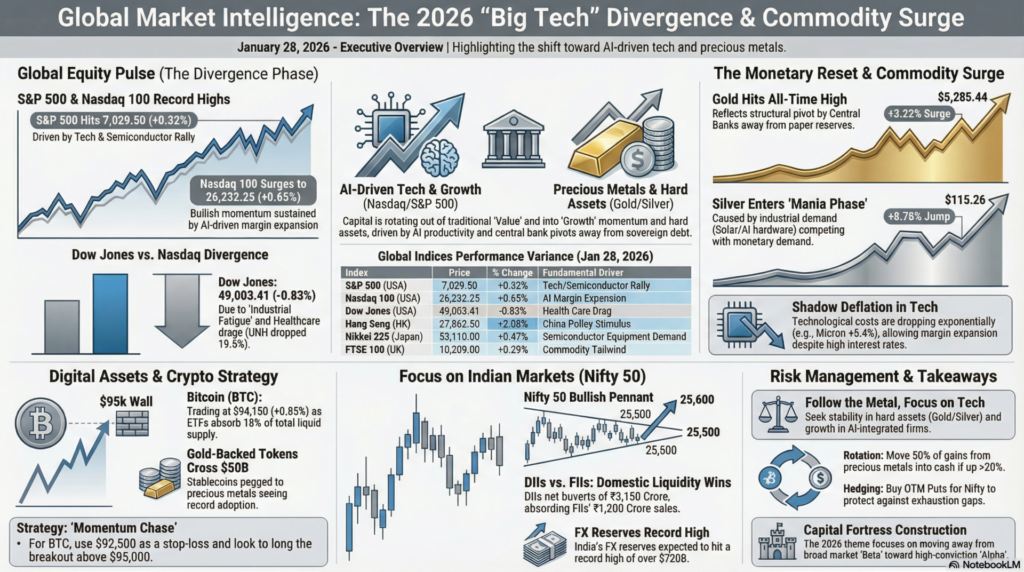

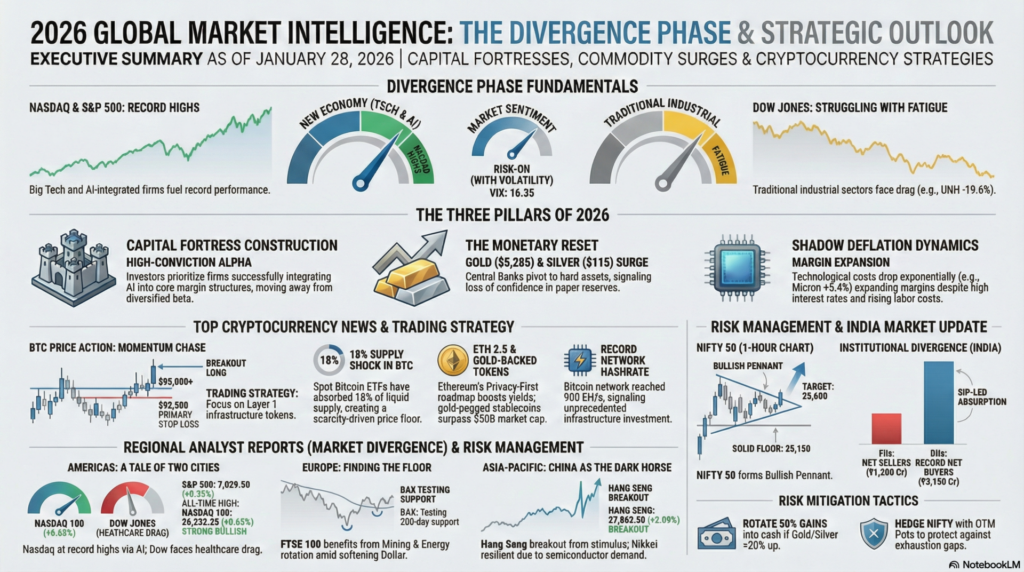

As of January 28, 2026, the global financial landscape is witnessing a profound “Divergence Phase.” While the Dow Jones struggles with industrial fatigue, the Nasdaq and S&P 500 are surging to record highs, fueled by a dual-engine of Big Tech earnings and AI-driven productivity gains. This “Risk-On” equity sentiment is being matched by an extraordinary breakout in Precious Metals, with Gold ($5,285) and Silver ($115) hitting monumental all-time highs as Central Banks accelerate their diversification away from sovereign debt.

