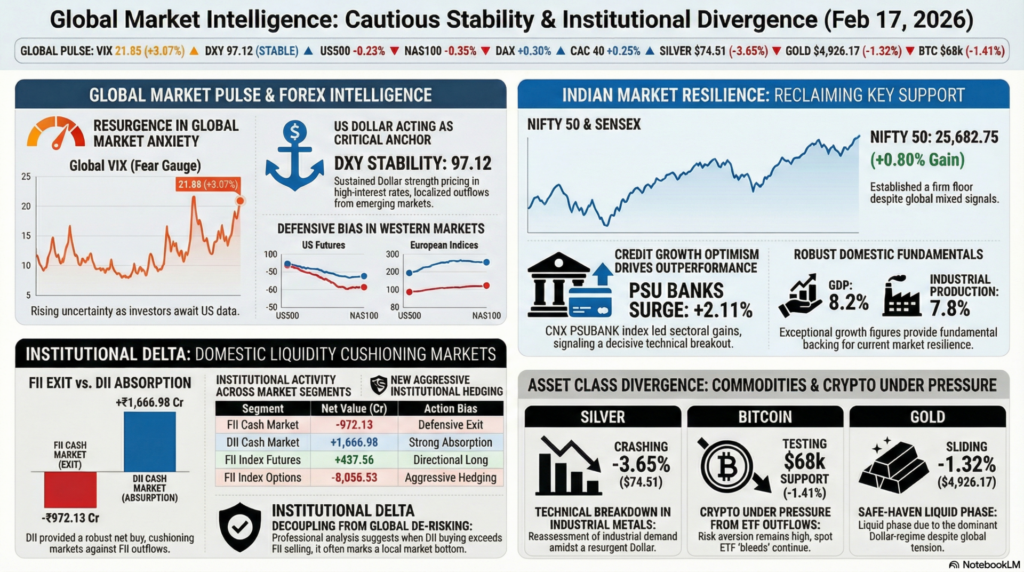

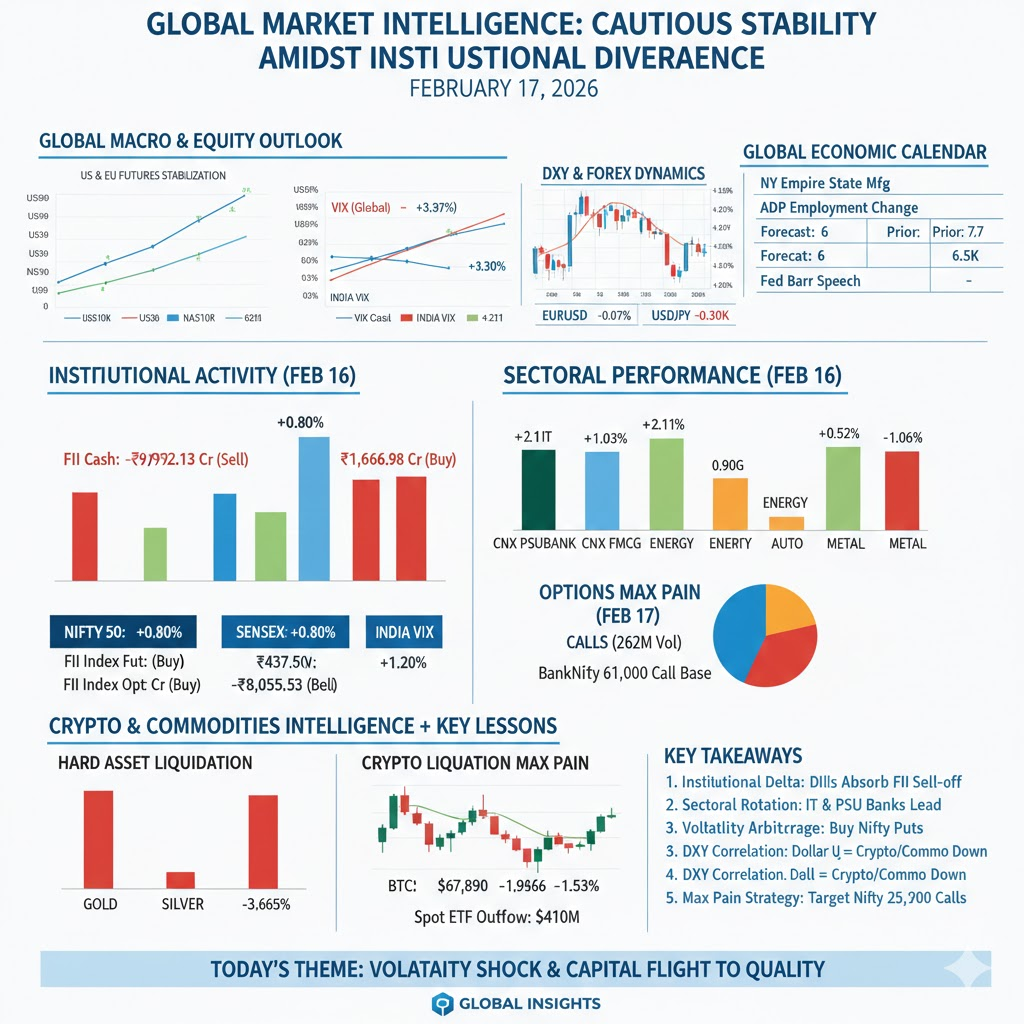

The global financial landscape on February 17, 2026, exhibits a theme of cautious stabilization following a period of persistent volatility. Western markets are navigating a “wait-and-watch” phase, with US futures showing marginal declines as investors digest lingering inflation concerns and prepare for upcoming manufacturing data. In Europe, major indices like the DAX and CAC 40 have opened with modest gains, reflecting a slight reprieve from recent de-risking. This collective plateauing suggests that global capital is momentarily parked, awaiting clearer signals from central bank officials and economic lead indicators. The Dollar Index (DXY) remains stable at 97.12, acting as a critical anchor for global risk appetite while safe-haven demand for gold remains present.

