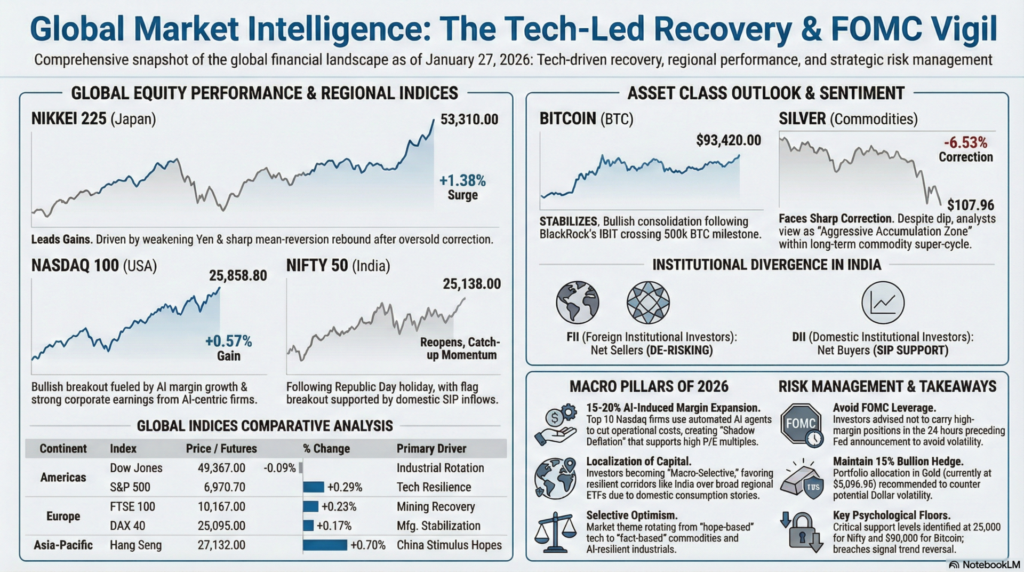

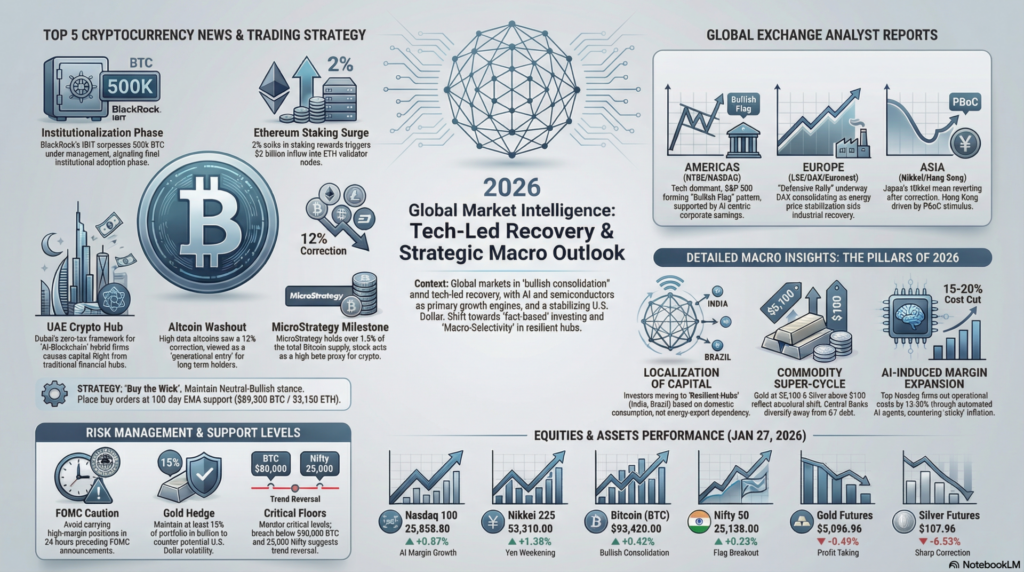

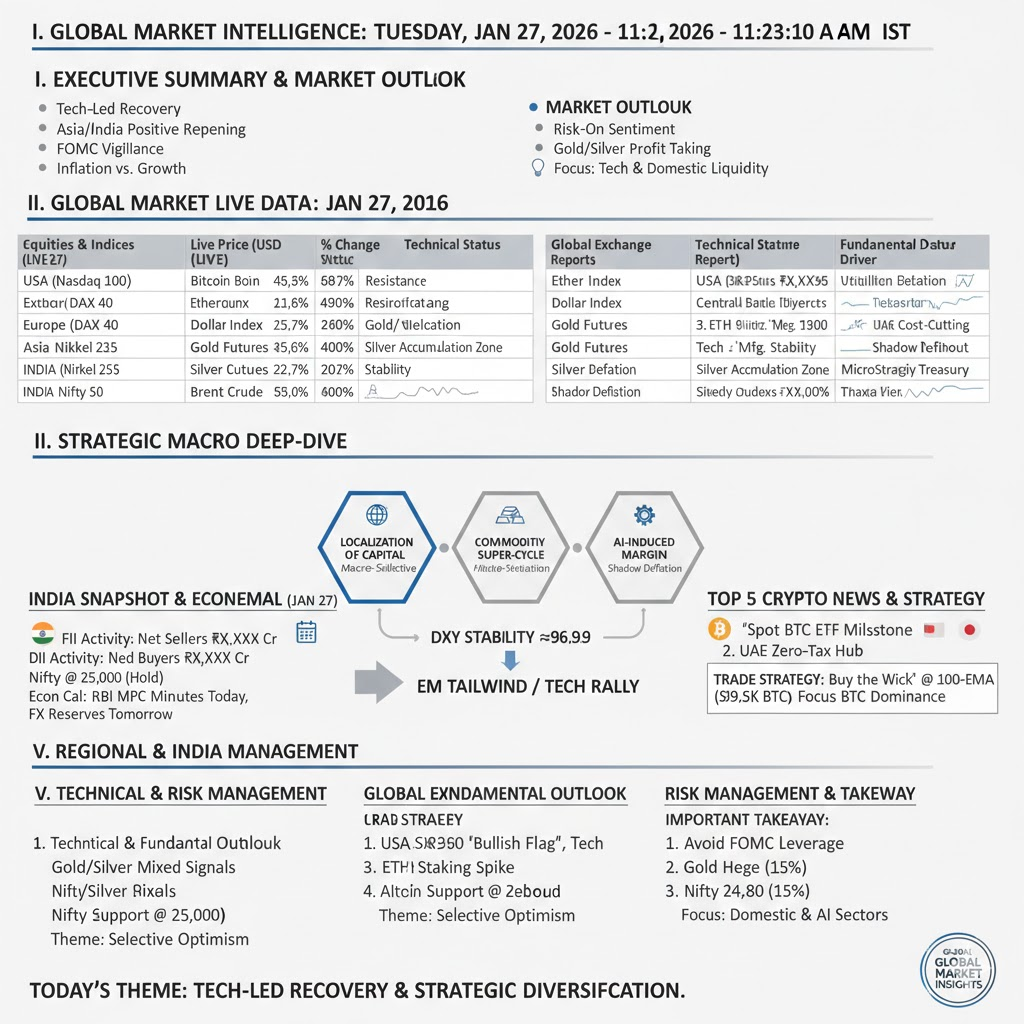

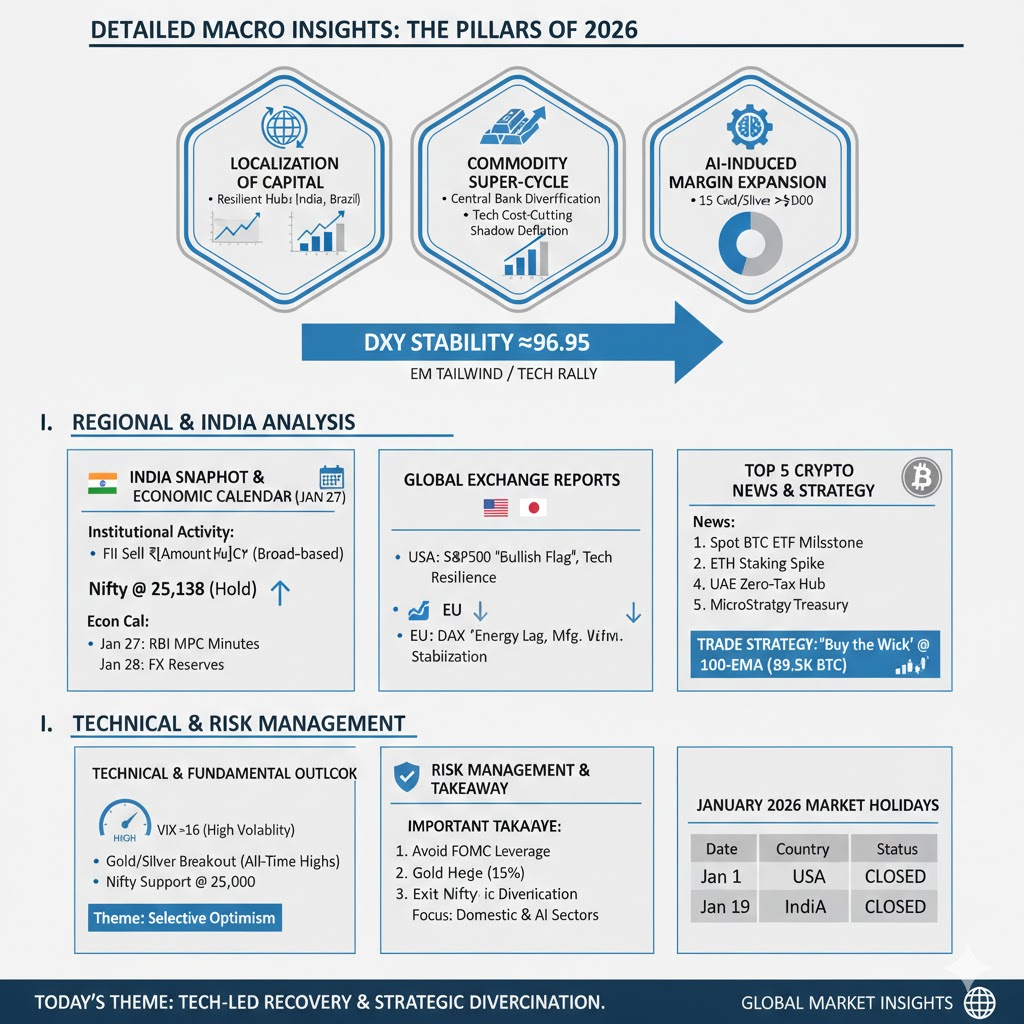

As of January 27, 2026, the global financial landscape is characterized by a “bullish consolidation” as markets digest recent volatility and position themselves for the upcoming Federal Open Market Committee (FOMC) announcements. Following a subdued session due to regional holidays, today’s activity is dominated by a sharp tech-led recovery in the U.S. and significant gains in the Asia-Pacific region. The tech sector, particularly AI and semiconductor giants, is once again acting as the primary engine for equity growth, while the U.S. Dollar Index (DXY) stabilizes near 96.95, providing a slightly more favorable backdrop for risk assets.

Market Reaction: We anticipate a “Risk-On” sentiment to persist through the mid-week session, especially in technology and growth-oriented indices. The Nikkei 225’s 1.38% surge and the Nasdaq’s 0.55% gain in futures suggest that institutional investors are “buying the dip” in tech after the recent