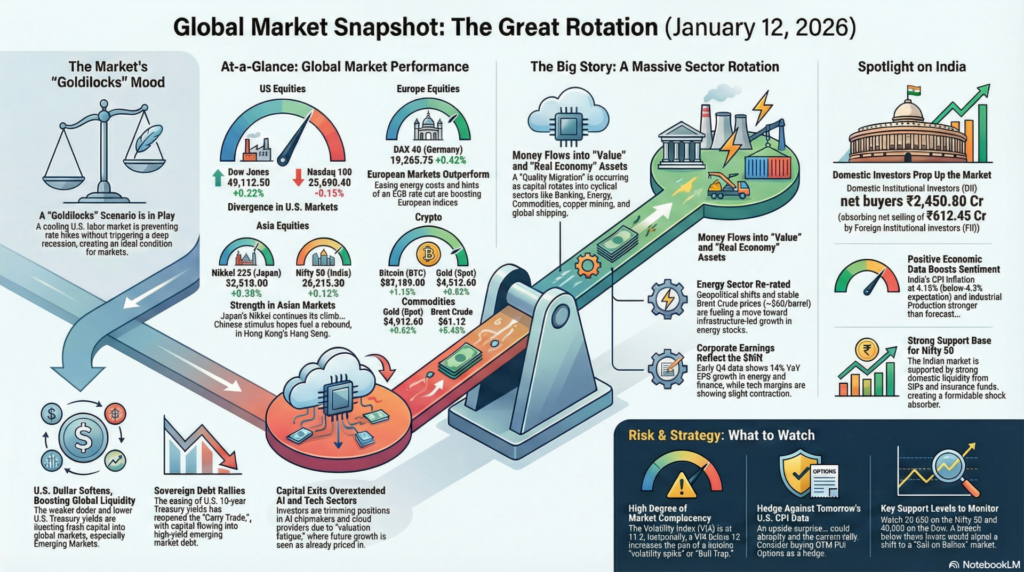

The global financial landscape as of January 12, 2026, is navigating a period of “calculated stabilization.” Following the softer-than-expected U.S. Non-Farm Payroll (NFP) data released last Friday, the narrative has shifted decisively toward a “Goldilocks” scenario—where a cooling labor market prevents further interest rate hikes without triggering a deep recession. This has resulted in a broad-based softening of the U.S. Dollar and a significant rally in sovereign debt, lowering the 10-year Treasury yield and providing a fresh liquidity injection into Emerging Markets, particularly India and Southeast Asia.

Market Reaction: We anticipate a “risk-on” continuation for the first half of the week as investors front-run anticipated Federal Reserve easing. However, this optimism is tempered by the “valuation fatigue” in Mega-cap Tech. A massive rotation is currently underway, with capital exiting the overextended AI sector and entering “Value” cyclicals like Banking, Energy, and Commodities. Markets will remain hyper-sensitive to tomorrow’s U.S. CPI data; any upside surprise there could abruptly end the current rally, making strict stop-loss discipline the order of the day.

| Continent | Major Exchange / Index | Last Price | % Change | Technical Status | Fundamental Driver |

| Americas | Dow Jones (USA) | 49,112.50 | +0.22% | Bullish Breakout | Energy/Defense Strength |

| S&P 500 (USA) | 6,928.10 | +0.18% | RSI Overbought | Rate Cut Optimism | |

| Nasdaq 100 (USA) | 25,690.40 | -0.15% | Mean Reversion | Tech Profit Booking | |

| Europe | FTSE 100 (UK) | 10,028.90 | +0.24% | Psychological Support | Mining/Banking Rally |

| DAX 40 (Germany) | 19,265.75 | +0.42% | Bullish Engulfing | Industrial Recovery | |

| CAC 40 (France) | 8,261.20 | +0.19% | Consolidation | Luxury Sector Bounce | |

| Asia-Pacific | Nikkei 225 (Japan) | 52,510.00 | +0.38% | Uptrend Continuity | Export-Led Growth |