Market Reaction: We expect a “Hyper-Selective” market reaction for the remainder of the week. The massive 19.6% drop in UnitedHealth (UNH) vs. the 5.4% rally in Micron (MU) signals that “Value” sectors are being sacrificed to fund “Growth” momentum. For the Indian markets, the sentiment is overwhelmingly positive following the post-holiday reopening, with the Nifty likely to test the 25,500 resistance zone. Investors should brace for increased volatility as the VIX creeps up to 16.35, suggesting that even while markets rise, the “cost of insurance” is increasing ahead of critical macro announcements.

| Continent | Index / Exchange | Live/Futures Price | % Change | Technical Status | Fundamental Driver |

| Americas | Dow Jones (USA) | 49,003.41 | -0.83% | Testing 50-DMA | Health Care Drag |

| S&P 500 (USA) | 7,029.50 | +0.32% | All-Time High | Tech/Semi Rally | |

| Nasdaq 100 (USA) | 26,232.25 | +0.65% | Strong Bullish | AI Margin Expansion | |

| Europe | FTSE 100 (UK) | 10,209.00 | +0.29% | Support Held | Commodity Tailwind |

| DAX 40 (Germany) | 25,011.00 | +0.01% | Sideways | Industrial Recovery | |

| CAC 40 (France) | 8,151.60 | +0.14% | Consolidation | Luxury Resilience | |

| Asia-Pacific | Nikkei 225 (Japan) | 53,110.00 | +0.47% | Mean Reversion | Tech Exports |

| Hang Seng (HK) | 27,862.50 | +2.08% | Breakout | China Policy Boost | |

| Nifty 50 (India) | 25,397.90 | +0.06% | Consolidating | DII Liquidity |

| Asset Class | Instrument | Live Price | % Change | Technical View |

| Crypto | Bitcoin (BTC) | $94,150.00 | +0.85% | Testing $95k Wall |

| Ethereum (ETH) | $3,340.20 | +1.10% | Bullish Breakout | |

| Forex | Dollar Index | 95.96 | -0.09% | Bearish Trend |

| USD/INR | 89.15 | -0.12% | Rupee Strength | |

| Commodities | Gold Futures | $5,285.44 | +3.22% | Vertical Surge |

| Silver Futures | $115.26 | +8.78% | Mania Phase | |

| Brent Crude | $66.95 | +0.54% | Supply Tightness |

Institutional Activity (Jan 28 – Live Update):

Economic Calendar (India Focus):

How to Trade Crypto Today:

The market is in a “Momentum Chase” phase. For BTC, the $92,500 level is now the primary stop-loss for long positions. The strategy is to “Long the Breakout” above $95,000. For Altcoins, focus on “Infrastructure Play” tokens (Layer 1s) as they are lagging the BTC move and provide better R/R (Risk/Reward) ratios.

The narrative for 2026 has solidified around “Capital Fortress Construction.” Investors are moving away from diversified “Beta” and toward high-conviction “Alpha.” This is why we see the Dow (old economy) falling while the Nasdaq (new economy) hits record highs. The market is effectively discounting any firm that hasn’t successfully integrated AI into its core margin structure.

The “Monetary Reset” is no longer a fringe theory. With Gold surging 3.2% in a single day to nearly $5,300, Central Banks are signaling a loss of confidence in “Paper Reserves.” This is a structural pivot that will likely define the entire decade. Silver’s 8.7% jump further confirms that industrial demand (Solar/AI hardware) is competing with monetary demand, creating a parabolic “squeeze.”

