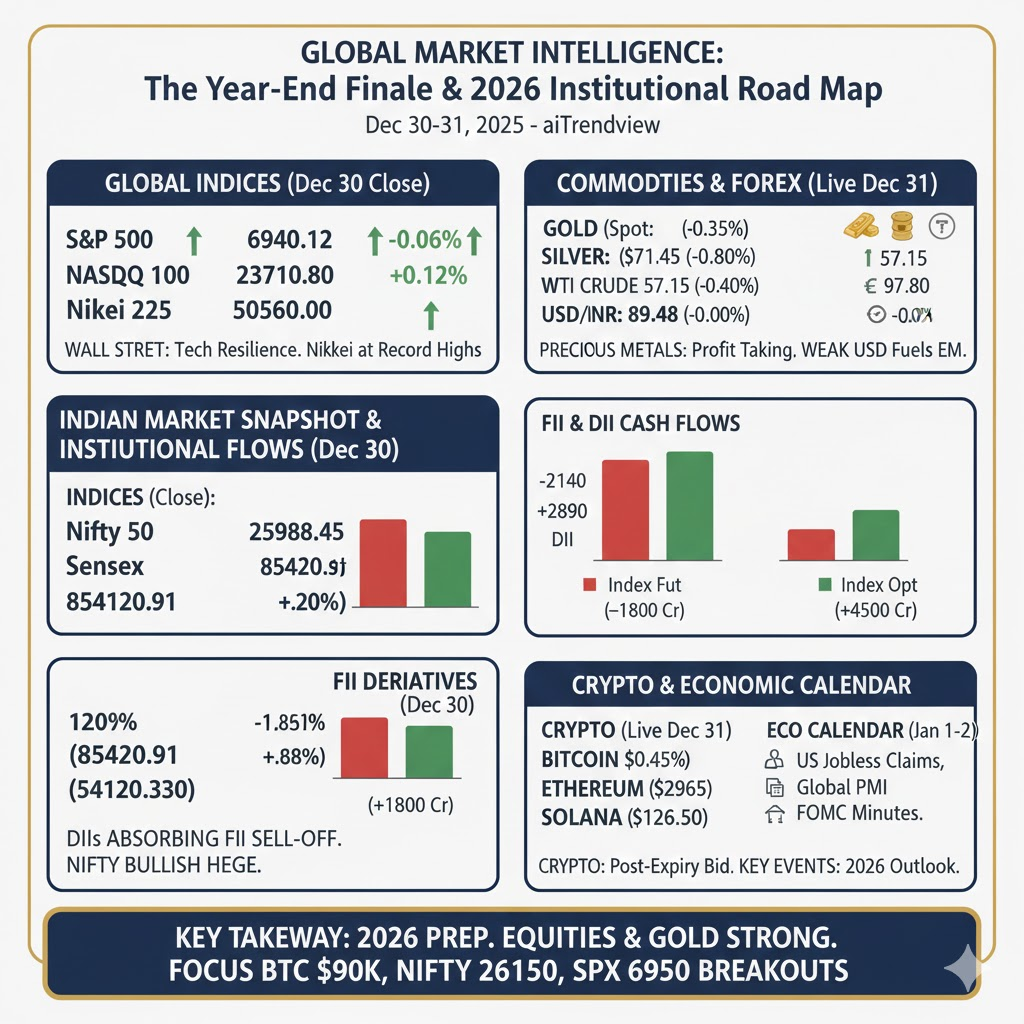

As we enter the final 24 hours of 2025, the global financial landscape is characterized by “Strategic Consolidation.” The trading session on December 30, 2025, saw major indices holding near record highs as institutional desks completed their year-end “window dressing.” Investors are transitioning from a year dominated by the AI infrastructure build-out to a 2026 outlook focused on sovereign debt management and the broader adoption of digital assets.

