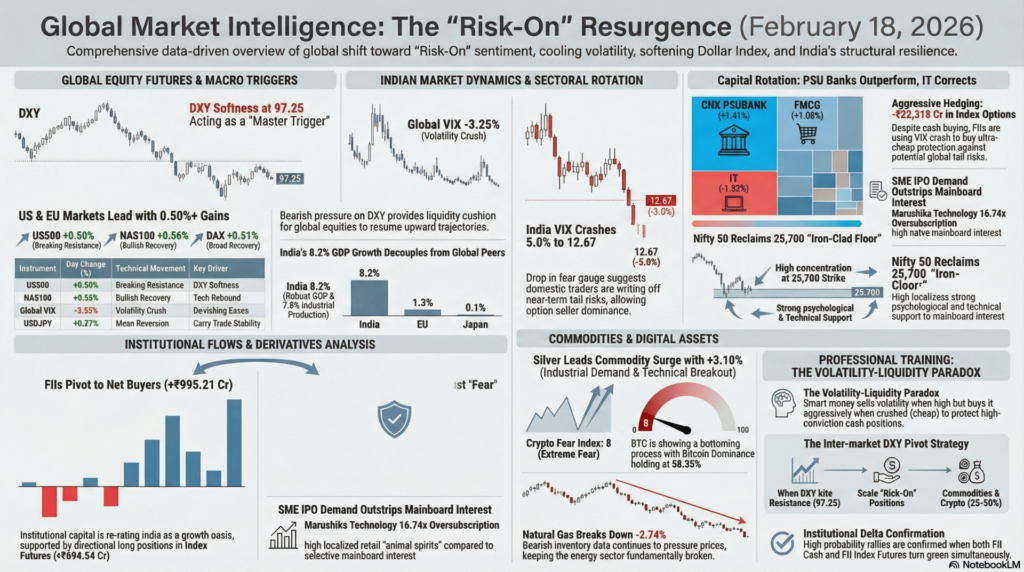

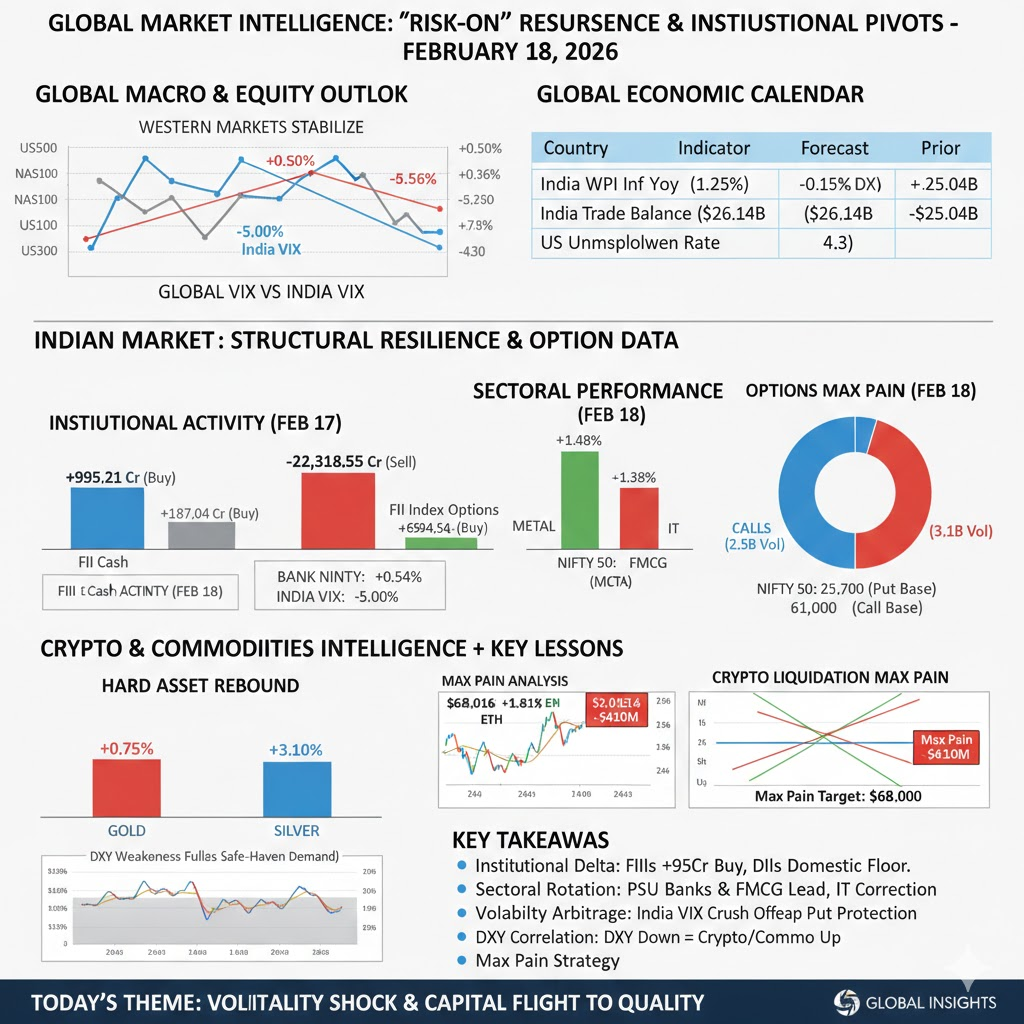

The global financial landscape on February 18, 2026, reflects a decisive shift toward “Risk-On” sentiment as major indices across the globe trade in green territory. Western markets are leading this charge, with the US500 gaining 0.50% and the NAS100 surging 0.56%, as investors recalibrate expectations following a period of post-inflation volatility. European markets are providing a robust tailwind, with the DAX up 0.51% and the Euro Stoxx 50 rising 0.58%, signaling a broad-based recovery in industrial and tech sentiment. This collective optimism is being significantly bolstered by a softening Dollar Index (DXY), which has retreated to the 97.25 level, and a sharp 3.25% drop in the Global VIX, indicating that institutional de-risking has largely plateaued for the current cycle.

