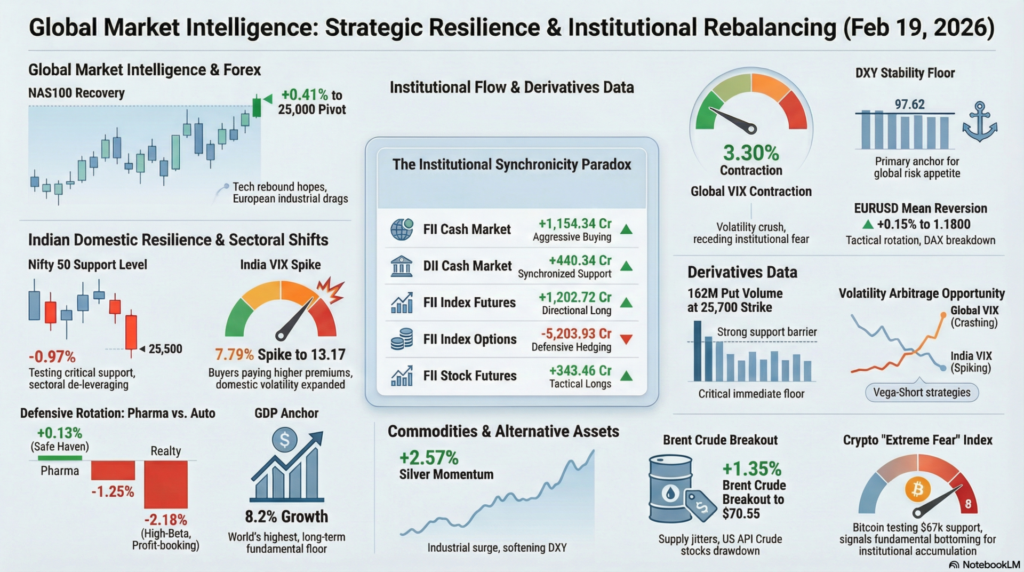

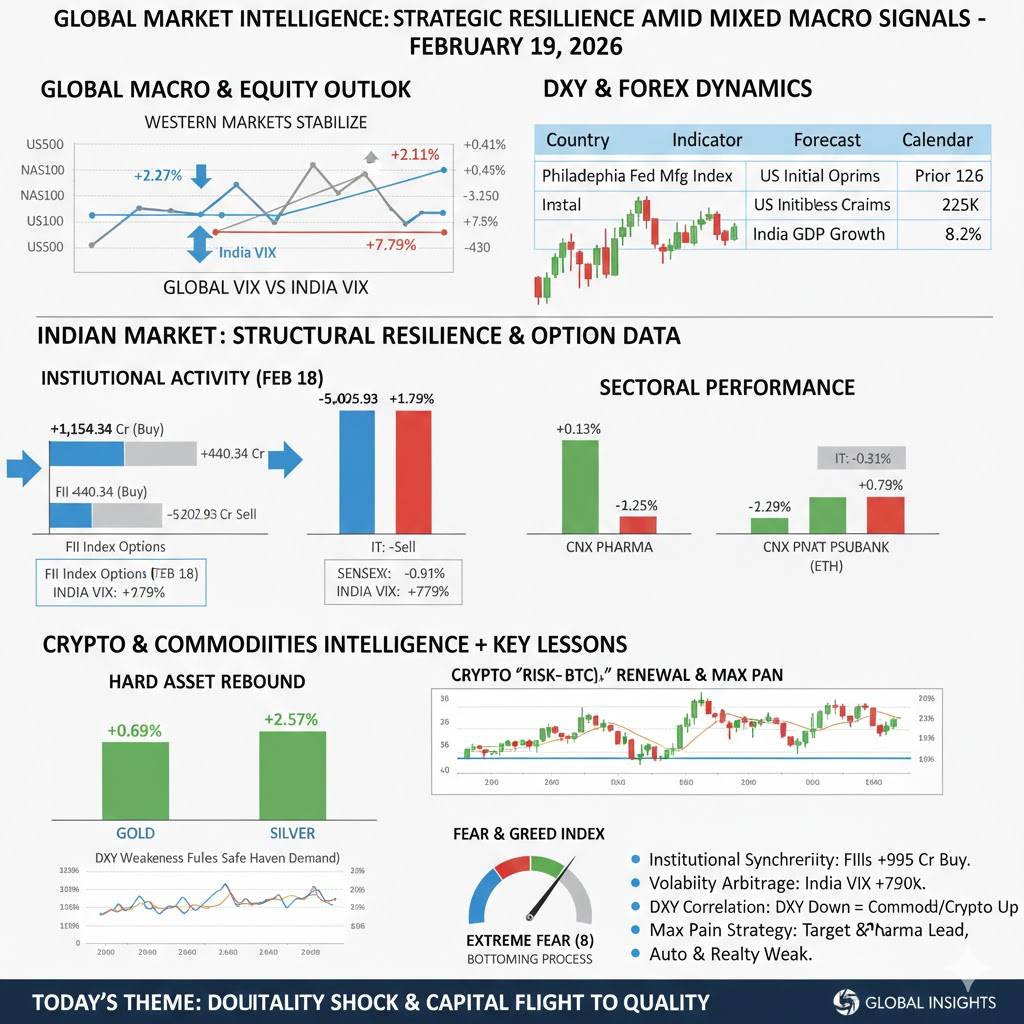

The global financial landscape on February 19, 2026, reflects a state of “Calibrated Caution” as investors digest a complex mix of cooling volatility and shifting economic lead indicators. Western markets showed modest strength, with US500 and NAS100 futures gaining 0.27% and 0.41% respectively, suggesting a steadying hand following recent sessions of price discovery. European markets, however, displayed localized weakness, with the DAX and CAC 40 slipping approximately 0.37% as traders repositioned ahead of critical Philadelphia Fed Manufacturing data. This collective plateauing suggests that global capital is in a “wait-and-watch” mode, closely monitoring the Dollar Index (DXY) as it maintains a stable floor near the 97.62 level, acting as a primary anchor for risk appetite.