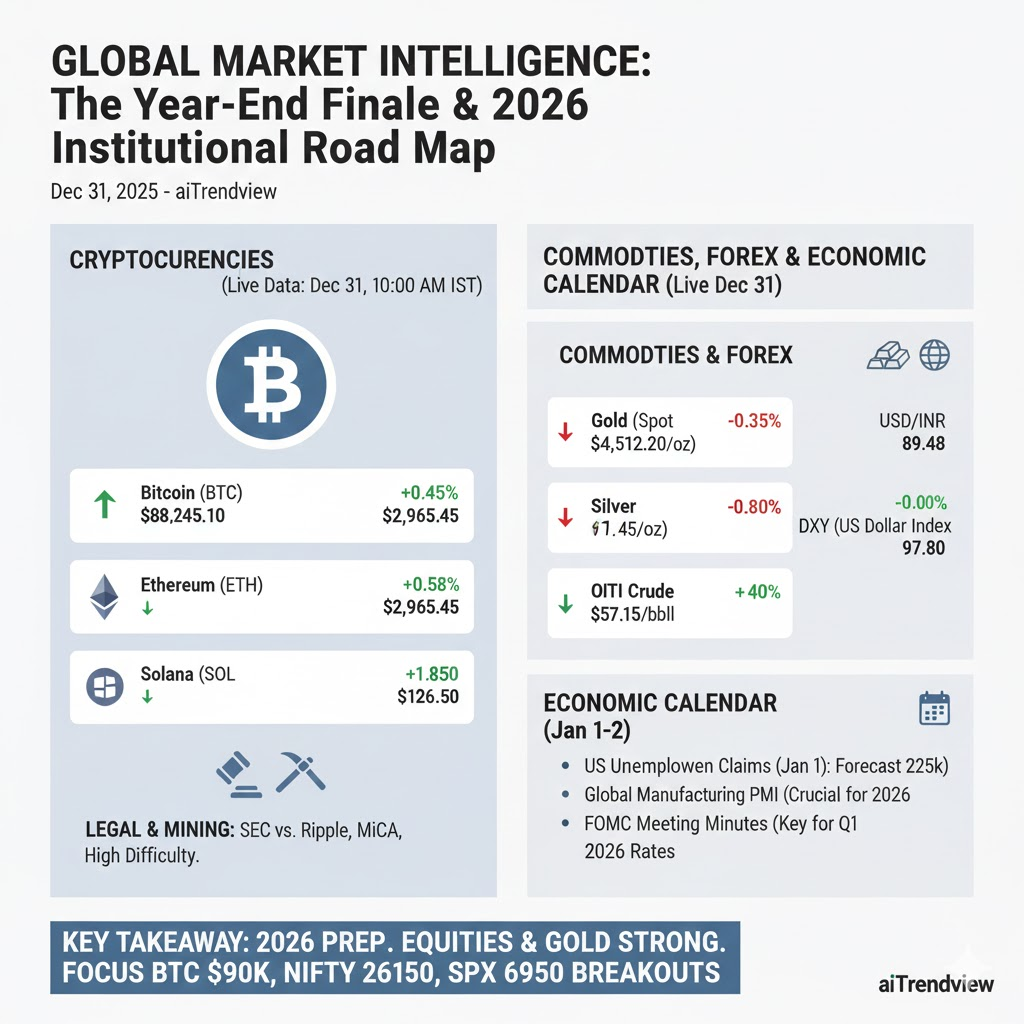

While Wall Street saw minor profit-taking in the final hour, the underlying breadth remains bullish. The US Dollar Index (DXY) continues its descent, currently testing the 97.80 support, which has historically acted as a springboard for Emerging Markets and Commodities. Today’s report breaks down the final closing data of the penultimate session and provides a live pulse of the crypto and forex markets heading into the New Year.