re-rating. However, a sense of “pre-FOMC jitters” remains, with the VIX holding steady at 16.15. For Indian markets, the reopening after Republic Day is expected to be positive, with the Nifty likely to track global peers and attempt a recovery towards the 25,200 level, supported by resilient domestic liquidity.

| Continent | Index / Exchange | Live/Futures Price | % Change | Technical Status | Fundamental Driver |

| Americas | Dow Jones (USA) | 49,367.00 | -0.09% | Testing 20-DMA | Industrial Rotation |

| S&P 500 (USA) | 6,970.70 | +0.29% | Above 50-SMA | Tech Resilience | |

| Nasdaq 100 (USA) | 25,858.80 | +0.57% | Bullish Breakout | AI Margin Growth | |

| Europe | FTSE 100 (UK) | 10,167.00 | +0.23% | Strong Support | Mining Recovery |

| DAX 40 (Germany) | 25,095.00 | +0.17% | Consolidating | Mfg. Stabilization | |

| CAC 40 (France) | 8,173.80 | +0.40% | Neutral-Bullish | Luxury Sector Dip | |

| Asia-Pacific | Nikkei 225 (Japan) | 53,310.00 | +1.38% | Sharp Rebound | Yen Weakening |

| Hang Seng (HK) | 27,132.00 | +0.70% | Testing Pivot | China Stimulus Hopes | |