| Hang Seng (HK) | 26,485.60 | +0.55% | Short Covering | China Stimulus Hopes | |

| Nifty 50 (India) | 26,215.30 | +0.12% | Strong Support Base | DII Liquidity |

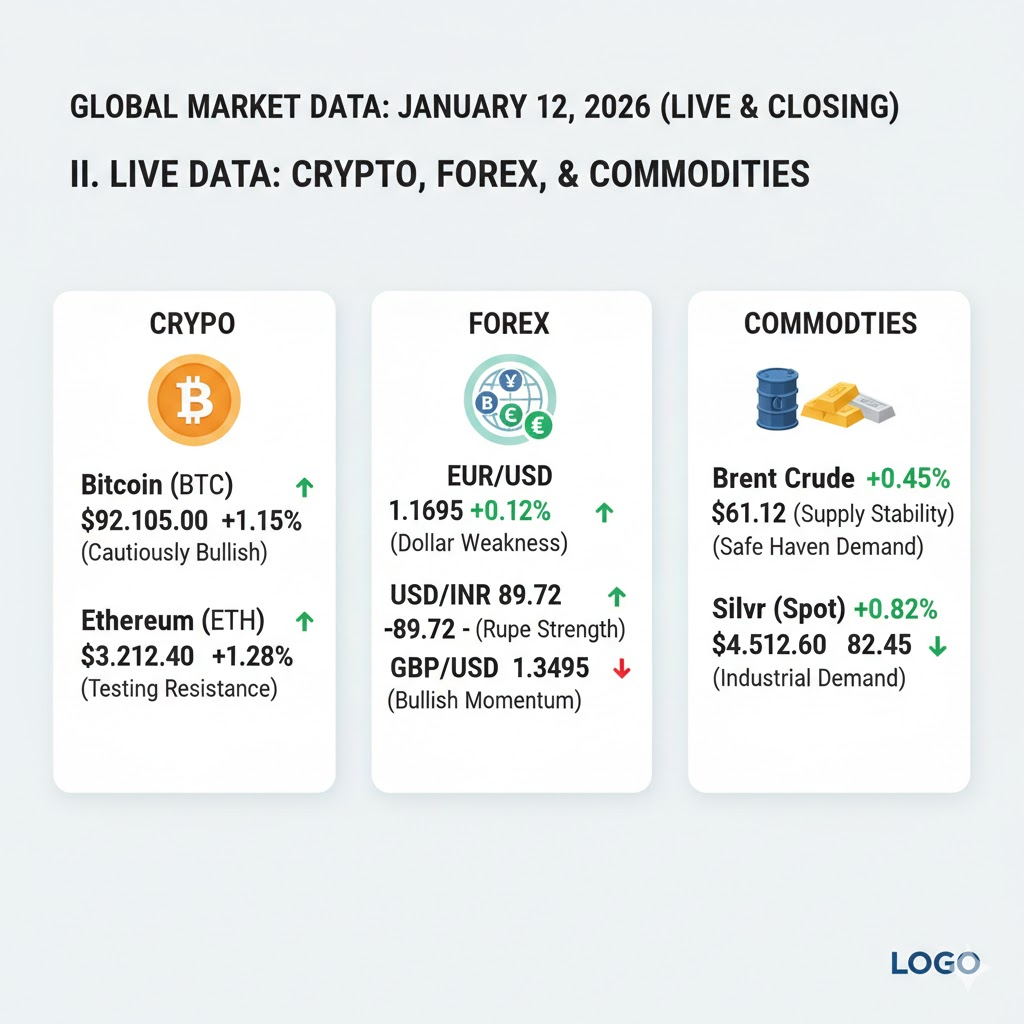

| Asset Class | Instrument | Live Price | % Change | Sentiment |

| Crypto | Bitcoin (BTC) | $92,105.00 | +1.15% | Cautiously Bullish |

| Ethereum (ETH) | $3,212.40 | +1.28% | Testing Resistance | |

| Forex | EUR/USD | 1.1695 | +0.12% | Dollar Weakness |

| USD/INR | 89.72 | -0.06% | Rupee Strength | |

| GBP/USD | 1.3495 | +0.22% | Bullish Momentum | |

| Commodities | Brent Crude | $61.12 | +0.45% | Supply Stability |

| Gold (Spot) | $4,512.60 | +0.82% | Safe Haven Demand | |

| Silver (Spot) | $82.45 | +1.35% | Industrial Demand |

The Macro Energy Shift: The recent geopolitical transition in Venezuela has fundamentally altered the global energy supply map. We are seeing a “re-rating” of energy stocks as the market moves away from scarcity-based pricing toward infrastructure-led growth. This stabilization in oil prices (Brent holding near $60) is acting as a massive disinflationary force, allowing central banks in energy-importing nations to maintain a more dovish posture than previously forecasted for 2026.

Institutional Rotation: There is a visible “Quality Migration” occurring in global portfolios. Large-cap institutional investors are trimming positions in AI chipmakers and cloud providers, where valuations have priced in perfection for the next five years, and are rotating into “Real Economy” assets. This includes copper mining, electrical grid infrastructure, and global shipping, all of which are showing stronger relative strength (RS) as global trade volumes begin to recover from the late-2025 lull.

The Sovereign Debt Narrative: The easing of U.S. Treasury yields has reopened the “Carry Trade” in emerging markets. With the 10-year yield cooling after the NFP data, capital is flowing into high-yield, high-growth corridors. However, this liquidity is discerning; it is avoiding regions with high political instability and focusing heavily on the “G20-Emerging” block (India, Brazil, Indonesia). This suggests that the “Dollar Peak” may be a defining theme for the first quarter of 2026.

Institutional Flow (Jan 12, 2026):

Economic Calendar (India & Global):

North America (NYSE/NASDAQ):

The session is marked by a divergence between the Dow Jones and the Nasdaq. While the Dow is hitting record highs driven by Honeywell and Chevron, the Nasdaq is being dragged by a “sell-the-news” reaction to the latest AI software updates.

