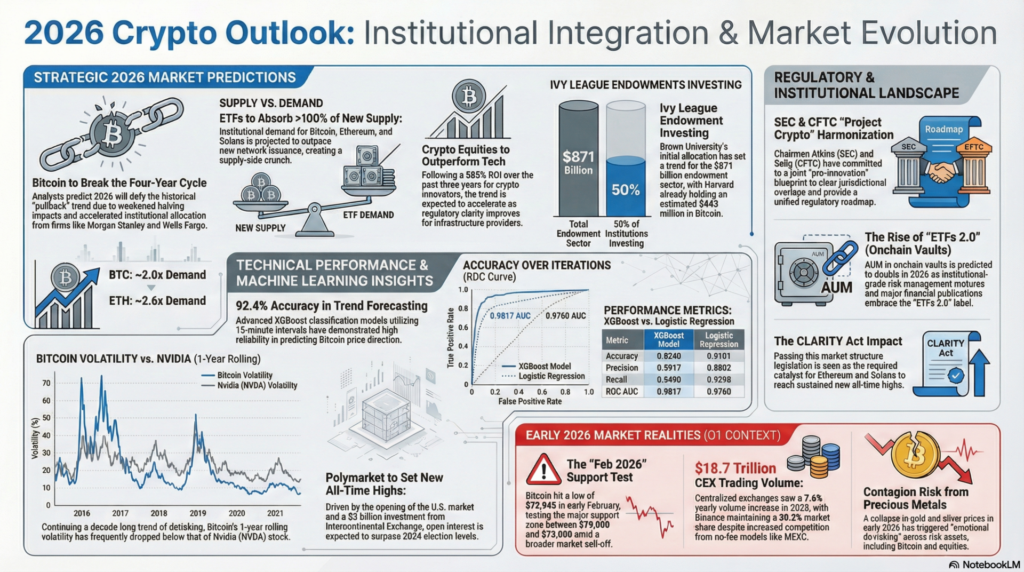

How to Trade Crypto Today:

The strategy today is “Defensive Accumulation.” Avoid high-leverage longs. For Bitcoin, place buy orders at the $91,200 support level with a tight stop-loss. For Ethereum, wait for a confirmed bounce at the $3,150 mark. Tip: In a high-DXY environment, crypto typically faces pressure; wait for Dollar stabilization before entering heavy positions.

The market is currently witnessing a “De-leveraging and Asset Rotation” phenomenon. The surge in Gold (+2.63%) alongside the Nifty breakout suggests that institutional desks are moving away from speculative US tech and into tangible growth (India) and tangible safety (Gold). This “dual-track” strategy is a direct response to the Federal Reserve’s transition and the U.S. fiscal impasse.

Furthermore, the “AI-Metaverse Convergence” is reaching a tipping point. While the hardware giants (NVIDIA, Meta) are consolidating, the focus is shifting to “Implementation Alpha.” Companies that are effectively integrating AI into manufacturing and logistics are seeing their P/E ratios expand, while traditional “AI-Obsolete” firms are being aggressively sold. This is why the Nasdaq is lagging while industrials remain resilient.

Lastly, the “Global Fiscal Pivot” is now in full swing. Investors are no longer rewarding growth for growth’s sake. They are demanding “Fiscal Prudence,” as seen in the positive reception of the Indian Budget. Any country that fails to show a clear path to debt reduction while maintaining infrastructure ROI is seeing its currency punished, while the Rupee’s strength (89.12) highlights the market’s confidence in India’s fiscal management.

How to View the Global Markets Today:

The market is in an “Institutional Calibration” phase. The violence of the commodity sell-off has ended, and we are now seeing a “Flight to Quality” that favors India and Gold. Do not fight the trend; the Indo-US trade narrative is the primary driver of alpha for February.

Risk Management Analysis:

Important Takeaway:

The theme of February 4 is “Strategic Realignment.” India has emerged as the global growth engine, while the U.S. navigates its policy transition. Stay long on “Trade-Beneficiary” sectors and maintain a defensive “Fortress USD” cash position for the crypto market.

Legal Disclaimer & Liability Waiver

This AI-generated report is strictly educational and does not constitute financial, legal, or professional advice. aiTrendview and its affiliates are not SEBI-registered advisors and assume zero liability for any losses or consequences resulting from its use. All data is autonomously harvested from public sources and may be flawed, delayed, or incomplete; therefore, you assume exclusive responsibility for independently verifying information before taking any action. Under no circumstances should this content be construed as a recommendation to trade or speculate in any security. By accessing this material, you acknowledge that any reliance on this data is at your sole risk, and you agree to be bound by strict intellectual property protections prohibiting the unauthorized redistribution or modification of this work.

© Copyright 2025. All Rights Reserved By aiTrendview.com a AQJ TRADERS Product

1) or fractional share

Investing in the stock markets carries risk: the value of investments can go up as well as down and you may receive back less than your original investment. Individual investors should make their own decisions or seek independent advice.