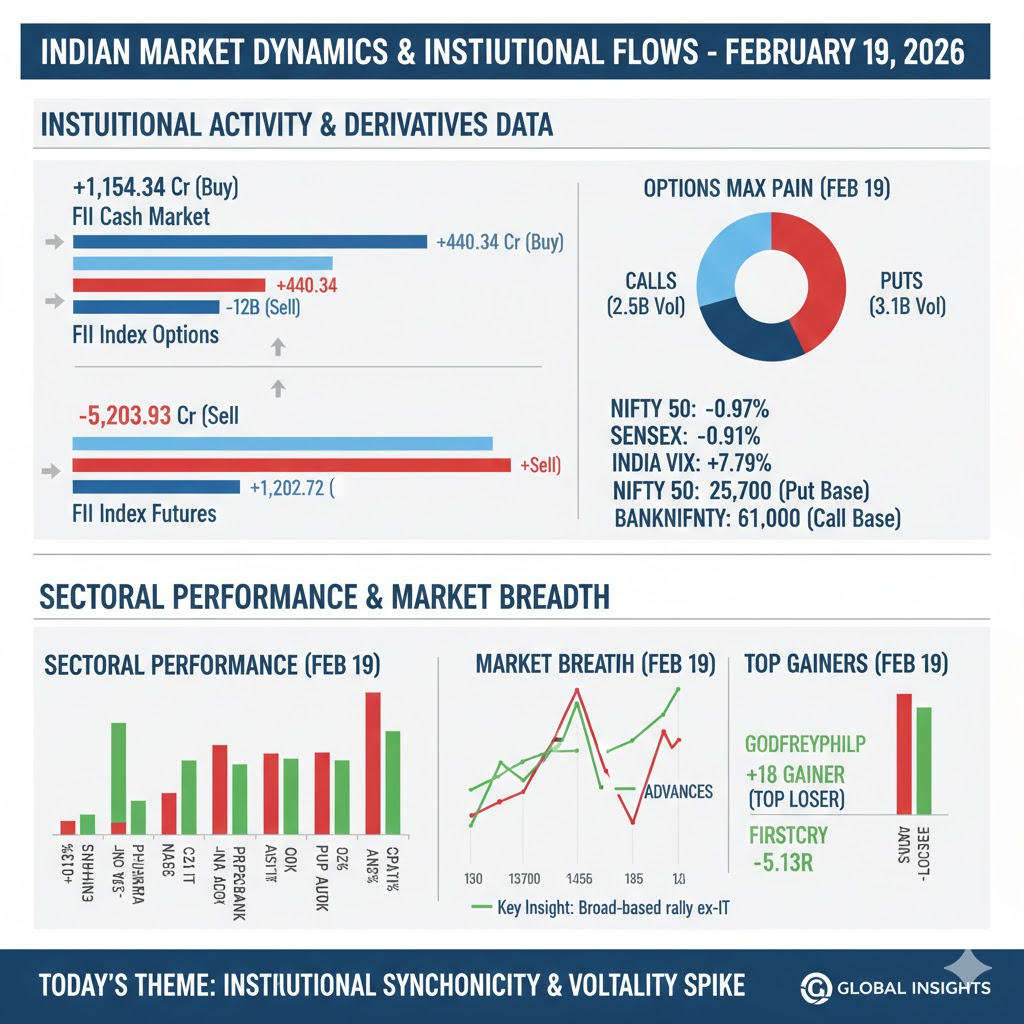

In the Indian domestic market, the narrative remains one of “Structural Resilience” despite a marginal cooling of institutional fervor. The Nifty 50 and Sensex both recorded declines of roughly 0.9%, successfully holding psychological support levels amidst a 7.79% surge in the India VIX to 13.17. Institutional activity showed a decisive bullish pivot, with Foreign Institutional Investors (FIIs) returning as aggressive net buyers with an inflow of +₹1,154.34 Crores in the cash market. This inflow was further bolstered by Domestic Institutional Investors (DIIs), who contributed +₹440.34 Crores, signaling a rare moment of institutional synchronization. While the IT and Auto sectors faced technical headwinds, the Public Sector Banking segment showed relative strength, providing a liquidity floor for the broader indices.

| Instrument | Price / Rate | Day Change (%) | Technical Movement | Key Event / Driver |

| US500 | 6,893.3 | +0.27% | Testing 6,900 Resistance | Fed Bostic Speech |

| NAS100 | 24,969.4 | +0.41% | Reclaiming 25k Pivot | Tech Rebound Hopes |

| US30 | 49,694.00 | +0.11% | Consolidating below 50k | Industrial Resilience |

| DAX (FDAX1) | 25,242 | -0.38% | Bearish Breakdown | EU Industrial Drag |

| DXY | 97.627 | -0.07% | Finding Floor Support | Dollar Index Recovery |

| VIX (Global) | 19.62 | -3.30% | Sharp Volatility Crush | Fear Mitigation |

| EURUSD | 1.1800 | +0.15% | Mean Reversion | Euro Strength |

| USDINR | 90.9620 | +0.23% | Rupee Softness | Domestic DXY Impact |

Technical Analysis: Global futures are exhibiting a “bullish-neutral” bias, with the NAS100 leading a charge back toward the 25,000 psychological milestone. The breakdown of the Global VIX by 3.30% is a primary technical trigger, indicating that institutional fear is receding as indices consolidate within narrow bands.