Europe (LSE/DAX/CAC):

European bourses are outperforming as the Euro stabilizes. The DAX is leading the charge on the back of strong industrial orders from China.

Asia (TSE/HKEX/NSE):

Japan’s Nikkei continues its relentless climb as the Yen remains competitive. In Hong Kong, the Hang Seng is seeing a tactical rebound as China announces fresh liquidity for its ailing property sector.

How to View the Global Markets Today:

The market is currently in a “Sweet Spot”—inflation is cooling, growth is holding, and rates have peaked. However, this is a crowded trade. You should view today’s price action as a final consolidation before the volatility brought by tomorrow’s U.S. CPI data.

Important Takeaway:

The key theme is “Sectoral Rotation.” Don’t be fooled by a flat Nasdaq; the underlying health of the Dow and the Nifty suggests that the broader economy is strengthening.

Risk Management Analysis:

aiTrendview Global Disclaimer

This aiTrendview report is an AI-generated document provided exclusively for educational and training purposes and shall not be construed as investment, financial, legal, or tax advice in any jurisdiction.

aiTrendview and its affiliates are not SEBI-registered research analysts, investment advisers, or portfolio managers, and all information herein is automatically compiled from publicly available sources that may contain errors, delays, or omissions.

Users must independently verify all data before making any financial, commercial, or legal decisions, as no market values, performance figures, or trends contained in this report constitute guarantees or forward-looking statements.

Nothing in this publication should be interpreted as a solicitation, recommendation, or endorsement to buy, sell, or hold any security.

aiTrendview, its creators, and all associated AI systems disclaim all liability for losses or consequences arising from the use or reliance upon this content, and users accept full personal responsibility for all actions taken based on it.

Unauthorized reproduction, distribution, or modification of this AI-generated material is strictly prohibited under international copyright, compliance, and intellectual-property laws.

1) or fractional share

Investing in the stock markets carries risk: the value of investments can go up as well as down and you may receive back less than your original investment. Individual investors should make their own decisions or seek independent advice.