| Nifty 50 (India) | 25,138.00 | +0.23% | Flag Breakout | Holiday Reopening |

| Asset Class | Instrument | Live Price | % Change | Technical View |

| Crypto | Bitcoin (BTC) | $93,420.00 | +0.42% | Bullish Consolidation |

| Ethereum (ETH) | $3,225.40 | +0.15% | Resistance at 3.3k | |

| Forex | Dollar Index | 96.95 | +0.10% | Stability Near 97 |

| USD/INR | 89.22 | -0.05% | Rupee Strength | |

| EUR/USD | 1.1812 | -0.10% | Rangebound | |

| Commodities | Gold Futures | $5,096.96 | -0.49% | High Profit Taking |

| Silver Futures | $107.96 | -6.53% | Sharp Correction | |

| Brent Crude | $64.28 | -0.76% | Demand Uncertainty |

Institutional Activity (Jan 27 – Provisional Sentiment):

Economic Calendar (India):

How to Trade Crypto Today:

The market is in a “Neutral-Bullish” range. Avoid buying the breakout. The strategy is to “Buy the Wick”—place buy orders at the 100-day EMA support ($89,500 for BTC). For Ethereum, the $3,150 level is a high-probability “bounce zone.” Trading Tip: Use “Trailing Stop Losses” of 2% to protect against the volatility usually seen in the 24 hours leading up to a Fed meeting.