Fundamental Analysis: The overarching fundamental theme is the recalibration of labor market expectations. With US Initial Jobless Claims forecasted at 225K, any deviation will likely spark a volatility spike. The Euro’s 0.15% gain against the Dollar suggests a tactical rotation back into EU assets despite the DAX’s marginal daily decline.

Economic Announcements: The US economic calendar is top-heavy with the Philadelphia Fed Manufacturing Index (Forecast: 8.5 vs Prior: 12.6) and Pending Home Sales (Forecast: 1.3%). Domestically, India’s 8.2% GDP growth remains the world’s highest, providing a long-term fundamental anchor for FII inflows.

| Index / Sector | Last Price | Day Change (%) | Technical Movement | Event / Driver |

| NIFTY 50 | 25,569.70 | -0.97% | Testing 25,500 Support | Sectoral De-leveraging |

| SENSEX | 82,971.18 | -0.91% | Sideways Bias | IT Sector Drag |

| BANKNIFTY | 60,988.30 | -0.91% | Holding 61k Level | PSU Banking Resilience |

| INDIA VIX | 13.17 | +7.79% | Spiking Fear Gauge | Volatility Expansion |

| CNX PSUBANK | 9,559.05 | -0.69% | Outperforming Benchmark | Credit Growth Hopes |

| CNX IT | 32,567.70 | -0.31% | Consolidating Gains | Global Tech Jitters |

| CNX AUTO | 27,974.00 | -1.25% | Sharp Bearish Pivot | Sales Volume Woes |

| CNX PHARMA | 22,572.25 | +0.13% | Defensive Buying | Safe Haven Rotation |

Technical Analysis: The Nifty 50 has witnessed a tactical retreat to the 25,500 support zone, dragged by a 1.25% crash in the Auto sector. A major technical event is the 7.79% spike in India VIX, suggesting that while institutional buyers are active, they are paying higher premiums to protect their long portfolios.