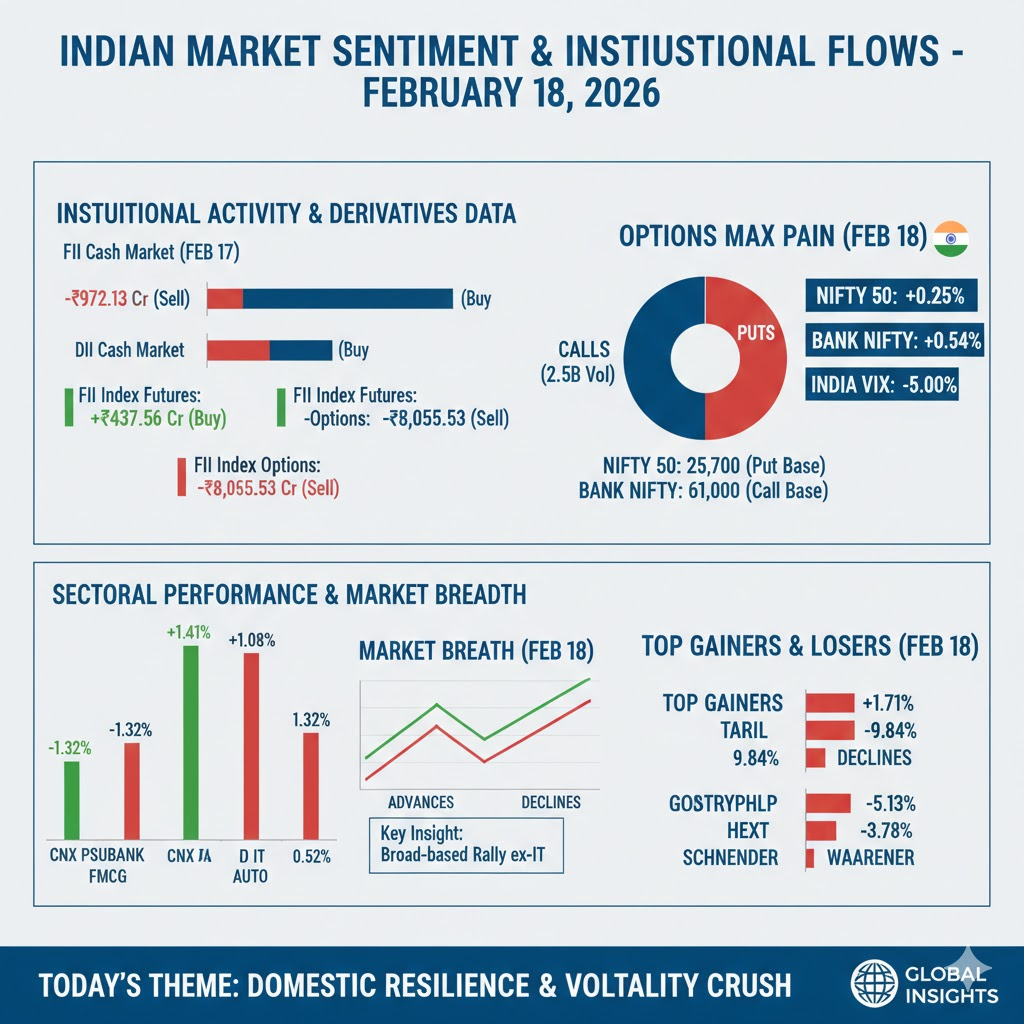

In the Indian domestic market, the narrative is one of structural resilience and a complete collapse in market fear. The Nifty 50 gained 0.25% to close at 25,788.70, while the Bank Nifty outperformed with a 0.54% surge, reclaimimg psychological levels near 61,500. A major highlight of the session is the 5.0% crash in the India VIX to 12.67, suggesting that domestic traders are effectively writing off near-term tail risks. Institutional activity remains healthy with FIIs turning net buyers in the cash market (+₹995.21 Cr), supported by steady DII inflows. While the IT sector faced a sharp 1.32% correction, the broader market breadth remains positive, led by a parabolic surge in PSU Banks (+1.41%) and FMCG (+1.08%), providing a firm floor for the indices.

| Instrument | Price / Rate | Day Change (%) | Technical Movement | Key Event / Driver |

| US500 | 6,879.2 | +0.50% | Breaking Resistance | DXY Softness |

| US30 | 49,752.00 | +0.41% | Consolidating Gains | Blue-chip Demand |

| NAS100 | 24,837.8 | +0.56% | Bullish Recovery | Tech Rebound |

| DAX (FDAX1) | 25,185 | +0.51% | Technical Breakout | EU Industrial Optimism |

| DXY | 97.255 | -0.15% | Bearish Pressure | Topping Signs |

| VIX (Global) | 19.63 | -3.25% | Volatility Crush | De-risking Eases |

| USDJPY | 153.67 | +0.27% | Mean Reversion | Carry Trade Stability |

| USDINR | 90.6725 | +0.07% | Sideways | Rupee Resilience |

Technical Analysis: Global futures are exhibiting a strong “Risk-On” bias, with the US500 leading a charge past immediate resistance zones. The Dollar Index (DXY) at 97.25 is currently the master trigger; its failure to hold higher levels has provided the necessary liquidity cushion for global equities to resume their upward trajectory.

Fundamental Analysis: The fundamental backdrop is dominated by the stabilization of global yields and a perceived “Goldilocks” environment where inflation is cooling without a hard landing. The 3.25% drop in Global VIX suggests that institutional capital is re-entering the market after processing recent US labor and manufacturing data.

Economic Announcements: The global economic heatmap shows India leading the pack with an 8.2% GDP growth and 7.8% industrial production, fundamentally decoupling from the slower-growth regimes of the EU (1.3%) and Japan (0.1%). The US unemployment rate at 4.3% remains a point of focus for the Fed, keeping terminal rate expectations stable.