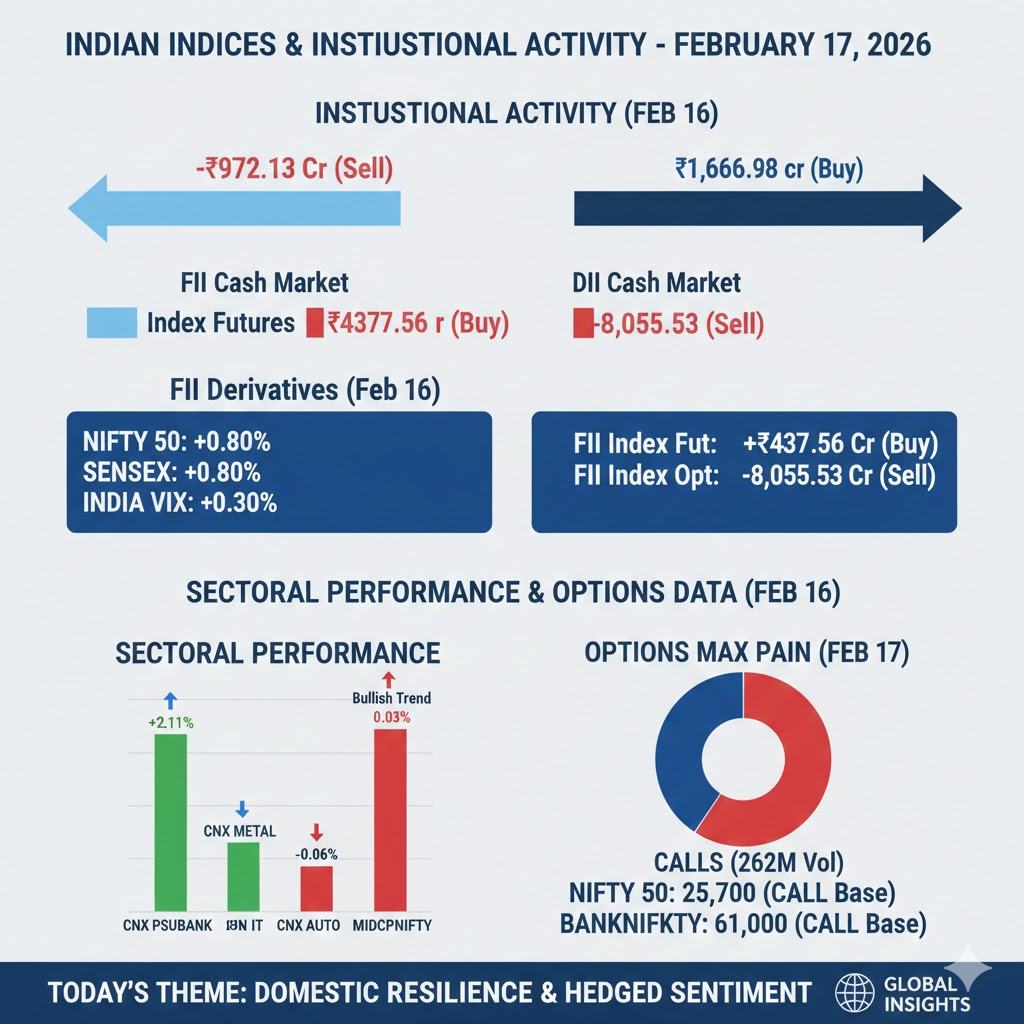

In India, the domestic narrative is one of resilient consolidation led by the technology and public sector banking sectors. The Nifty 50 and Sensex both recorded gains of 0.8%, successfully reclaiming key psychological support levels amidst a slight uptick in domestic volatility to 13.33. Institutional activity remains deeply bifurcated; while Foreign Institutional Investors (FIIs) continued their defensive exit with a net sell of -₹972.13 Crores in the cash market, Domestic Institutional Investors (DIIs) provided a robust liquidity cushion with a net buy of +₹1,666.98 Crores. This strong domestic absorption, combined with a 1.03% surge in the IT sector, has provided a firm floor for Indian equities even as global peers remain mixed.

| Instrument | Price / Rate | Day Change (%) | Technical Movement | Key Event / Driver |

| US500 | 6,819.8 | -0.23% | Testing 6,820 Support | Risk Aversion Persists |

| US30 | 49,477.00 | -0.11% | Consolidating below 50k | Mixed After Long Weekend |

| NAS100 | 24,584.6 | -0.35% | Bearish Pressure | Tech Sector Jitters |

| DXY | 97.128 | +0.03% | Holding Gains | Dollar Index Stability |

| VIX (Global) | 21.85 | +3.07% | Fear Gauge Spiking | Uncertainty Rising |

| EURUSD | 1.1843 | -0.07% | Bearish Bias | Euro Weakness |

| USDJPY | 153.05 | -0.30% | Mean Reversion | Yen Appreciation |

| USDINR | 90.6520 | -0.09% | Rupee Strength | Domestic Resilience |

Technical Analysis: Global futures are currently exhibiting a defensive bias, with the NAS100 leading declines as it tests immediate support levels. A major technical headwind is the 3.07% spike in the Global VIX, indicating a resurgence in market anxiety. The Dollar Index (DXY) holding at 97.12 continues to exert pressure on global risk-on trades.