| Index | Closing Value | Day Change | Performance |

| Dow Jones (DJI) | 48,812.45 | -0.02% | Consolidation |

| S&P 500 (SPX) | 6,940.12 | -0.06% | Near Record High |

| NASDAQ 100 (NDX) | 23,710.80 | -0.01% | Tech Resilient |

| Nikkei 225 (Japan) | 50,560.00 | +0.12% | Record Levels |

| DAX 40 (Germany) | 24,302.10 | -0.04% | Euro-Stability |

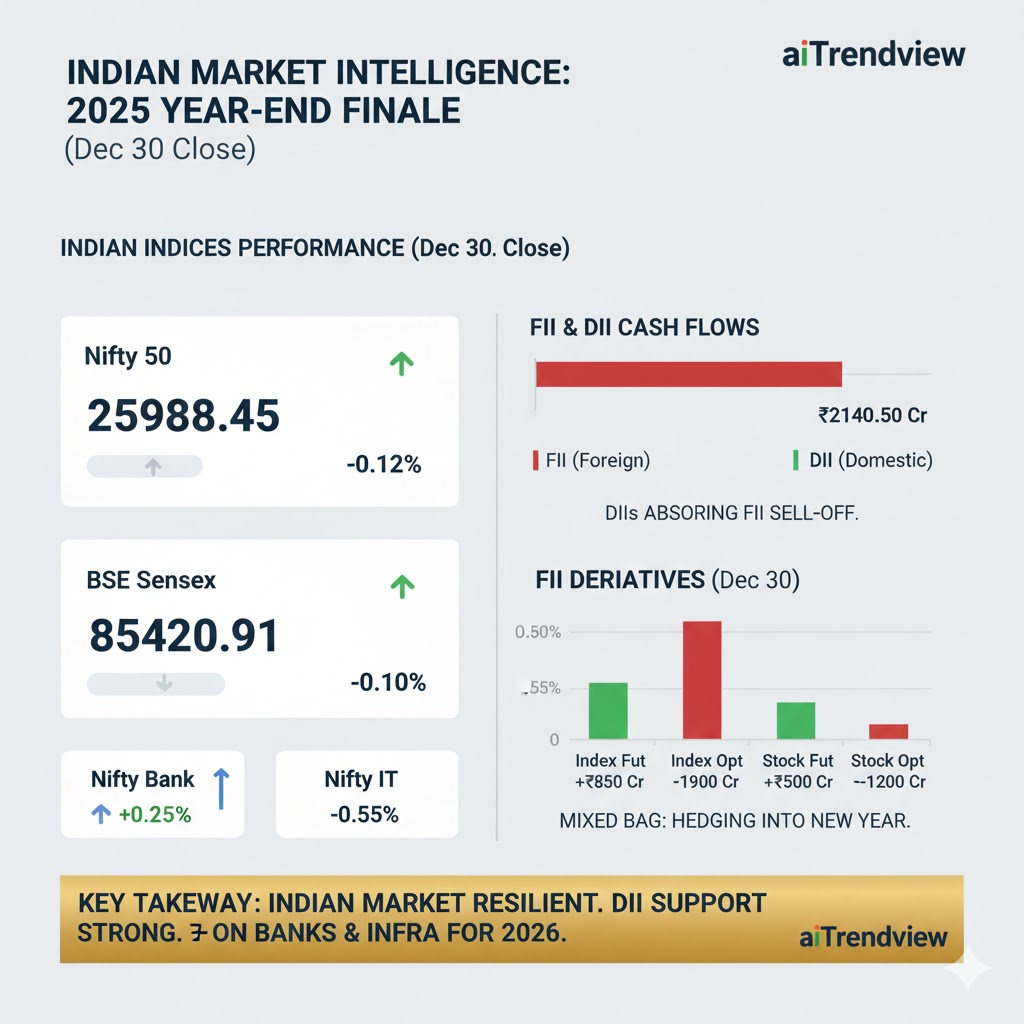

The Indian markets on Dec 30 witnessed extreme volatility in the final hour of trade as the Dec F&O expiry looms. While the Nifty 50 struggled to hold the 26,000 mark, the Midcap sector saw a sharp 0.8% bounce, indicating “bottom fishing” by domestic funds.

| Index | Closing Value | Change (%) | Status |

| Nifty 50 | 25,988.45 | -0.12% | Testing 26k |

| BSE Sensex | 85,420.91 | -0.10% | Consolidating |

| Nifty Bank | 54,120.30 | +0.25% | Outperforming |

| Nifty IT | 44,150.75 | -0.55% | Profit Booking |

| Category | Net Cash (Dec 30) | Past 5-Day Trend |

| FII (Foreign) | -2,140.50 | Consistent Selling |

| DII (Domestic) | +2,890.20 | Aggressive Buying |

| Asset | Live Price (USD) | 24h Change | Sentiment |

| Bitcoin (BTC) | $88,245.10 | +0.45% | Accumulation |

| Ethereum (ETH) | $2,965.45 | +0.58% | Testing $3k |

| Solana (SOL) | $126.50 | +1.85% | Bullish Momentum |

| XRP | $1.89 | +0.92% | Rangebound |

As we transition into 2026, the market message is clear: Equities remain the preferred asset class, backed by AI growth and domestic Indian liquidity. However, the parabolic rise in Gold and Silver suggests that smart money is hedging against sovereign debt risks. For the final session of 2025, expect low-volume “painting of the tape” as fund managers aim for a high-water mark close.

Key Pivot Levels for tomorrow:

aiTrendview Global Disclaimer

This aiTrendview report is an AI-generated document provided exclusively for educational and training purposes and shall not be construed as investment, financial, legal, or tax advice in any jurisdiction.

aiTrendview and its affiliates are not SEBI-registered research analysts, investment advisers, or portfolio managers, and all information herein is automatically compiled from publicly available sources that may contain errors, delays, or omissions.

Users must independently verify all data before making any financial, commercial, or legal decisions, as no market values, performance figures, or trends contained in this report constitute guarantees or forward-looking statements.

Nothing in this publication should be interpreted as a solicitation, recommendation, or endorsement to buy, sell, or hold any security.

aiTrendview, its creators, and all associated AI systems disclaim all liability for losses or consequences arising from the use or reliance upon this content, and users accept full personal responsibility for all actions taken based on it.

Unauthorized reproduction, distribution, or modification of this AI-generated material is strictly prohibited under international copyright, compliance, and intellectual-property laws.

1) or fractional share

Investing in the stock markets carries risk: the value of investments can go up as well as down and you may receive back less than your original investment. Individual investors should make their own decisions or seek independent advice.