| Index / Sector | Last Price | Day Change (%) | Technical Movement | Event / Driver |

| NIFTY 50 | 25,788.70 | +0.25% | Reclaiming 25,800 | Large-cap Support |

| BANK NIFTY | 61,502.30 | +0.54% | Outperforming Pivot | PSU Bank Rally |

| INDIA VIX | 12.67 | -5.00% | Fear Collapse | Option Seller Dominance |

| CNX PSUBANK | 9,634.55 | +1.41% | Sectoral Leader | Credit Growth Optimism |

| CNX FMCG | 52,336.65 | +1.08% | Defensive Breakout | Value Rotation |

| CNX IT | 32,638.10 | -1.32% | Sharp Correction | Global Tech Headwinds |

| CNX METAL | 11,991.75 | +1.38% | Mean Reversion | Industrial Demand |

| MIDCPNIFTY | 13,723.75 | +0.38% | Rangebound Churn | Selective Buying |

Technical Analysis: The Nifty 50 is demonstrating a “Slow & Steady” accumulation pattern, successfully holding the 25,700 floor. A major technical highlight is the CNX PSUBANK sector’s 1.41% surge, marking a decisive breakout, while the CNX IT sector’s 1.32% crash indicates that capital is rotating out of overvalued growth and into defensive value (FMCG).

Fundamental Analysis: Domestic sentiment is being propped up by stable interest rate expectations (RBI at 5.25%) and robust domestic consumption. The 5.0% crush in India VIX is a fundamental signal that institutional players are not expecting any major negative surprises in the first quarter of 2026.

Stock Highlights: Godfrey Phillips (+18.71%) led the top gainers, while FirstCry (-5.13%) faced significant selling pressure. High-momentum names like Force Motors continue to hit new 52-week highs, showing localized “animal spirits”.

| Segment | Net Buy/Sell (Cr) | Action Bias |

| FII Cash Market | +995.21 | Resumed Buying |

| DII Cash Market | +187.04 | Marginal Support |

| FII Index Futures | +694.54 | Directional Long |

| FII Index Options | -22,318.55 | Aggressive Hedging |

| FII Stock Futures | -1,927.10 | Selective Profit Booking |

| Index | ATM Strike | Put Volume (Max) | Call Volume (Max) | Market Sentiment |

| NIFTY | 25,700 | 3,111,149,600 | 2,547,251,265 | Put Writing Heavy |

| BANK NIFTY | 61,000 | 5,693,430 | 5,999,820 | Stiff Resistance |

Technical Analysis: The Nifty option chain indicates a massive concentration of Put writing at the 25,700 strike (3.1 Billion volume), suggesting that traders view this level as an iron-clad floor for the current expiry. However, the FII net short position in options (-₹22,318 Cr) suggests they are using the VIX crush to buy ultra-cheap protection against global tail risks.

Fundamental Analysis: Institutional rebalancing shows FIIs returning as net buyers in the cash market (+₹995 Cr) for the first time this week. This pivot, combined with strong long positions in Index Futures (+₹694 Cr), suggests that global capital is re-rating the Indian “Growth Oasis” as US yields stabilize.

IPO Update: The primary market remains selective; Fractal Industries saw a 2.01x subscription, while Marushika Technology was oversubscribed by 16.74x, indicating that SME retail demand continues to far outstrip mainboard institutional interest.