Fundamental Analysis: Domestic sentiment is propped up by stable interest rate expectations (RBI at 5.25%) and robust corporate industrial production (+7.8%). The Pharma sector’s contrarian gain (+0.13%) highlights a fundamental flight to defensive value as high-beta sectors like Realty (-2.18%) face profit-booking.

Economic Announcements: The Indian economic focus remains on the WPI Inflation Rate forecast of 1.25%. Traders are also awaiting Bank Loan Growth data (Prior: 13.1%) to gauge the pace of domestic credit expansion for the first quarter of 2026.

| Segment | Net Buy/Sell (Cr) | Action Bias |

| FII Cash Market | +1,154.34 | Aggressive Buying |

| DII Cash Market | +440.34 | Synchronized Support |

| FII Index Futures | +1,202.72 | Directional Long |

| FII Index Options | -5,203.93 | Defensive Hedging |

| FII Stock Futures | +343.46 | Tactical Longs |

| Index | Strike | Call Volume (Max) | Put Volume (Max) | Market Sentiment |

| NIFTY | 25,700 | 112,301,735 | 162,082,310 | Put Writing Heavy |

| BANKNIFTY | 61,000 | 8,080,290 | 3,380,370 | Resistance Base |

Technical Analysis: The Nifty option chain indicates a high concentration of Put writing at the 25,700 strike (162M volume), suggesting that traders view this level as a critical immediate floor. Conversely, BankNifty faces stiff resistance at the 61,000 Call level, where volume stands at 8.08M.

Fundamental Analysis: Institutional behavior is exceptionally bullish; FIIs have resumed aggressive buying in both Cash and Index Futures (+₹2,357 Cr combined). This suggest that global capital is finding extreme value in the Indian “Growth Oasis” despite the -0.97% benchmark dip, viewing it as a long-term accumulation opportunity.

IPO Update: The primary market shows high SME demand; Marushika Technology was oversubscribed by 16.74x, while mainboard Fractal Industries saw a steady 2.01x subscription, indicating that retail “animal spirits” remain high.

| Instrument | Price | Day Change (%) | Technical Status | Headline Sentiment |

| Bitcoin (BTC) | $66,845.2 | +0.65% | Testing $67k Support | ETF Recovery Hopes |

| Ethereum (ETH) | $1,970.0 | +0.73% | Reclaiming Pivot | Mean Reversion |

| GOLD (XAUUSD) | $5,011.76 | +0.69% | Resuming Bullish Trend | Inflation Hedge |