The primary narrative of early 2026 is the “Localization of Capital.” Capital is no longer blindly chasing global indices. Instead, it is flowing into “Resilient Hubs.” India and Brazil are outperforming because of their domestic consumption stories, while Germany and Japan are struggling with energy-export dependency. This means global investors must now be “Macro-Selective,” choosing individual country corridors rather than broad regional ETFs.

The “Commodity Super-Cycle” is hitting its second peak. Gold at $5,100 and Silver above $100 are not just speculative bubbles—they are reflections of Central Bank diversification. With sovereign debt levels in the G7 reaching “unsustainable” labels, hard assets have become the primary treasury reserve of choice. This structural shift is permanent, and the current 6% dip in Silver should be viewed as an aggressive “Accumulation Zone.”

Lastly, “AI-Induced Margin Expansion” is the only thing keeping U.S. Tech afloat. While interest rates remain high, the top 10 Nasdaq firms have managed to cut operational costs by 15-20% through automated AI agents. This “Shadow Deflation” in corporate expenses is countering the “Sticky Inflation” in consumer prices, allowing P/E multiples to remain elevated despite a hawkish Federal Reserve.

How to View the Global Markets Today:

The market is in a “Momentum Re-Rating” phase. The easy gains are over; 2026 is about “Stock Selection” and “Asset Diversification.” Important Takeaway:

The theme for Jan 27 is “Selective Optimism.” Capital is rotating from “hope-based” tech and entering “fact-based” commodities and AI-resilient industrials.

Risk Management Analysis:

aiTrendview Global Disclaimer

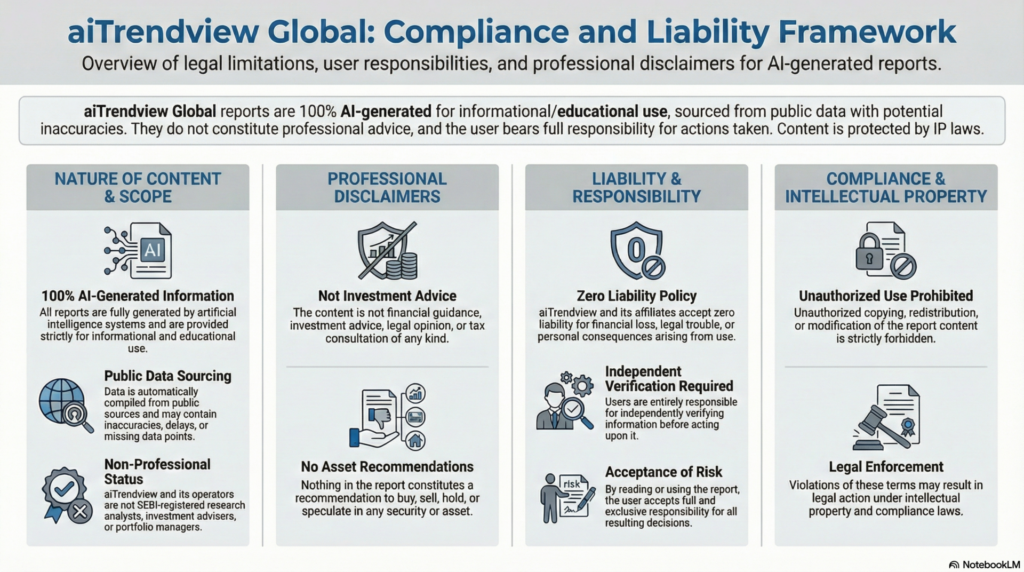

This report is fully AI-generated and is provided strictly for informational and educational use only. It is not investment advice, financial guidance, legal opinion, tax consultation, or professional recommendation of any kind. aiTrendview and its operators are not SEBI-registered research analysts, investment advisers, or portfolio managers. All data is automatically compiled from public sources that may contain inaccuracies, delays, or missing information. If you act on this content without verifying it independently, that is entirely your responsibility.

Nothing in this report is a recommendation to buy, sell, hold, or speculate in any asset or security. aiTrendview, its creators, developers, affiliates, and associated AI systems accept zero liability for financial loss, legal trouble, or personal consequences arising from the use of this material. By reading or using this report, you accept full responsibility for your decisions. Unauthorized copying, redistribution, or modification of this content is prohibited and may result in legal action under intellectual property and compliance laws.

© Copyright 2025. All Rights Reserved By aiTrendview.com a AQJ TRADERS Product

1) or fractional share

Investing in the stock markets carries risk: the value of investments can go up as well as down and you may receive back less than your original investment. Individual investors should make their own decisions or seek independent advice.