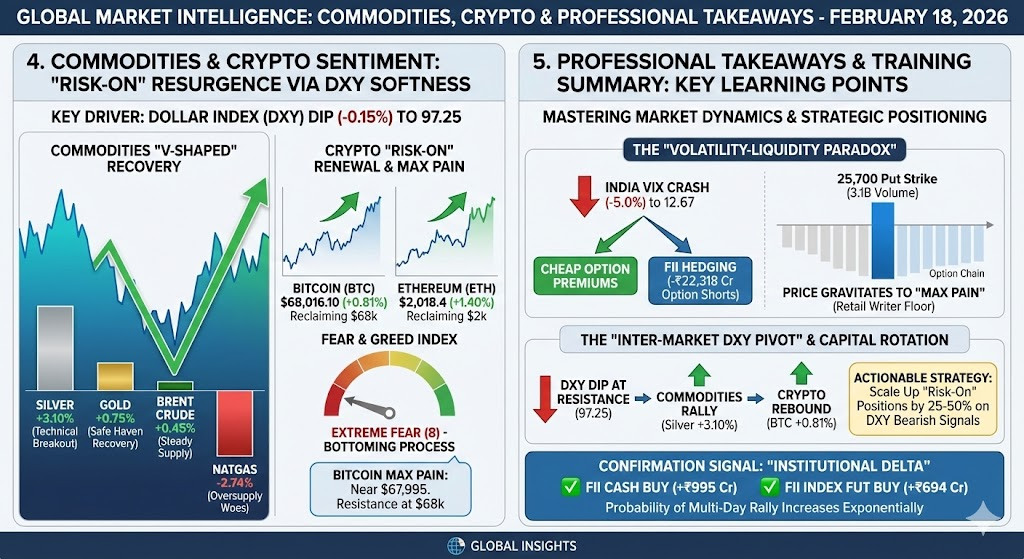

| Instrument | Price | Day Change (%) | Technical Status | Headline Sentiment |

| Bitcoin (BTC) | $68,016.10 | +0.81% | Reclaiming $68k | Bullish Pivot |

| Ethereum (ETH) | $2,018.4 | +1.40% | Reclaiming $2k Pivot | Momentum Rebound |

| GOLD (XAUUSD) | $4,914.46 | +0.75% | Safe Haven Recovery | Buying on Dips |

| SILVER | $75.778 | +3.10% | Technical Breakout | Industrial Surge |

| BRENT CRUDE | $67.145 | +0.45% | Sideways | Supply Outlook Steady |

| NATGAS | $3.378 | -2.74% | Bearish Breakdown | Oversupply Woes |

Technical Analysis: Commodities are seeing a “V-shaped” recovery led by Silver’s 3.10% surge. Gold has staged a strong rebound to $4,914, reclaiming its status as a hedge against currency debasement as the DXY softens. In crypto, Bitcoin is undergoing a period of “Max Pain” near $67,995, with liquidated longs reaching a standoff at the $68k resistance zone.

Fundamental Analysis: The crypto market is seeing a renewal of “Risk-On” flows, with Bitcoin Dominance at 58.35%. Despite recent ETF outflow jitters, the current “Extreme Fear” (Index: 8) suggests a market bottoming process where institutional whales are beginning to accumulate.

Economic Announcements: Natural Gas remains fundamentally broken with a 2.74% decline, driven by bearish inventory data. Traders are awaiting US mortgage rate data to gauge the long-term impact on industrial energy demand.

For educational and training purposes, today’s session highlights the “Volatility-Liquidity Paradox.” The 5.0% crash in India VIX alongside a -₹22,318 Crore FII Option shorting teaches us that “Smart Money” sells volatility when it’s high but buys it aggressively when it’s crushed to protect high-conviction cash positions. When the VIX drops, option premiums become cheap, allowing FIIs to “buy insurance” at a discount for their massive ₹995 Cr cash buys. A trainee should observe how the Nifty gapped to the 25,700 Put writing strike, where the highest liquidity is clustered, proving that price gravitates toward the “Max Pain” of the retail writer during a recovery phase.

Secondly, the “Inter-market DXY Pivot” provides a key lesson in capital rotation. The 0.15% dip in the Dollar Index was the primary oxygen for Silver’s 3.10% move and Bitcoin’s 0.81% rebound. For a professional trader, the takeaway is absolute: when the DXY shows a bearish candle at the 97.25 resistance, your “Risk-On” positions in commodities and crypto should be scaled up by 25-50%. Use the “Institutional Delta” (FII Cash Buy + FII Index Fut Buy) as your ultimate confirmation; when both are green, the probability of a multi-day rally increases exponentially.

Legal Disclaimer & Liability Waiver

This AI-generated report is strictly educational and does not constitute financial, legal, or professional advice. aiTrendview and its affiliates are not SEBI-registered advisors and assume zero liability for any losses or consequences resulting from its use. All data is autonomously harvested from public sources and may be flawed, delayed, or incomplete; therefore, you assume exclusive responsibility for independently verifying information before taking any action. Under no circumstances should this content be construed as a recommendation to trade or speculate in any security. By accessing this material, you acknowledge that any reliance on this data is at your sole risk, and you agree to be bound by strict intellectual property protections prohibiting the unauthorized redistribution or modification of this work.

1) or fractional share

Investing in the stock markets carries risk: the value of investments can go up as well as down and you may receive back less than your original investment. Individual investors should make their own decisions or seek independent advice.