| SILVER | $79.187 | +2.57% | Strong Momentum | Industrial Surge |

| BRENT CRUDE | $70.555 | +1.35% | Bullish Breakout | Supply Jitters |

| NATGAS | $3.324 | -2.03% | Bearish Breakdown | Oversupply Woes |

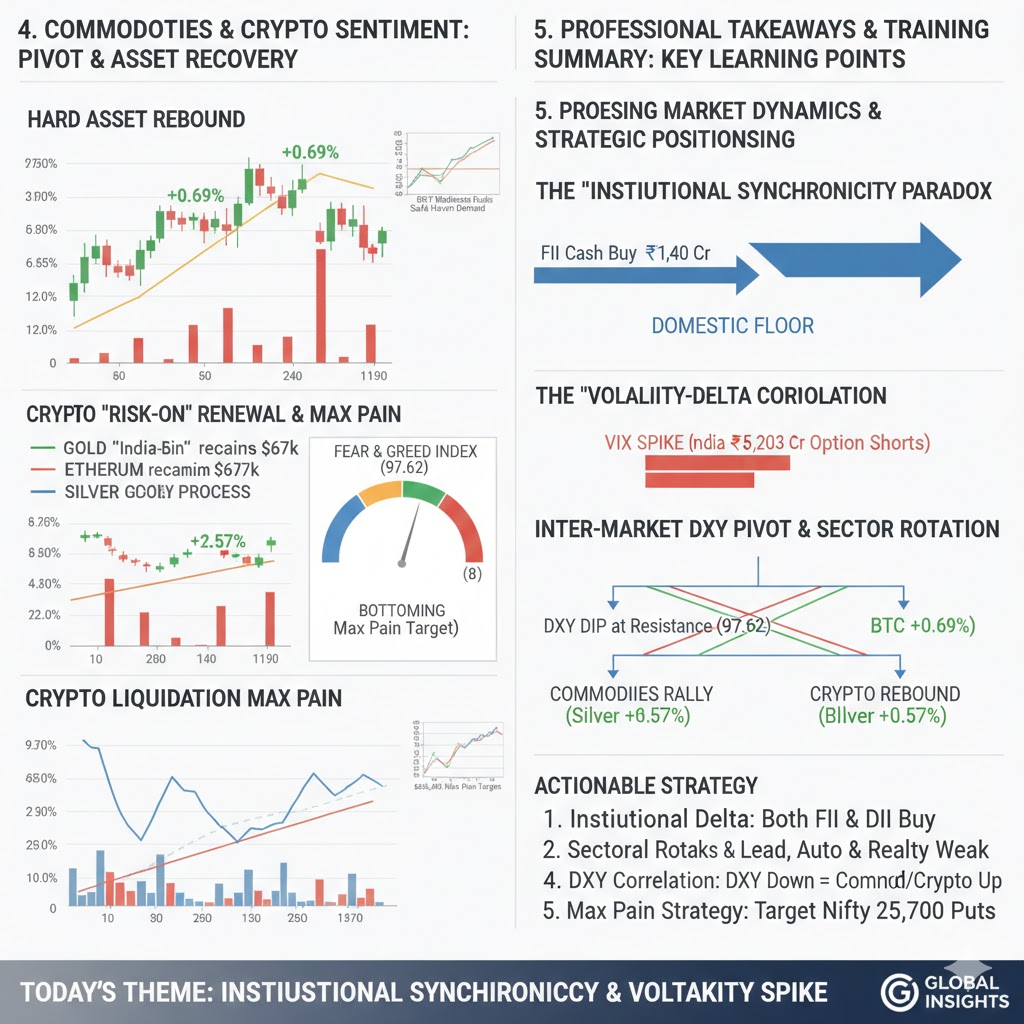

Technical Analysis: Commodities are leading the charge today, with Silver surging 2.57% and Gold reclaiming the $5,010 level. In the crypto market, Bitcoin is undergoing a period of “Max Pain” near $66,845, with liquidated longs and shorts reaching a standoff as distance to pain points remains balanced.

Fundamental Analysis: The 1.35% jump in Brent Crude is driven by easing Iran risks and a steady global supply outlook. Crypto sentiment remains in “Extreme Fear” (Index: 8), which traditionally serves as a fundamental bottoming signal for long-term institutional accumulation.

Economic Announcements: US API Crude Oil Stock Change of -0.609M compared to the prior 13.4M indicates a sharp drawdown, fundamentally supporting the recent Brent price recovery.

For educational and training purposes, today’s session highlights the “Institutional Synchronicity Paradox.” Despite the Nifty 50 dropping nearly 1%, we witnessed a massive +₹1,154 Cr FII buy and a +₹440 Cr DII buy. This teaches us that professional capital often uses “Red Days” and volatility expansion (VIX +7.79%) to accumulate high-conviction positions at a discount. For a trainee trader, this is a masterclass in separating “Price Action” from “Flow Action.” While the price looks weak, the underlying flows are aggressively bullish, suggesting that the current dip is a localized liquidity flush rather than a structural reversal.

Secondly, the “Volatility-Delta Correlation” observed in the commodities market provides a key lesson in capital rotation. The 2.57% surge in Silver and 1.35% in Brent Crude, occurring alongside a softening Dollar Index (-0.07%), demonstrates that capital is flowing into “Hard Assets” as a hedge against potential US manufacturing weakness. For a professional trader, the takeaway is clear: when the Global VIX crashes (-3.30%) but the India VIX spikes (+7.79%), it creates a “Volatility Arbitrage” opportunity where domestic options become overpriced, allowing for sophisticated “Vega-Short” strategies if the underlying index stabilizes. Mastering these inter-market signals is essential for navigating the complex global macro environment of 2026.

Legal Disclaimer & Liability Waiver

This AI-generated report is strictly educational and does not constitute financial, legal, or professional advice. aiTrendview and its affiliates are not SEBI-registered advisors and assume zero liability for any losses or consequences resulting from its use. All data is autonomously harvested from public sources and may be flawed, delayed, or incomplete; therefore, you assume exclusive responsibility for independently verifying information before taking any action. Under no circumstances should this content be construed as a recommendation to trade or speculate in any security. By accessing this material, you acknowledge that any reliance on this data is at your sole risk, and you agree to be bound by strict intellectual property protections prohibiting the unauthorized redistribution or modification of this work.

1) or fractional share

Investing in the stock markets carries risk: the value of investments can go up as well as down and you may receive back less than your original investment. Individual investors should make their own decisions or seek independent advice.