Fundamental Analysis: The overarching fundamental theme is the market’s sensitivity to upcoming US economic data, specifically the Empire State Manufacturing Index and ADP Employment Change. The continued strength of the US Dollar suggests that investors are pricing in a sustained high-interest-rate environment, leading to localized outflows from emerging markets.

Economic Announcements: The US economic calendar is top-heavy with the NY Empire State Manufacturing Index (Forecast: 6 vs Prior: 7.7) and NAHB Housing Market Index (Forecast: 38 vs Prior: 37). Domestically, the RBI Market Borrowing Auctions remain the primary focus for managing domestic liquidity.

| Index / Sector | Last Price | Day Change (%) | Technical Movement | Event / Driver |

| NIFTY 50 | 25,682.75 | +0.80% | Holding 25,600 Floor | IT Sector Lead |

| SENSEX | 83,277.15 | +0.80% | Bullish Breakout | Large-cap Support |

| INDIA VIX | 13.33 | +0.30% | Consolidation at Base | Steady Fear Levels |

| CNX IT | 33,075.05 | +1.03% | Sectoral Leader | Demand Rebound |

| CNX PSUBANK | 9,500.80 | +2.11% | Strong Outperformance | Credit Growth Optimism |

| CNX FMCG | 51,778.30 | +0.90% | Defensive Buying | Value Rotation |

| CNX METAL | 11,828.40 | -1.06% | Bearish Breakdown | Global Industrial Lag |

| CNX AUTO | 28,174.55 | +0.52% | Mean Reversion | Sales Recovery Hope |

Technical Analysis: The Nifty 50 has demonstrated significant technical strength, reclaiming the 25,600 milestone with a 0.8% gain. A major sectoral highlight is the CNX PSUBANK index surging 2.11%, signaling a decisive breakout from its recent range. Conversely, the Metal sector remains in a bearish channel, reflecting weak global industrial cues.