Finally, “Shadow Deflation” is the secret sauce for earnings. Large tech firms like Micron (up 5.4%) are proving that while labor costs rise, technological costs are dropping exponentially. This allows for margin expansion even in a high-interest-rate environment, which is the primary reason why the “expected” market crash from high rates never fully materialized.

| Date | Country | Occasion | Market Status |

| Jan 1 | USA / India | New Year’s Day | CLOSED |

| Jan 19 | USA | Martin Luther King Jr. Day | CLOSED |

| Jan 26 | India | Republic Day | CLOSED |

How to View the Global Markets Today:

The market is in a “Hyper-Momentum” phase. Do not short a parabolic move. Instead, wait for “Mean Reversion” entries on the 4-hour timeframes.

Risk Management Analysis:

Important Takeaway:

The theme of the day is “Follow the Metal, Focus on Tech.” Stability is being found in hard assets, while growth is concentrated in AI-integrated firms. Diversify your “Fortress” and ignore the noise in traditional industrial laggards.

aiTrendview Global Disclaimer

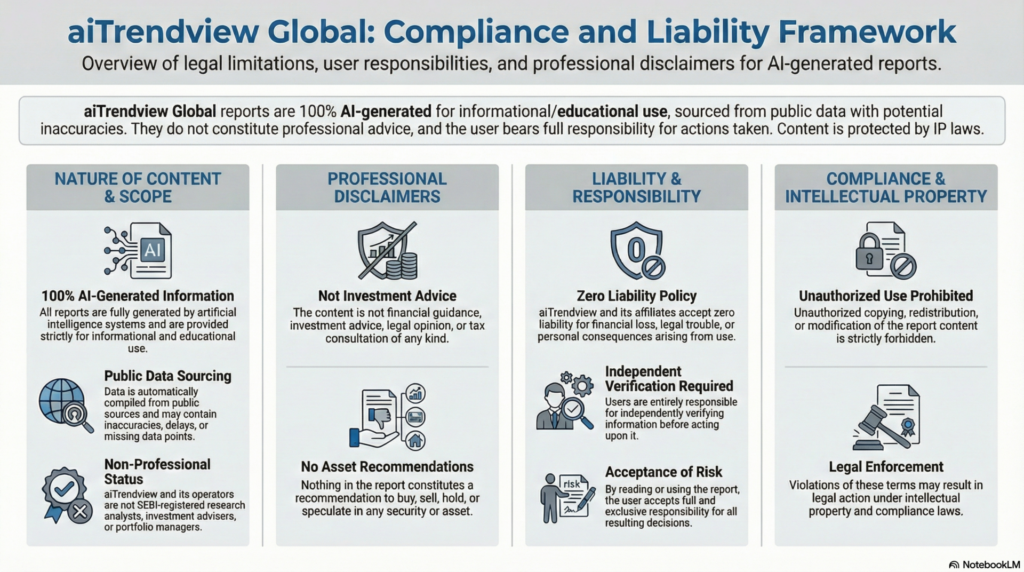

This report is fully AI-generated and is provided strictly for informational and educational use only. It is not investment advice, financial guidance, legal opinion, tax consultation, or professional recommendation of any kind. aiTrendview and its operators are not SEBI-registered research analysts, investment advisers, or portfolio managers. All data is automatically compiled from public sources that may contain inaccuracies, delays, or missing information. If you act on this content without verifying it independently, that is entirely your responsibility. Nothing in this report is a recommendation to buy, sell, hold, or speculate in any asset or security. aiTrendview, its creators, developers, affiliates, and associated AI systems accept zero liability for financial loss, legal trouble, or personal consequences arising from the use of this material. By reading or using this report, you accept full responsibility for your decisions. Unauthorized copying, redistribution, or modification of this content is prohibited and may result in legal action under intellectual property and compliance laws.

© Copyright 2025. All Rights Reserved By aiTrendview.com a AQJ TRADERS Product

1) or fractional share

Investing in the stock markets carries risk: the value of investments can go up as well as down and you may receive back less than your original investment. Individual investors should make their own decisions or seek independent advice.