Fundamental Analysis: Domestic sentiment is propped up by India’s exceptional 8.2% GDP growth and robust 7.8% industrial production. The resilience in the IT sector (+1.03%) is a fundamental reaction to easing global valuation concerns and steady domestic earnings. PSU banks are benefiting from optimistic credit growth projections.

Economic Announcements: US Fed official Barr’s upcoming speech is being monitored for further cues on the labor market and monetary trajectory. Locally, the market is successfully absorbing the RBI’s market borrowing auctions, maintaining stable yield curves for the first quarter of 2026.

| Segment | Net Buy/Sell (Cr) | Action Bias |

| FII Cash Market | -972.13 | Selective Exit |

| DII Cash Market | +1,666.98 | Strong Absorption |

| FII Index Futures | +437.56 | Directional Long |

| FII Index Options | -8,055.53 | Aggressive Hedging |

| FII Stock Futures | +35.11 | Neutral Sideways |

| Index | ATM Strike | Call Volume (Max) | Put Volume (Max) | Market Sentiment |

| NIFTY | 25,700 | 3,111,149,600 | 2,547,251,265 | Call Writing Heavy |

| BANKNIFTY | 61,000 | 5,995,680 | 3,151,530 | Resistance Base |

Technical Analysis: The Nifty option chain indicates massive Call writing at the 25,700 strike, suggesting that traders view this as a primary immediate ceiling. The FII net short position in options (-₹8,055 Cr) suggests that institutional players are aggressively buying protective puts to hedge against global tail risks.

Fundamental Analysis: Institutional rebalancing shows a clear pattern where DIIs are providing the “liquidity floor” for the Indian market, absorbing significantly more than the FII outflows. This trend underscores deep domestic confidence in India’s structural growth story, even as global capital remains cautious.

Economic Announcements: India’s current account to GDP standing at -0.6% remains well within manageable thresholds, providing a fundamental anchor for institutional long positions in domestic indices.

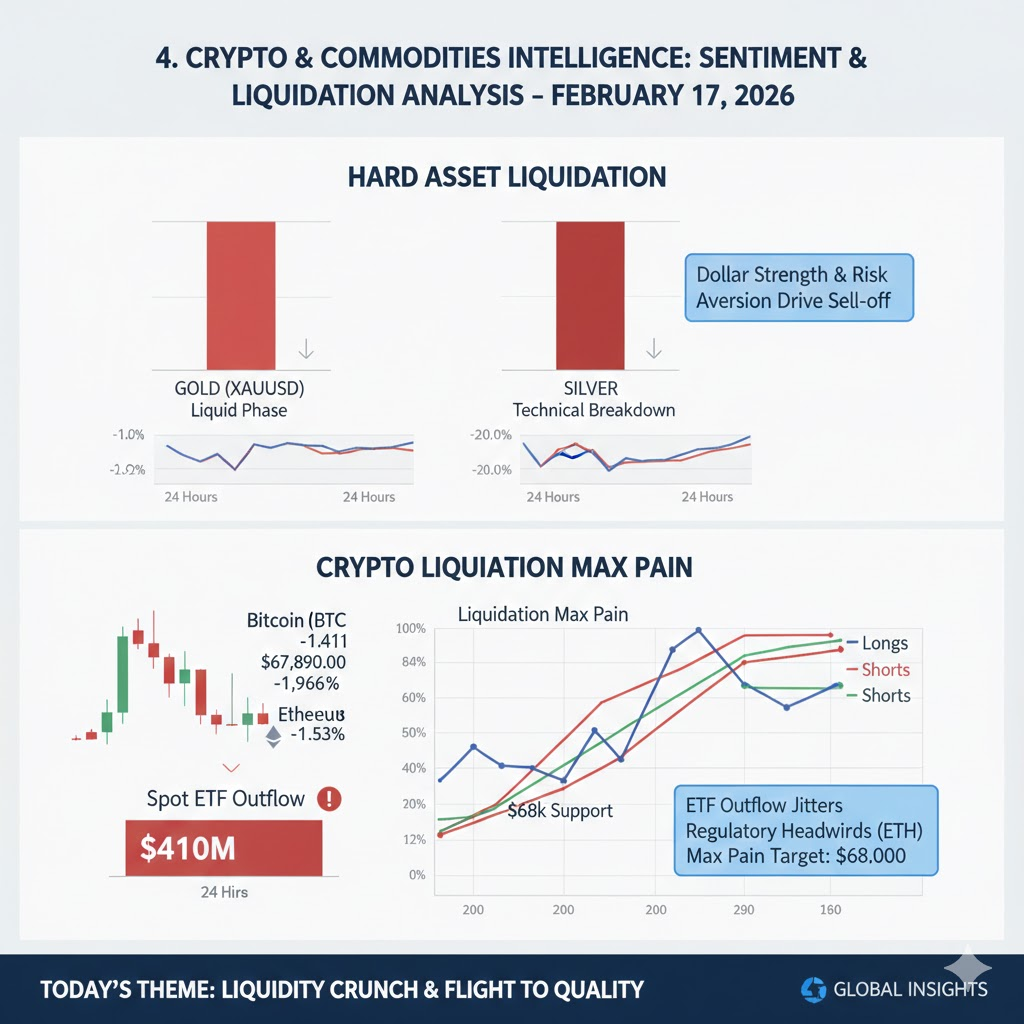

| Instrument | Price | Day Change (%) | Technical Status | Headline Sentiment |

| Bitcoin (BTC) | $67,890.00 | -1.41% | Testing $68k Support | ETF Outflow Jitters |

| Ethereum (ETH) | $1,966.8 | -1.53% | Bearish Divergence | Regulatory Headwinds |

| GOLD (XAUUSD) | $4,926.17 | -1.32% | Liquid Phase | Dollar Strength Impact |

| SILVER | $74.51 | -3.65% | Technical Breakdown | Industrial Fatigue |

| BRENT CRUDE | $67.78 | -0.51% | Sideways | Supply Outlook Steady |

| NATGAS | $3.557 | -0.53% | Bearish Bias | Oversupply Woes |

Technical Analysis: Commodities are currently the main victim of the Dollar’s resurgence, with Silver crashing 3.65% and Gold sliding 1.32%. The technical breakdown in Silver suggests a period of industrial demand reassessment. In crypto, Bitcoin is facing downward pressure, testing the critical $68,000 psychological floor.

Fundamental Analysis: The primary fundamental headwind for digital assets is the persistent bleed in spot Bitcoin ETFs, as risk aversion remains high. Crude oil is under pressure as easing Iran risks and a steady supply outlook continue to keep a lid on any potential price recovery.

Economic Announcements: The Dollar holding its gains is the master trigger for today’s asset movements. Traders are awaiting the ADP Employment Change Weekly data to gauge if the US labor market’s resilience will continue to support the current Dollar-dominant regime.

For educational and training purposes, today’s session highlights the Sectoral Rebalancing & Domestic Absorption phenomenon. The 0.8% rise in Indian benchmarks amidst a -₹972 Cr FII exit proves that the quality of domestic liquidity (DIIs +₹1,666 Cr) is now sufficient to decouple the Indian market from global de-risking cycles. For a trainee trader, this underscores the importance of the “Institutional Delta”; when DII buying significantly exceeds FII selling, it typically marks a local market bottom. The IT sector’s 1.03% move serves as a classic “Value Pivot” as investors rotate out of high-beta sectors into established large-caps.

Secondly, the “Volatility Arbitrage” observed today provides a key lesson in risk management. The spike in Global VIX (+3.07%) versus the stability in India VIX (+0.3%) teaches us that fear is not always uniform across continents. For a professional trader, this suggests that one can use domestic Indian indices as a “Volatility Hedge” when Western markets are in a fear-expansion phase. Mastering the Dollar Index (DXY) Correlation remains essential; as long as the DXY stays above 97, commodities and cryptos will likely remain in a “sell-on-rise” mode, requiring a reduced position size for all risk-on bets.

Legal Disclaimer & Liability Waiver

This AI-generated report is strictly educational and does not constitute financial, legal, or professional advice. aiTrendview and its affiliates are not SEBI-registered advisors and assume zero liability for any losses or consequences resulting from its use. All data is autonomously harvested from public sources and may be flawed, delayed, or incomplete; therefore, you assume exclusive responsibility for independently verifying information before taking any action. Under no circumstances should this content be construed as a recommendation to trade or speculate in any security. By accessing this material, you acknowledge that any reliance on this data is at your sole risk, and you agree to be bound by strict intellectual property protections prohibiting the unauthorized redistribution or modification of this work.

1) or fractional share

Investing in the stock markets carries risk: the value of investments can go up as well as down and you may receive back less than your original investment. Individual investors should make their own decisions or seek independent advice.